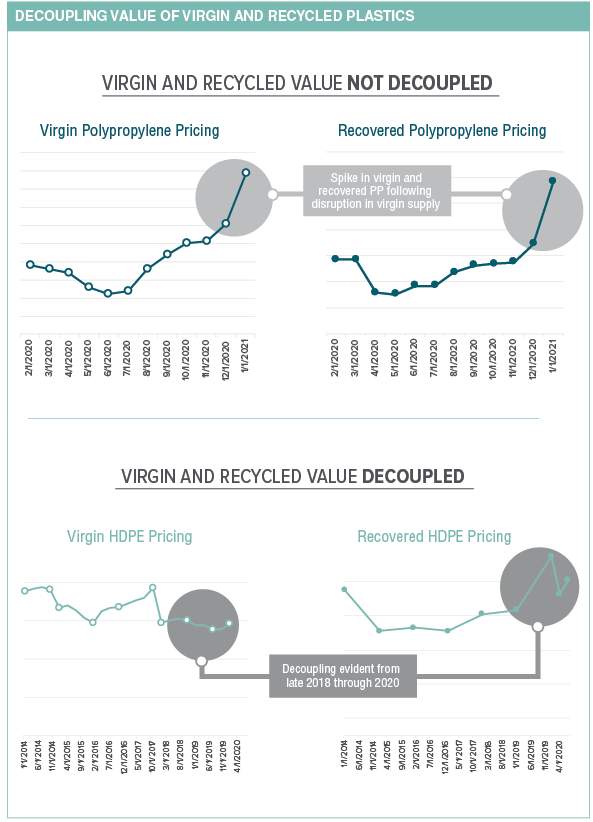

Historically, recycled plastic resin and bale prices have closely tracked virgin resin pricing. High virgin resin prices create good times for plastic reclaimers. Conversely the remarkably low virgin resin prices experienced across most plastic types in the last few years have made it tough for reclaimers to pass on a value to material recovery facilities (MRFs) and make any profit margin.

Little surprise then that there has recently been a lot of talk about “decoupling” the value of recycled resins from their virgin counterparts to enhance economic sustainability for reclaimers, MRFs and communities engaged in plastics recovery.

Mandates for the use of minimum content in plastic products, which have passed in California and Washington state, effectively achieve that decoupling by requiring that certain manufacturers use post-consumer resin (PCR). One long-standing example is the California Rigid Plastic Packaging Container (RPPC) law, which requires certain high-density polyethylene (HDPE) rigid plastic packaging to contain minimum recycled content levels. This mandate, combined with corporate content commitments, has driven the demand for natural HDPE PCR that accounts for skyrocketing market values for natural HDPE bales (currently, the plastics is the most valuable commodity in many community recycling programs, surpassing even aluminum cans).

Still, the value of most plastics, including polypropylene (PP), remains firmly tied to virgin resin markets because the recycled material is used predominantly as low-cost substitutes for virgin resin. As a result, bale pricing for these recovered materials is subject to the turbulence of virgin resin markets that are influenced by a host of factors, Including natural disasters, mechanical failures, corporate bankruptcies and international policy shifts.

The recent spike in PP bale prices illustrates this dynamic. The price uptick in late 2020 resulted from a supply shortage following two December events: a fire at Total Petrochemicals in La Port, La. and an unexpected shutdown in the PP line at Formosa Plastics Corp. in Texas.

While higher pricing is a welcome sight for MRFs in the short term, it’s unlikely the boost will be sustained once the supply recovers from these disruptions. Back in late 2010, virgin PET prices spiked due to a confluence of events that impacted supply, and the phenomenon drove PET bale markets to record highs for most of 2011. However, prices returned to more average levels by later the same year.

To create more resilient markets for recycled PP and other resins, the value of PCR needs to be decoupled from the supply and demand dynamics of virgin plastics. Recycled content commitments, whether voluntary or mandatory, must ensure the price paid for PCR provides value to the entire supply chain, supporting a strong sorting system and a vibrant reclamation sector.

Additionally, a broader range of plastic products must be targeted for PCR mandates and commitments. This action would help to strengthen markets for the full range of plastics in the recycling bin.

This month’s Data Corner was produced by RRS. Learn more at recycle.com.

This article appeared in the Spring 2021 issue of Resource Recycling. Subscribe today for access to all print content.