This article appeared in the April 2023 issue of Resource Recycling. Subscribe today for access to all print content.

The focus on plastic waste continues to grow, with major international policy initiatives such as the UN Global Plastic Waste Treaty and state legislation such as California’s polystyrene ban gaining momentum. While solid pollution threats (ocean plastics and microplastics, for example) are at the forefront of mainstream awareness, the general public and industry alike struggle to understand the outsized impact plastic has on climate.

According to the International Energy Agency, about 12% of global oil supply each year is used to create plastic, accounting directly for 3.4% of global greenhouse gas emissions. Reducing consumption of petrochemicals is the most effective method of limiting fossil-based emissions, and we need to continue advancing efforts to reduce our dependence on plastics especially.

However, many petrochemical forecasts anticipate increased demand in the coming years. For example, in the IEA’s “Future of Petrochemicals” report’s reference technology scenario, demand for petrochemicals is expected to increase by 30% and account for more than 30% of increased oil demand into 2030.

Even with aggressive efforts to cut demand, petrochemicals will play a role in the global economy for the foreseeable future, which means the decarbonization of existing processes is critical for the petrochemical industry to reduce its emissions footprint.

Increased demand forecasts indicate that the impact of sourcing, producing and recovering petrochemical products will continue to pose a significant threat to climate targets and broader sustainability goals. Accordingly, actors in the plastics supply chain need to consider the invisible waste of emissions associated with the plastics they produce.

As visible plastic waste initiatives continue to attract attention, there should be a parallel increased focus on their associated climate risks. More environmentally conscious consumers and buyers will push for lower embodied emissions across corporate supply chains to meet Scope 3 targets. Companies that make decisions now to reduce their products’ emissions footprints will be well positioned to fulfill future demand while steadily progressing toward sustainability targets.

Getting clearer on the plastics climate picture

The mission of The Rocky Mountain Institute’s (RMI) Horizon Zero project is to enable the creation of climate-differentiated products so that actors can make informed investment and purchasing decisions.

The first step toward reducing emissions is understanding where emissions sources are situated in a supply chain; you cannot mitigate what you do not know. RMI’s Horizon Zero team is working with stakeholders to develop robust product-level accounting guidance for plastics.

Without that granular guidance, plastic buyers cannot count the emissions they can avoid, and plastic producers cannot quantify the impact of incorporating decarbonization strategies in production processes. Carbon accounting methodology confidence allows producers to make targeted changes to reduce their climate impacts and seize marketplace differentiation.

