This article originally appeared in the January 2018 issue of Resource Recycling. Subscribe today for access to all print content.

In 2015, a bill that passed in the Texas Legislature required the state’s environmental agency to conduct a comprehensive study on the Lone Star State’s recycling industry.

At the time, state Sen. José R. Rodriguez (D-El Paso), who co-sponsored the legislation, said the goal was to help give Texas materials recovery “a shot in the arm.”

Several years later, the results of that study are ready to share, and the economic implications laid out in the report could very well provide just the kind of booster Rodriguez envisioned.

What are the key takeaways? The study found 9.2 million tons of MSW were recycled in Texas in 2015, and this material was valued at $702 million.

Further, the statewide recycling rate was pegged at 22.7 percent, which is almost 4 percentage points higher than was determined by another analysis that took place two years prior.

Finally, the overall economic impact of the recycling industry in Texas was shown to exceed $3.3 billion in 2015 and supported more than 17,000 direct, indirect and induced jobs.

In this feature, we’ll offer details on how this important industry analysis was orchestrated. We’ll also dive into the numbers on current recovery and lay out some of qualitative information the study brought to light on market development opportunities for Texas, funding sources for businesses and communities, and infrastructure needs and opportunities.

A collaborative, voluntary approach

House Bill 2763, sponsored by Rodriguez and Rep. Ed Thompson (R-Pearland), required the Texas Commission on Environmental Quality (TCEQ), the state’s regulatory agency, to conduct a recycling analysis that was in many ways a follow-up to another study, the Texas Recycling Data Initiative (TRDI).

Texas Rep. Ed Thompson (in gray suit on left), who co-sponsored the bill requiring an economic impact study of the state’s recycling industry, shares his perspectives during a meeting with the study’s recycling industry committee.

The TRDI effort was released by the State of Texas Alliance for Recycling (STAR) in February of 2015 and provided the first real look in more than 20 years at the levels of recycling occurring in Texas. However, that six-year project provided limited economic data, and in the wake of TRDI’s release it was clear that industry professionals and policymakers craved more data, particularly in a state that is pro-business and is experiencing big boosts in population.

The first study established a strong methodology for measuring recycling economic information through a voluntary, collaborative and confidential process. And because of that, TRDI received particular attention from state lawmakers who saw the value in diving even deeper into the recycling industry and its economic impacts in Texas.

Once the bill requiring the analysis was passed, state officials got to work. Before issuing a request for project proposals to retain a contractor to complete the legislatively required study, the TCEQ hosted a stakeholder meeting and received overwhelming feedback from attendees to ensure the study continued to build on the successes of TRDI, specifically ensuring the confidentiality of the data received.

Through a competitive bidding process, the TCEQ retained an environmental and economic consulting firm, Burns & McDonnell, to complete the research. Burns & McDonnell had worked on the TRDI study, and the project team for the updated analysis also included contributors from the earlier effort: STAR, Boisson Consulting and Wussow Consulting. In addition, Cox McLain Environmental Consulting (CMEC) was brought in to perform the econometric modeling.

As was the case with TRDI, the new analysis, called the Study on the Economic Impacts of Recycling (SEIR), was a collaborative, voluntary effort and its success depended upon input, endorsement and involvement from a broad range of recycling industry stakeholders, including a recycling industry committee (RIC). The RIC included professionals representing commodity groups and trade organizations who were able to utilize their networks to help increase survey participation through targeted outreach.

As was also the case with TRDI, survey results were collected through Re-TRAC Connect, an online waste reduction and recycling measurement system managed by Emerge Knowledge Design Inc. The project team took quality control measures to prevent double counting and to assist potential respondents with any issues they might have had providing their data electronically through Re-TRAC.

Large leaps in both recycling and disposal tonnages

It’s important to note the legislation underpinning SEIR laid out a clear definition of recycling to be used in the project. Recycling was defined as “a process by which materials that have served their intended use or scrapped, discarded, used, surplus, or obsolete materials are collected, separated, or processed and returned to use in the form of raw materials in the production of new materials.” This definition also included composting activities and the land application of sludge or biosolids.

In many ways the heart of the study was a survey sent to stakeholders, which requested information on broad, straightforward material categories, including some material subgrades (for example, plastics were broken down into PET, HDPE and plastics Nos. 3-7).

Data was also utilized from specific supplemental sources that are identified in the report.

Data was collected primarily from both Texas-based and out-of-state processors and end users/manufacturers that use recycled material. The project team also collected data from household hazardous waste facilities.

