This story originally appeared in the March 2017 issue of E-Scrap News. Subscribe today for access to all print content.

The first thing that comes up in any conversation about e-plastics is the inherent complexity of the stream. The plastics in question, the downstream markets, and the way the materials are used in today’s electronic devices – they’re all marked by nuance and complications.

Sorting, recycling and marketing the plastics content in end-of-life devices can be painstaking, not to mention economically challenging. Few firms today even want to handle the material and even fewer domestic plastics reclaimers are willing to buy it.

“Your average plastics recycler wants nothing to do with it,” said Andrew Rubin, president of FCM Recycling, a Canadian electronics recycling company that recently invested heavily in infrastructure to recover e-plastics.

But the rise of plastics usage in electronics (see sidebar below) is forcing companies in the U.S. to figure out how to deal with the issue. Landfilling remains one course of action, but recycling the material isn’t out of the question – the export market, particularly in China, has been relatively strong and some are still holding out hope that a domestic market for the material could flourish.

To help e-scrap entities better understand how to handle e-plastics, we checked in with a number of companies working to make sense of the stream and explore what might lead to e-plastics progress in the years ahead.

Variety, value and e-plastic ‘stigma’

The first thing all e-scrap professionals should know about the plastics space is that material variety is the norm and classification can be confusing.

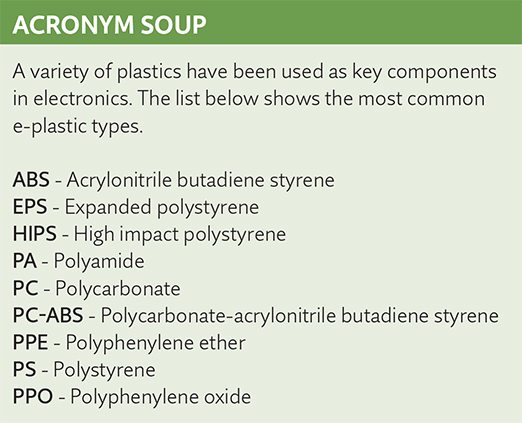

Since the late 1980s, the plastics industry has resorted to what’s known as the resin identification code to distinguish between the various kinds of plastics in use today. The code defines seven different kinds of plastics by resin type.

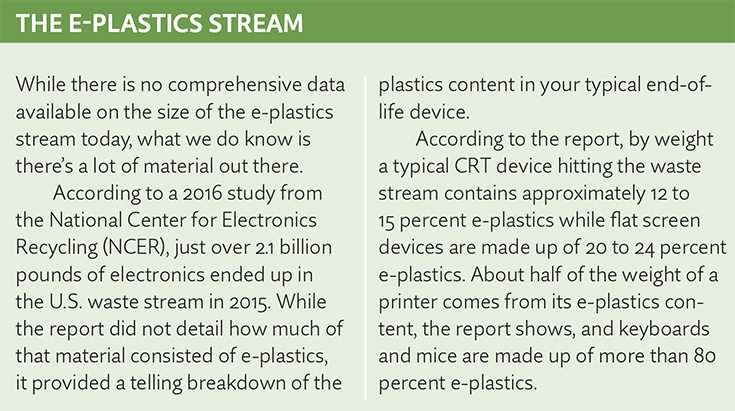

And an increasingly wide range of plastic resins have been used in consumer electronics, including acrylonitrile butadiene styrene (ABS), high impact polystyrene (HIPS) and expanded polystyrene (EPS). See the box below for an e-plastics glossary.

But not all devices utilize just one resin and this complicates recovery efforts. According to Tom Bolon, the president of Columbus, Ohio-based Novotec Recycling, CRT monitor housings generally contain PC/ABS, but CRT TV housings often consist of HIPS. Meanwhile, flat panels often use a mix of PC/ABS and HIPS.

Printers can have up to four or five different plastics in their construction, he noted, while the fronts and backs of TVs and monitors are often made with two different resin types. “E-plastics are a tough category due to the variety and complexity of the original recyclable that they are derived from,” Bolon said.

But that’s not the only challenge facing the e-plastics recovery chain.

Another major impediment comes down to simple economics. The value of e-plastics is often not worth the labor to attempt to separate the material.

“Mixed plastics [is] one of the lowest and least valuable of materials categories, and one of the most common materials streams derived from electrical and electronic equipment,” a 2016 report by the National Center for Electronics Recycling states. “The incredibly low value of this material underscores the challenges in assuming profitable recycling for all devices.”

