Outerwall, the publicly traded firm that owns electronics trade-in company ecoATM, has been facing financial pressure. A recent report from Outerwall shows ecoATM lost more than $100 million last year.

Following a much-publicized critique last month of its business model from one of its core investors, Outerwall announced this week it would be exploring “financial and strategic alternatives to maximize shareholder value.”

Since that announcement, several news outlets, including Geek Wire, have suggested that Outerwall could be looking for a buyer of the entire business.

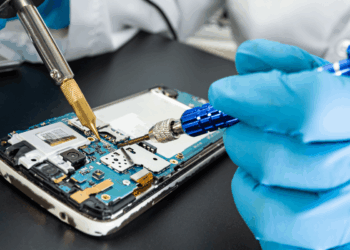

In a letter filed in February, Engaged Capital, which owns a 14.6 percent stake in the company, called on Outerwall to “sell or shut down” the ecoATM business. Outerwall also owns mobile-device reseller Gazelle.

“In total, management has already invested over $400 million into ecoATM via acquisitions, operating losses and capital expenditures. Despite this large investment, losses worsened last year and the business continues to lose money. We struggle to see how the acquisition of Gazelle, which also generates losses, provides a solution,” the letter read.

Outerwall reported owning and operating 2,250 ecoATM kiosks as of Dec. 31, 2015. The ecoATM venture, which relies on consumers trading in their used devices for cash, had an operating loss of more than $137 million in 2015.

Outerwall, which bought ecoATM for $350 million in 2013, told E-Scrap News in a statement it “does not intend to discuss or disclose developments with respect to this process unless and until the Board has approved a definitive course of action or the process is otherwise concluded.”