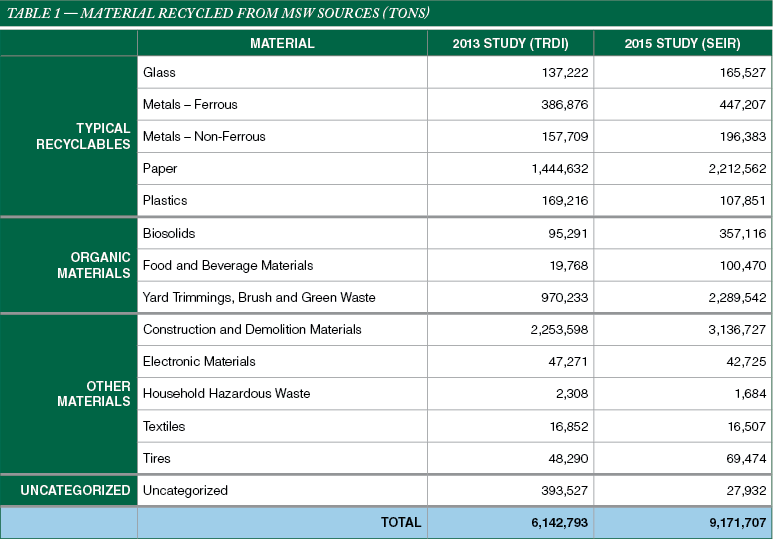

The survey showed approximately 9.2 million tons of Texas MSW material was recovered in 2015, up a little more than 50 percent from the 6.1 million tons of MSW that TRDI determined were recycled in 2013.

Based on the tons of MSW recycling reported for the study, the 2015 recycling rate for Texas was 22.7 percent, which is 3.8 percentage points higher than what was determined in the TRDI study. Although the number of tons recycled grew by 50 percent between 2013 and 2015, the recycling rate growth was not as significant due to a large increase in the number of tons disposed by Texans in 2015. Specifically, the quantity of material landfilled increased from 26.4 million tons in 2013 to 31.0 million tons in 2015.

Based on the tons of MSW recycling reported for the study, the 2015 recycling rate for Texas was 22.7 percent, which is 3.8 percentage points higher than what was determined in the TRDI study. Although the number of tons recycled grew by 50 percent between 2013 and 2015, the recycling rate growth was not as significant due to a large increase in the number of tons disposed by Texans in 2015. Specifically, the quantity of material landfilled increased from 26.4 million tons in 2013 to 31.0 million tons in 2015.

Although many other states and entities calculate recycling quantities and rates, state-to-state comparisons can be notoriously misleading, and the study includes key points to consider when comparing this data. For example, some states include residuals in their numbers; others have mandatory reporting. For these reasons, the reported recycling rate for Texas is likely understated in comparison to other states, and the study is intentionally conservative.

The report also includes material-by-material summaries of the tons documented through the study, with additional information about each material type: total tons, confidence level, supplemental data and more. Table 1 above provides a tonnage comparison between the 2013 and 2015 studies.

Additionally, the report looked at the quality of the materials recycled. While TRDI reported an average contamination rate of 13 percent for MRFs responding to the survey, SEIR found this number increased to 18.3 percent for single-stream material. The contamination rate for organics was reported lower (8.8 percent) and contamination in C&D was just under 4 percent. It is likely that organics and C&D levels were lower due to more control over inbound material from a small and more specific segment of generators.

As noted, the ultimate objective of SEIR was to move beyond a count of materials diverted and sketch the industry’s larger economic picture.

Understanding the costs, value and quality of recyclable material is an essential part of understanding and increasing recycling in Texas.

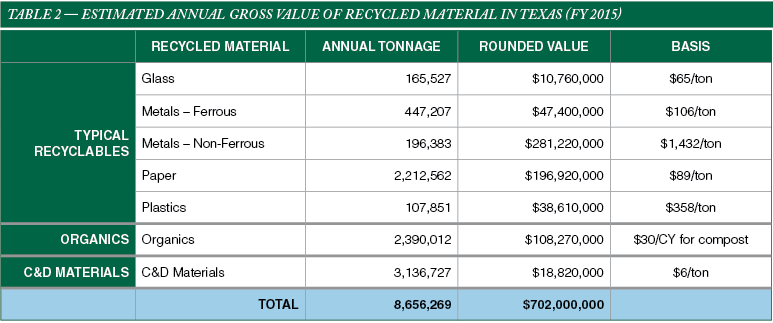

Although the value of recyclables is changing constantly and each commodity has a different value, the project team found that the value of single-stream materials collected over the past five years was $89 per ton. Given the composition of the tonnage reported as recycled in 2015, $702 million in materials were recycled in 2015, as shown in Table 2 above.

