The price of copper has continued to rise and is nearing a high not seen since June 2022.

According to the London Metal Exchange, on Jan. 18 the metal was trading for $9,436 per metric ton (roughly $4.28 per pound). For several weeks before, it was averaging about $8,400 per metric ton, a price it had risen to following a mid-June drop from about $9,700 to about $7,000 per ton.

Looking at the past year, the price peaked in early March 2022 at just under $10,800 per metric ton.

The Wall Street Journal noted copper is seeing its longest winning streak since late July 2021 and is attributing the increased price largely to China loosening COVID-19 policy, which has driven up consumer and industrial demand, along with domestic investors betting inflation has reached its height.

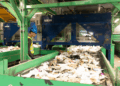

According to a weekly market report from the Institute of Scrap Recycling Industries (ISRI), U.S. exports of recycled non-ferrous metals, including copper, were up 4% year over year, totaling 3 million metric tons.

U.S. exports of recycled copper and copper alloys also increased 2.5% year over year through November, rising to 862,000 metric tons. That’s due to higher demand from China, which rose 26%; India, where demand was up 66%; and Thailand, which saw an increase in demand of 45%. Those increases offset the 57% drop in recycled copper shipments to Malaysia, ISRI stated.

However, The Wall Street Journal warned that the “global growth outlook remains murky.”

“Copper prices are still 16% off their all-time highs from early 2022, when Russia’s invasion of Ukraine raised worries about supply,” the story noted.

Another Wall Street Journal article emphasized that caution, predicting that “odds are that 2023 will end with industrial-metal prices, at least, higher than they are now. But the story is a bit more complicated than just that.”

While three-month copper futures are already up 9% in 2023, it’s not a given that China will see a boom in construction, because its economy “is climbing out of a deep hole,” the story noted.

“A better than expected outlook for all three of the world’s major economic engines – the U.S., China and Europe – is cause for cautious optimism,” the Wall Street Journal stated. “But caution might still be the operative word for commodity investors until clearer economic and monetary signals emerge from China and the U.S. this spring.”