This article originally appeared in the Winter 2018 issue of E-Scrap News. Subscribe today for access to all print content.

Everyone has heard of bitcoin, but according to many financial experts, it is the information-organization tool underpinning the currency – called blockchain – that has the real power to reshape the world of commerce.

In fact, a number of different players in varying global industries have recently made moves to leverage the power of blockchain to enhance traceability and reliability in their own supply chains. And similar possibilities exist in e-scrap, if stakeholders are able to sufficiently grasp the potential and organize appropriately.

Undoubtedly, questions arise as soon as e-scrap professionals dive into the subject. What’s the difference between blockchain and bitcoin? How is it going to affect businesses in the electronics reuse and recycling arena? And what steps can we collectively take now?

This article will try to offer some guidance.

Just picture a spreadsheet

The word “blockchain” generates a lot of confusion. Blockchain is ultimately just a concept, a few different ideas, which can be used together to create a new kind of database. But here’s an easy way to understand it: When you hear the word “blockchain,” replace it with “a big spreadsheet that no one owns and anyone can use.”

A big spreadsheet like this could hold a bank ledger (which is essentially how bitcoin works), but it could also let unrelated companies jointly keep a reliable and secure record of their transactions – as long as everyone agrees on what to name the columns.

But why should we trust sharing this spreadsheet?

For one thing, the data can never be changed. Imagine if the second row of this spreadsheet holds a tiny picture of the first row. The third row holds a tiny picture of the second row, which still holds the tiny picture of the first row. That pattern continues throughout, so in the 101th row, we see a tiny picture of the 100th row and that picture holds pictures of the 99 preceding rows. It’s like one’s reflection in a house of mirrors, but we call it a “chain” of “blocks.” If any data is deleted or changes, all the following pictures no longer match. So data can’t be altered.

Additionally, we know we can count on the person controlling the spreadsheet … because there is no person. No one owns, hosts or runs it. It’s completely decentralized, with everyone running a copy.

Imagine if every internet web server kept a copy of the spreadsheet with software to keep them in synch. Falsifying one copy (or even 100) would accomplish nothing because the fakes would not match the consensus.

Now it’s true that bad data could still be entered on our big shared spreadsheet. But the source of that data will always be known. Each data row (referred to as a “blockchain address”) is owned by a person with a password (a “private key”), which is needed to enter the data or transfer it to another person. Holding the password is proof of ownership.

Taking supply chains by storm

Let’s bring this back to bitcoin. If blockchain is Microsoft Excel, then bitcoin is an .xls file. It’s a single-purpose spreadsheet for tracking money, similar to a big shared bank journal, but no one owns it (and that frightens bankers). Other spreadsheet files can be made to track any sort of data, and big companies around the world are already doing this today.

Walmart, for instance, has been using blockchain on a major initiative that began this year. Working with IBM, the retailer has been using a blockchain-based system to track mangoes, a type of fruit that can carry salmonella. Prior to blockchain, it would take Walmart over six days to trace a salmonella outbreak back to the originating farm. Now it takes 2.2 seconds to identify a given mango’s provenance.

This “one-step traceability” trial was so successful that Walmart has decreed that all their suppliers of leafy vegetables must use their blockchain by Jan. 31, 2019.

Another example can be seen in the city of Dubai, which has announced it’s moving all real estate transactions to the blockchain. What was once a pile of paperwork can be digitized as a new row in a shared spreadsheet, and this includes the proof of ownership: the deed. This row is now an “asset token,” a digital representation of the property, providing a permanent history of the house or building in question. To sell the property, the owner simply digitally transfers the token to another person, including the deed and the paperwork. In this way, all assets of value will eventually be digitally represented, bought and sold.

More evidence of blockchain’s growing use can be seen in an IBM partnership with Maersk, the world’s largest shipping company. They’ve created a shipping blockchain called TradeLens that has signed on over 96 ports and shipping partners. Maersk estimates the cost of processing the volumes of paperwork required by ports and customs can equal the cost of physically transporting the goods. By passing this paperwork on a digital asset token as the goods move from port to port, answering a simple question like “where is my container?” can be reduced from 10 steps to one, and transit times can be reduced by up to 40 percent.

So if blockchain is being implemented in supply chains around the world, it seems logical that the concept will also eventually be integrated into the reverse supply chain for electronics.

Envisioning our industry’s blockchain future

In the electronics recycling and reuse market, devices already get digitized, tagged and tracked, with “for sale” lists loaded to different marketplaces.

Similarly, data sanitization and test reports are generated as files. And jurisdictions with extended producer responsibility frameworks and other formal recycling programs already get digital reports on waste tonnage from recyclers.