According to the report, mixed plastics found in TVs, computers and printers had little to no recovery value. Electronic recycling companies largely echo that sentiment.

Bolon from Novotec said the value of mixed e-plastics today ranges “from zero to a couple of cents” per pound.

The use of brominated flame retardants (BFRs) has also been a historical barrier to recovery.

While many original equipment manufacturers have moved away from using BFRs in their products, older devices, particularly TVs and computers, still contain the chemical mix. As the U.S. Environmental Protection Agency notes on its website, “Many flame retardant chemicals can persist in the environment, and studies have shown that some may be hazardous to people and animals.”

At present, there are no regulatory restrictions for incorporating recycled plastics with BFRs into new products in the U.S., but the domestic market remains limited. According to FCM’s Rubin, a “stigma” often surrounds BFR-containing recycled plastics, with most North American buyers interested in only non-BFR material.

Non-BFR plastics are hard to come by and come at a premium, he said. But he noted such reticence to use plastics with BFRs may be unnecessary. “The material is perfectly safe and works just the same as any non-BFR material,” he noted. “You don’t want to put it in children’s toys and food, but apart from that, it has no effect on production and it doesn’t need to be handled specially.”

A typical flat screen monitor is made up of 20 to 24 percent plastic by weight, but variety and complexities in the material mix make e-plastics from a range of devices difficult to cost-effectively recycle.

Still, the European Union restricted the use of BFRs in electronic products in 2003 under the Restriction of Hazardous Substances Directive. The U.S. EPA, meanwhile, is continuing to study BFRs in accordance with the Toxic Substances Control Act for potential human health and environmental risks.

E-plastics processing 101

A typical e-scrap recycling operation in the U.S. will dismantle the electronic devices they receive and eventually send them through a shredding system, which produces a mix of plastics, metals, glass and other contaminants. Processors committed to recycling e-plastics will attempt to sort the plastics out through manual or automated separation systems, ideally producing homogenous streams for downstream buyers.

It’s an uphill climb, noted Duane Beckett, the president of Brockport, N.Y.-based Sunnking Recycling.

“Recyclable plastics are kept separate into as clean of a stream as we can make it, much like any metal category that we separate into and sell,” Beckett said. “Plastics recyclers in general are very finicky with regards to the materials they accept.”

While Sunnking mostly attempts to recover the ABS plastics found in CRT and flat panel devices, Beckett noted not all electronics recycling operations have the necessary equipment or interest in handling the material. What doesn’t get recycled heads to landfill, “representing a significant cost over time,” Beckett noted.

And Sunnking is not alone. Craig Boswell, the president of HOBI International, a firm that focuses on the mobile and IT asset disposition markets, said while e-plastics represent just a small part of the company’s business, the stream has nonetheless emerged as a challenge.

“We have struggled over the last few years to find consistent markets for our more contaminated PC/ABS streams with the price of petroleum being so low,” Boswell said, referencing the fact that depressed oil prices have made virgin plastic production cheaper and thus lessened the price competitiveness of recycled material.

“Cleaner streams, such as printer plastic, still have some demand,” Boswell added, “but the smaller, more contaminated streams from mobile device recycling are difficult. The only markets we have found have been overseas, and even those have not been consistent.”

China and other foreign buyers

As Boswell noted, the saving grace for e-scrap firms aiming to recycle e-plastics has historically been the export market. By all accounts, China has been the landing spot for much of the U.S. e-plastics stream.

“They have the need for the plastic and the labor and technology to do more efficient separations than are generally possible in the U.S,” Novotec’s Bolon said. “You can separate and regrind and develop domestic markets for recycled e-waste plastics, but it is a specialty and requires a lot of work and patience since the market changes all the time. And cheap virgin material can come in from China any time and eliminate a client’s orders quickly.”

While China continues to be the destination for much of the U.S.’s e-plastic, the quality of incoming loads remains an issue there.

China’s Green Fence customs initiative in recent years has had an impact on e-plastics imports. The Green Fence policy directed customs officials in China to increase inspections of loads of recovered materials. Steve Skurnac, the global president of Sims Recycling Solutions, noted exports to China have been hampered in recent years.

“There are issues with Chinese imports due to mixed and contaminated plastics loads,” Skurnac said.

It’s a second initiative, however, known as the Sword, that appears to be putting an even greater squeeze on plastics coming into China for recycling.