The project team used the IMPLAN input-output analysis tool to estimate the industry’s economic impacts. Based on the IMPLAN model, the total impact of the state’s 2015 recycling industry on the Texas economy was estimated to be more than $3.3 billion. The industry also supported more than 17,000 direct, indirect and induced jobs.

“The size of the recycling industry is similar to broadcasting, paper manufacturing and pipeline transportation,” according to Michael Bomba, who led the econometric modeling for the project. “Comparisons to the pipeline industry are particularly impressive given the importance of the oil and gas industry in Texas.”

Trends shaping state’s present and future

A critical section of SEIR describes key trends in Texas recycling and identifies barriers and opportunities to expanding the industry and markets. The key points are outlined in the paragraphs below.

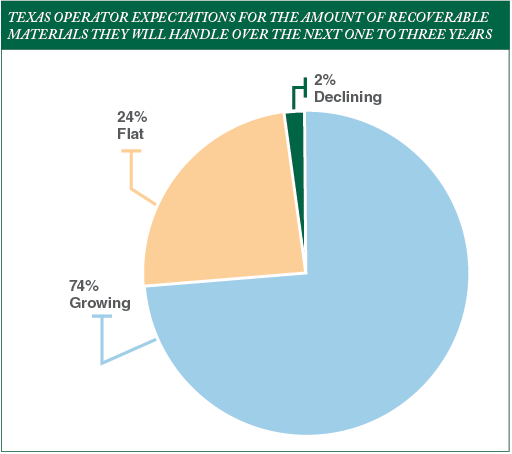

Recyclable material quantity expected to grow. Based on survey results, Texas companies and public agencies surveyed were optimistic about their future recycling business operations. As the chart below shows, 74 percent of respondents said they expect the amount of recyclable materials their business handles to grow over the next one to three years.

Uneven recycling growth. Multiple Texas cities have presented solid waste plans with high diversion benchmarks and other ambitious goals, including Austin, Dallas, Denton and San Antonio. This indicates that municipal recycling in many large Texas cities is growing at the same time many rural, remote municipalities continue to face challenges.

Uneven recycling growth. Multiple Texas cities have presented solid waste plans with high diversion benchmarks and other ambitious goals, including Austin, Dallas, Denton and San Antonio. This indicates that municipal recycling in many large Texas cities is growing at the same time many rural, remote municipalities continue to face challenges.

Evolving waste stream increases costs. The types of products and packaging that are being produced and entering the waste and recycling stream are rapidly changing and evolving. This presents challenges in handling this material, which leads to increased recycling processing costs and reduced revenues for recycling companies.

Reduced demand for recyclable materials. Over the last two decades, high demand for recyclable metals, paper and plastics, especially in China, has helped to drive expansion of curbside recycling in the U.S. and worldwide. In recent years, global demand has fallen while supplies remained relatively flat. Reduced demand for recyclable materials has led to lower pricing and stricter quality standards imposed by manufacturers.

Demand for recyclable materials is nonetheless sufficient. Despite weakened markets, there continues to be sufficient demand for high-quality recyclable materials collected in Texas.

Organics sector growing. Diversion and recycling of organic material through composting and land application is slowly and steadily increasing in many parts of Texas, but growth is constrained by economics and geographic distance, lack of processing facilities, low value markets and challenges in collection efficiency.

C&D materials recycling thriving. In Texas, recycling of construction and demolition materials is strong and growing where markets or market drivers exist, particularly in the more sprawling metropolitan areas, like the North Texas and Houston regions.