In other words, the data surrounding e-scrap is already computerized, and the computers are already on the internet. But the data points themselves are not connected. These details still get put on paper, mailed, faxed, or communicated over instant messaging or the phone. Blockchain holds the potential of giving the industry an avenue to seamlessly connect information about assets in a secure and verifiable manner.

Should electronics recovery professionals successfully leverage the technology, the initial impacts will likely be seen in the realms of verification and traceability.

By turning devices (or pounds of e-scrap) into asset tokens, the industry can eliminate delays and mistakes in transmitting paperwork. At the same time, material generators will trust that the data on their devices was destroyed because the corresponding tokens will be cryptographically signed by the wiping software. Proof of provenance and verification of authenticity will help with anti-counterfeiting efforts. And the location and method of the final disposition of an asset can be validated to ensure responsible recycling. If your intent is to commit fraud, you’d be foolish to operate in such a system.

In this first phase of e-scrap blockchain deployment, businesses will run without any major shifts, just much more efficiently (estimates in efficiency gains range from 25 percent to 50 percent). It probably won’t be disruptive in the way Uber was to the taxi business; it will be more akin to an incremental improvement, like the switch from fax to email a decade or two ago.

The next phase of implementation will almost assuredly be more game-changing, with the sector revolution being driven by two factors: use of cryptocurrency as payment and use of smart contracts (written in computer code) to enforce agreements.

Let’s start with the cryptocurrency discussion. An asset token can also hold crypto (money), just like a bitcoin address. In an e-scrap trading framework, adding funds to an asset token would be similar to taping a $5 bill to a device, but with the caveat that the bill can only be removed with permission of the owner. Also, adding crypto to a device, either as means of purchase or to prepay for services, would involve no credit card fees and no transaction fees.

But because this is all happening in a digital arena, we can start to add a lot more nuance to the ways we are transferring funds. An asset token can also hold a simple snippet of computer code, which can never be changed. The blockchain will automatically run this code on command, running operations like pinging the outside world, transfering money, and updating device ownership details.

It’s true the computing power of blockchains are no more than what we saw in mid-1990s mobile phones, but those capabilities are sufficient for simple code procedures such as “if-then-else.” Here are some examples of how that coding could be utilized to generate “smart contracts” between traders:

IF requested payment is uploaded THEN notify the warehouse to ship the goods.

IF shipment is received AND a test report is attached within seven days THEN pay the seller ELSE move the funds to a third-party arbitration contract.

IF “a data sanitization report” signed by “compliant wiping software” is uploaded THEN pay the ITAD AND pay a usage fee to the wiping software company AND notify the original owner.

Because an asset token can hold funds until an agreement is met, it acts like a free escrow service. Two parties can create a programmatic agreement without use of a third-party and without having to trust (or even know) each other.

However, none of that will be possible until the the use of cryptocurrency is more accepted and smart contract tools emerge to simplify the process for traders without programming skills. Those realities may still be five to 10 years down the road.

The significant hurdle to reaping benefits

While many of the blockchain possibilities for our industry are still a few years off, there nonetheless are vital actions that need to take place among stakeholders very soon if we want to realize the future laid out above.

There is some concern that it will take the e-scrap industry a while to reach a critical mass of blockchain participants. But in reality, slow user adoption is a secondary issue. Users won’t need to learn new complex systems. The software they already use simply needs to “connect” on the back end of the wider e-scrap blockchain network.

The real barrier to taking advantage of blockchain’s potential in electronics reuse and recycling will be the development of a truly open and level system.

The early adopters of blockchain in the wider world of business have been able to do so in large part because they have tightly controlled supply chains. Walmart, for instance, can require its farms and transporters to use the system, and Dubai public officials can force adoption through regulation.

The complications that most other sectors will likely experience can be seen in early hiccups in the implementation of TradeLens, the shipping blockchain. Recent reports indicate its full adoption remains uncertain because Maersk’s competitors may not join the party.

That’s the kind of issue that will hinder other supply chains that have numerous players with conflicting interests and no central authority. Without a clear, sector-wide plan, individual stakeholders will inevitably try to step in and fill the void. And that will lead to one of several scenarios, none of which will lead to full harnessing of blockchain’s potential.

In the e-scrap industry, here are the possibilities that could unfold:

Fragmentation. ERP (inventory management) software is a likely blockchain entry point, since those systems run the software that digitally identifies and tracks assets entering the reuse chain. An ERP service provider could create an initial blockchain, and their competitors would likely follow suit – with their own individual frameworks. Trading networks, where assets are listed for sale and traded, might also start developing separate blockchains. And then the giants like eBay, Amazon, and Alibaba would get in the mix. Ultimately, this won’t work. Imagine if Dubai allowed two blockchains to coexist for real estate. To reach the market, you’d have to “list” your property on both, but you cannot have two deeds to the house.