The Sword was launched in February of this year as part of an effort by the Chinese government to improve the quality of incoming loads of foreign recyclables, including e-plastics, and crack down on informal recycling operations in China and Hong Kong.

According to Steve Wong, the executive president of the China Scrap Plastics Association, the Sword initiative is “of profound impact.”

“Most of these scraps are contaminated with foreign waste,” Wong said. “Thus far I have heard nobody would risk importing e-plastics into China to avoid the trouble of being investigated.”

Wong added that “there are thousands of containers stuck in Hong Kong.”

Jim Fei, the owner of Baycrest International, a California broker that sends e-plastics to China, told E-Scrap News he has still found markets in China for the material. He argued baled and shredded e-plastics “are fairly clean.”

“We are still moving a lot of e-plastics to customers in China,” Fei said. “There are backups and slowdowns at the ports due to the inspection process, but our processors are still taking e-plastic. The only material that may have a problem is the shredded e-plastic with circuit boards contamination.”

Jim Cornwell, the president of processor URT, said his company has had to rely on the market overseas.

“URT has explored domestic markets in the past and found that many of these recyclers only wanted clean ABS with no other plastics mixed in the stream, or in reality that they were merely brokers shipping the material overseas and only processing a very small percentage domestically,” Cornwell said. “I don’t know how feasible it is to recycle domestically.”

Pushing e-plastics recovery forward

One company that has made a significant investment in North American processing, however, is FCM Recycling.

The Canadian electronics recycling company recently opened a facility in Quebec that is dedicated to processing up to 15,000 metric tons of e-plastics each year. The company invested heavily in the operation – over $4 million in research and development and equipment.

“It was very clear to us as time evolved that plastics was becoming more and more representative in the waste stream,” said FCM’s Rubin.

The e-plastics site operated by FCM expects to process about 5,000 metric tons of material in 2017, all of which is being recycled in North America and used in a range of products, including construction shims, flower pots and sheets used to manufacture various products. He also noted that the firm is actively buying e-plastic from other electronics recycling operations in North America to feed the recycling operation.

In addition to using a proprietary sorting process to successfully separate the various plastics, the plant utilizes grinders, air classification systems and metal detection systems.

“The markets are there,” Rubin explained. “What it comes down to is making the investment in the equipment to bring it to a level where it’s usable. You have to make the investment to separate the material, to grind the material down, to melt the material and re-pelletize it. If you get it to a pelletized form, there are plenty of markets.”

A related piece of the e-plastics recovery puzzle is generating enough large-scale and consistent demand to convince recovery firms to invest in equipment. Many have pointed to the need for original equipment manufacturers (OEMs) in the electronics industry to close the loop and reincorporate recovered e-plastics into new products.

One example of such activity can be seen at computer giant Dell, which works alongside manufacturer Wistron to bring recovered e-plastics into new products. Dell has operated a take-back program for years that allows the company to source and control its recycled feedstock directly. In 2014, Dell released its first computer featuring recycled e-plastic: the OptiPlex 3030 All-in-One desktop.

“The closed-loop process delivers an energy-efficient product made from recycled content that is nominally less expensive, with the potential to show greater cost savings as the program scales,” Dell notes on its website.

Willing to make the investment?

Sims’ Skurnac said improved sortation and further OEM support could help catalyze domestic markets for e-plastics.

“Better resin separation will drive higher prices and manufacturers trying to close the loop may sponsor plastic recycling and remanufacturing initiatives with recyclers,” Skurnac said.

“Better resin separation will drive higher prices and manufacturers trying to close the loop may sponsor plastic recycling and remanufacturing initiatives with recyclers,” Skurnac said.

Bolon of Novotec noted that obtaining enough supply is crucial to developing markets further downstream, especially when it comes to manufacturers.

“For any plastic, no matter how clean it is, if you don’t have enough volume, there is no market,” Bolon said. “A manufacturer has to be able to rely on a constant supply of the same exact product in order to set up a line or product.”

Sunnking’s Beckett also pointed out that recycling companies have to be willing to make the investment to separate e-plastics by resin type and then store material in order to produce a marketable commodity.

“Unless a processor has a large facility or a baler, loose plastics take a large amount of floor or gaylord space,” said Beckett. “This is also costly.”

But as complex as the e-plastics stream may be, electronics processors are beginning to see it as an important commodity segment in the years ahead and one that will, at some point or another, drive investment.

Said FCM’s Rubin, “It’s only a matter of time before new and novel solutions pop up to treat this material here in North America.”