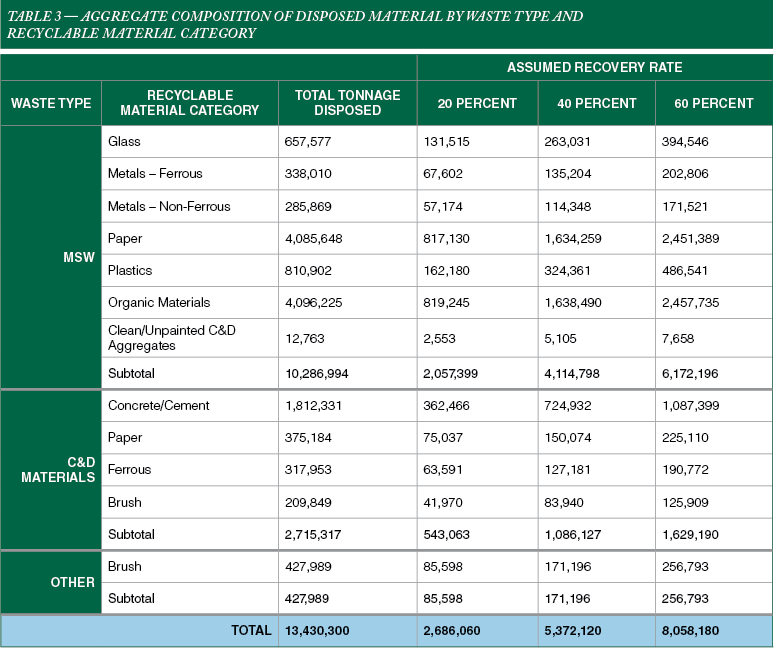

Significant diversion potential exists. Part of the intent of the study was to show what could potentially be recycled but is currently being thrown away in landfills. The project team used waste composition studies from many of the major Texas cities, including Austin, Dallas and Fort Worth, to estimate what residential MSW is generated. The only commercial MSW characterization study came from Dallas, so that was the basis for the composition of commercial MSW in Texas.

The report determined that more than 13 million additional tons of MSW, C&D and other material (mainly yard trimmings and brush) could be recycled but is not currently. As the study shows throughout, this creates a significant opportunity to recover more material that is of value and holds a large economic impact through job creation and local and state revenue.

The study expresses potential impacts at three levels of increased recycling: 20 percent, 40 percent and 60 percent. Table 3 details the composition and details of the 13 million tons of material that could be recycled.

Expanding the volume of recycled materials from MSW in Texas could create even more additional economic activity, according to analysis using the IMPLAN tool. For example, an increase to a 60 percent recycling rate could create more than 10,000 additional jobs in Texas – half of which would be directly related to the collection, processing and transporting of recyclable materials.

At a 60 percent recycling rate, the overall economic impact would climb to nearly $5.5 billion annually.

A guide to growth

A guide to growth

How exactly can such recycling potential be achieved? In addition to providing a large amount of quantitative information, the report is also meant to be used as a resource for communities and businesses in Texas hoping to begin materials recovery operations or grow existing ones.

“There are very innovative companies in Texas trying to help push the recycling needle forward,” said Paul Kuhar, vice president for Champion Waste & Recycling Services, a C&D facility in the North Texas region. “However, we need cities to engage in the process with mandates and ordinances.”

There are a number of sections of the study that include comprehensive information on funding opportunities through government groups or trade associations and market development opportunities. The report also features four case studies from communities in different regions of Texas tackling recycling programs in entirely different ways to fit each individual community.

One case study describes how the small rural town of Booker, in the Texas panhandle, was able to start drop-off recycling managed by the school district. Another case study shows how a public-private partnership helped the city of Dallas share risks and revenue with its recycling processor to build a stronger and more sustainable program for its residents.

The continuation of such initiatives has the support of some key state leaders. Following completion of the study, the two co-authors of the legislation behind it reflected on the project’s importance for Texas.

“I’m pleased with the results of this study showing the economic importance of recycling,” said Rep. Thompson. “The study shows that not only is recycling beneficial for the environment by saving space in landfills, but it also plays a positive role in the Texas economy.”

Sen. Rodriguez agrees: “It’s clear industry was hungry for reliable data to demonstrate that existing recycling efforts across Texas, on top of providing a valuable environmental service, are also massive economic drivers for the state. The final report does a tremendous job of validating that recycling is a booming, highly motivated industry keeping millions of tons of material out of our landfills while also producing tens of thousands of well-paid jobs and billions of dollars in economic output.

“No doubt the report will also prove invaluable to current recyclers as a resource for identifying development opportunities and funding models, and learning from best practices across Texas,” Rodriguez continued. “What’s more, the report compellingly predicts opportunity for even more economic growth by focusing public and private investment toward recycling.”

Sara Nichols contributed to the Study on the Economic Impacts of Recycling as the executive director for the State of Texas Alliance for Recycling, a position she left at the end of last year. She can be contacted at [email protected]. Scott Pasternak, an associate with Burns & McDonnell, managed the study. He can be contacted at [email protected]. Both authors are based in Austin, Texas.

A guide to growth

A guide to growth