This article originally appeared in the June 2017 issue of E-Scrap News. Subscribe today for access to all content.

Waste electrical and electronic equipment (WEEE) has been widely reported as being the world’s fastest-growing waste stream.

The estimated 50 million metric tons of this material that is generated globally each year represents a 50 percent increase compared with 2010. This trend particularly holds true in countries with increasing population and economic development, such as India, China and Brazil.

In many industrialized countries, however, the growth seems to have actually reached its peak and the quantity of used electronics generation is now flat or even decreasing every year.

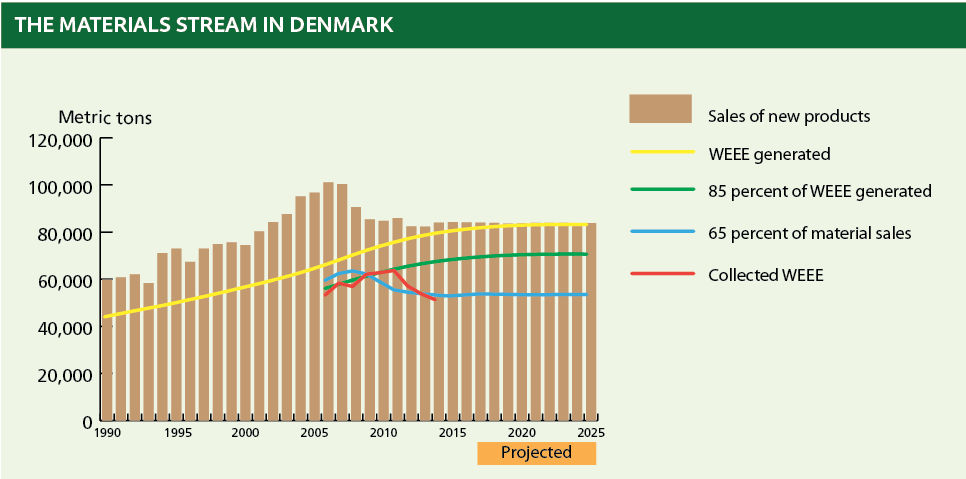

Research in Denmark underscores this trend. According to estimates, annual WEEE generation in Denmark increased from 45,000 to 81,000 metric tons between 1990 and 2015, with a growth rate of 2 to 3 percent each year until 2011. From 2012 onward, WEEE generation began to slow and is not projected to change significantly over the next decade. Similar patterns have been identified in Sweden, Norway and Austria. Since 2008, in those three countries and Denmark, flat numbers and declines have been the norm in both the amount of WEEE collected and the amount of new material put on the market when calculated by weight.

But falling figures in WEEE generation and collection might not tell the whole story. As programs develop in Europe and other regions around the world, it’s becoming clear that device reuse is not being fully integrated into the tracking systems stakeholders use to determine success or failure and to identify where future opportunities may exist.

In the European Union, where member states are required to hit clear thresholds in terms of WEEE management, the lack of information on reuse could have particularly resounding impacts.

European directive details

Denmark, with a population of 5.7 million, is a member state of the European Union. As such, Denmark has a WEEE management system that complies with the EU’s WEEE directive, which became law in early 2003. Starting in August 2005, the directive required each member state to establish a collection and treatment system for household WEEE. Countries were also required to report on the quantities of new electrical and electronic equipment put on the market and collected WEEE as well as the methods used to handle collected material. The directive was revised in 2012.

The collection target of 4 kilograms (roughly 8.8 pounds) per resident per year set by the first iteration of the directive has been easily achieved in Denmark – in 2014, for example, the country’s system collected 12.7 kilograms per capita. However, the 2012 recast of the directive requires that by 2019, the minimum collection rate to be achieved annually shall be 65 percent of the average weight of covered material placed on the market in the three preceding years, or 85 percent of WEEE generated in the member state.