Without a single, agreed-upon platform, all the most powerful attributes of blockchain go out the window.

Reliance on an outside system. Another possibility is that some huge blockchain from another industry could take off and become commonly used across different business sectors. This scenario might work, but it would certainly not provide the efficiency of a network developed specifically for e-scrap. For example, if IBM’s food blockchain crossed industries, it probably won’t have a methodology for communicating “data erasure status” or “cellphone lock status.” We would have the option of tracking “bacteria count per million,” but not many electronics reuse or recycling operations are very concerned with that statistic.

A central authority wins. The worst-case scenario would be a single entity owning the playing field. If a company like Amazon or eBay takes control, their primary incentive will be to monetize the network, and individual traders would have little to no recourse to influence changes or improvements. Meanwhile, a manufacturer-owned blockchain could be used to provide asset information back to the OEM that they’d use in their constant fight against the right to repair. Also, a central authority could potentially have their own private view into our otherwise confidential trading data.

Alliance at work on a protocol

To prevent these scenarios, our industry needs to a define single blockchain, a common system that will interoperate with the needs of every stakeholder group. Back when phones were first being invented, if a protocol for telephone systems hadn’t been established, one brand of phone wouldn’t have been able to ring another. It’s the same with email and the internet. No matter what software you use, you can communicate with others online. We need to do the same with our blockchain.

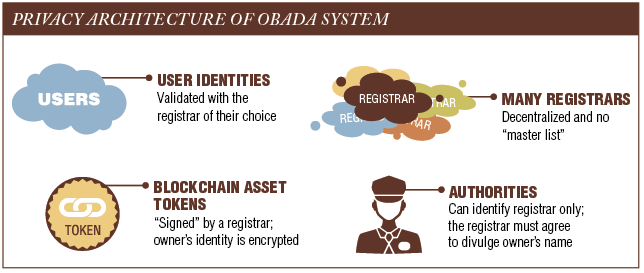

An e-scrap industry blockchain would ideally be built to fundamentally protect business privacy while providing safeguards for authorities to prevent fraud and ensure compliance. It would also be one that no central authority owns and in which competition would flourish.

That’s why a new group, the Open Blockchain for Asset Disposition Alliance (OBADA), was formed. It’s a nonprofit multi-stakeholder organization with the goal of building the protocol blockchain best suited to our industry as a whole.

Since OBADA was formed in 2017, interest has been accelerating each month, and over 40 organizations representing multiple stakeholder groups now participate in the working group. These stakeholders include:

- Certification bodies, nonprofits, and academic researchers, such as SERI, Repair.org, Free ICT Europe, Yale University, and the U.S. EPA.

- Industry groups and trade associations, such as the Association of Service and Computer Dealers and the North American Association of

- Telecom Dealers (AscdiNatd), the E-Reuse Conference, Ereuse.org, the Service Industry Association and the Reverse Logistics Association.

- The major ERP (inventory management) vendors.

- The major trading networks.

- Drive-wiping software and services.

- Several other organizations.

It’s still early and fairly informal; really, the group is a think tank trying to figure this all out. But OBADA does have a working prototype “simulator” (available at obada.io), which anyone can experiment with using standard web APIs and a working Ethereum prototype created by ereuse.org. The source code is open source and published at github.com/obada-protocol. OBADA would be thrilled to have more organizations testing our implementations.

In addition, the project now has an “alpha tester,” with the the University of Vermont recently agreeing to allow Good Point Recycling of Middlebury, Vt. to track the school’s disposed assets using the simulator blockchain. The transactions will be anonymized but verifiable via SERI and the AscdiNatd. AscdiNatd is also representing OBADA on a U.S. Customs Advisory Committee that is proposing a blockchain solution for the U.S. government.

Let’s avoid a blockchain Betamax

If you think of the Walmart mangoes or the containers being moved by Maersk, you’ll realize that there’s a good chance you’re already involved in blockchain’s growing power within supply chains. To bring it to our industry, we simply need to define a standard way for computer systems to talk to each other, allowing every actor to interoperate.

What can you do now? When talking to software vendors, ask if their blockchain plans include considerations of how their data will synch with others across the industry. If they don’t, those service providers are essentially building the blockchain equivalent of Betamax.

And of course, tell all relevant parties about OBADA, and if you are interested in more, contact the alliance at [email protected] and join the working group monthly call.

We’re in a unique position to shape the direction of a remarkable form of technology and open up new business opportunities. Let’s not waste this moment.

Rohi Sukhia is founder and CEO of the e-scrap trading network Tradeloop and helped form the Open Blockchain for Asset Disposition Alliance (OBADA).