My research looked into the existing WEEE landscape in Denmark in light of the new targets. According to the recast directive, 85 percent of WEEE generated is broadly equivalent to 65 percent of new material put on the market averaged over three preceding years. However, research estimates suggest a significant difference between these two numbers (see chart above). This means there is a room for error, and the targets are not equally applicable for countries like Denmark.

Furthermore, the numbers reported by the Danish Producer Responsibility System show a significant gap between material put on the market and collected WEEE for the collection category of “small appliances,” which includes small household appliances, IT and telecommunication equipment, and consumer electronics.

On average, 58,000 metric tons of new “small appliance” products were sold annually on the Danish market from 2007 to 2014, but the average annual end-of-life material collection total for the category during the time frame was only 24,000 metric tons. This suggests the majority (59 percent) of the end-of-life material in this category is not being collected by the official collection system.

While there are possibilities of informal collection and stockpiling of the products, these avenues alone do not explain the large gap between tonnages of marketed and collected products. A much more likely explanation is that the products are still in use by a second user after the end of their first life. There is already a sizable market of used electronics in Denmark, especially for high-value household appliances, IT equipment and consumer electronics.

These secondhand items are traded via user-to-user online platforms such as dba.dk, which is owned by eBay. There also exist businesses that buy such items from users and resell with warranty after refurbishment.

These reuse activities are today happening outside the official WEEE management system, which is mainly focused on material recycling. And this fact carries economic repercussions. When selected high-value products from the electronics stream are diverted to another flow, the recyclers working within the official system only receive low-value and bulky items with lower material value. This phenomenon adds challenges for a recycling sector that is already facing the difficulties of keeping up with diversity in product design and material composition.

Without reliable quantification, the actual potential of material recovery cannot be properly understood.

The potential revenue carried by the secondary resources available in WEEE in Denmark has been estimated at 122 million euros (roughly $137 million). Gold and plastic are the two key resources, carrying more than half of the total revenue. Copper is the next important metal and represents more than 15 percent of the potential revenue.

However, the actual exploitable revenues could significantly vary among different resources depending on the technological and economic feasibility of their recovery. Further, the actual material recovery also depends on the type of products and the end-of-life management system being employed. That all means there is not a clear understanding of the value of materials that could be resold or recycled for commodity returns, and thus, concerned stakeholders don’t know what mechanisms need to be in place to ensure that WEEE recovery remains a profitable business sector.

Furthermore, the industry is left unable to reliably track the amounts leaking out of the official collection channels.

Better alignment with end goals

Currently, there exists in Denmark and other EU countries a policy problem that has created a mismatch – the existing incentive mechanisms do not align with the ultimate goals in management of end-of-life electronics.

In the current system, residents have to pay for visiting the “recycling centers” in order to discard their end-of-life products, but they can earn money if the products are sold to the reuse market. Meanwhile, municipalities lack the motivation for improving the collection system to support reuse – they don’t have the right to sort and sell the potentially reusable products, as the products technically belong to the collective schemes that represent producers. And the collection schemes are built around an infrastructure that brings the end-of-life products directly to the pre-processors from the collection points without considering the possibilities of reuse. This is understandable because from the producers’ perspective, it would run against their primary business interest to encourage reuse and expand the field of secondhand devices competing with new products.

A better incentive mechanism would more effectively engage municipalities, recyclers, reuse market stakeholders, and the producers to develop an increasingly transparent system for documenting the flows of new and end-of-life products.

A collection system respecting the remaining functionality of discarded products and encouraging better communication between different stakeholders is essential. It needs to be further supported by relevant policies to provide a win-win situation for the parties involved in the management of end-of-life electronics.

Keshav Parajuly recently received his Ph.D. at the University of Southern Denmark. His thesis, “Circular Economy in E-waste Management: Resource Recovery and Design for End-of-Life,” was published earlier this year and can be found at tinyurl.com/parajuly-thesis. He can be contacted at [email protected].