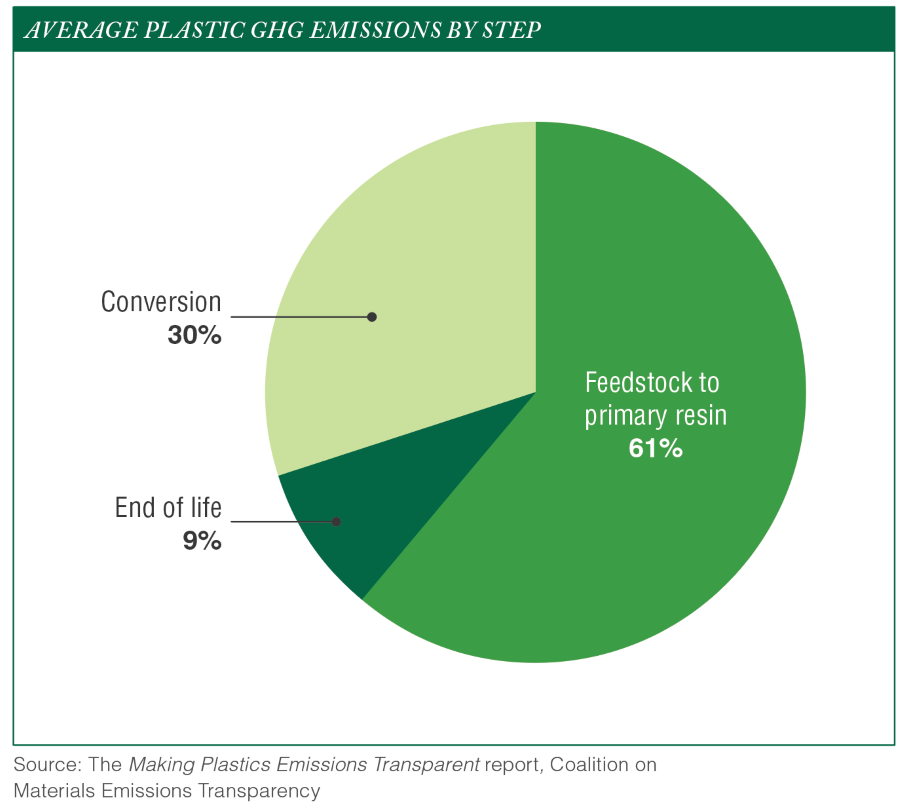

The current carbon accounting landscape for plastics is diverse, reflecting the complexity of the supply chain itself. The most comprehensive carbon accounting guidance for plastics to date is Together for Sustainability’s “Product Carbon Footprint Guideline.” This guidance covers cradle-to-gate chemicals production, including plastics up to resin production. The cradle-to-gate boundary covers approximately 60% of a plastic’s life cycle emissions, omitting product conversion steps from resin to fabricated product, and then on to end-of-life considerations.

This represents a step in the right direction, moving from corporate-level emissions reporting toward product-level accounting, but the Horizon Zero team believes there is additional room to improve in the plastics space. The team envisions a product carbon footprint methodology that covers 90% of a plastic’s life cycle emissions and allows for differentiation to the fabricated product level by geography and asset greenhouse gas (GHG) performance, providing the necessary information and transparency to decarbonize across all scopes.

Understanding and activating product conversion’s climate impact

Currently, most product carbon footprint calculations stop at the bulk resin production gate. This leaves out the plastics extrusion and fabrication steps, which together constitute a vital segment of the plastic supply chain that contributes about 30% of total life cycle emissions for a plastic.

Fabricators make the final decision on how much mechanically recycled resin enters the product and what type of virgin resin to use. Producers at this step of the supply chain also make product design and procurement decisions that can influence the end-of-life emissions for a given product, another potentially significant portion of a plastic’s life cycle emissions.

Often these producers are working in house or on a contract basis with direct buyers who, as end users, are closest to the consumers pushing for improved sustainability practices. Fortunately, these producers also possess the necessary tools to drive lower embodied emissions today.

The heavily electrified nature of the fabrication portion of the supply chain allows for significant emissions reductions through renewable energy procurement. A comprehensive accounting guidance should include these processes and collect the right data to drive decarbonization action.

Going beyond the production process

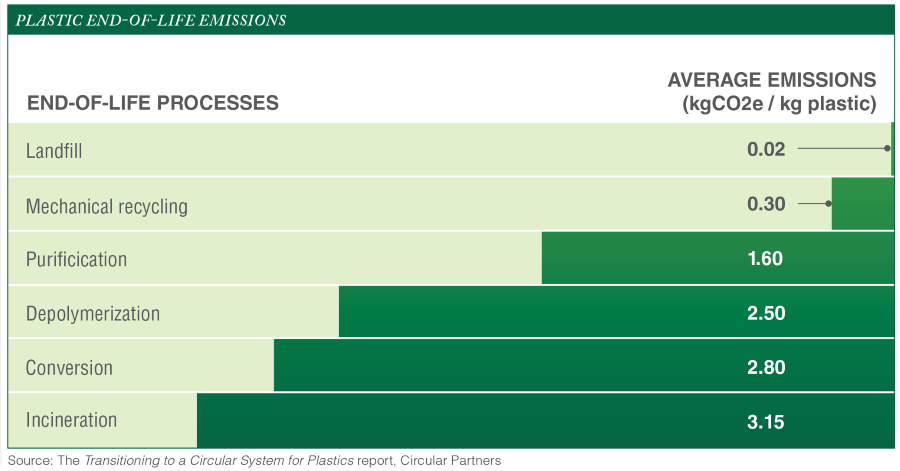

Plastic emissions do not stop after consumer use. Plastic end-of-life emissions could account for an additional 16 million metric tons of carbon dioxide equivalent (CO2e) emissions per year globally and can account for as much as 70% of a product’s entire carbon footprint, depending on the waste disposal method.

Traceability presents a unique issue in plastics carbon footprint accounting, with 23% of plastic waste categorized as mismanaged with end-of-life emissions unknown. Half of all plastic waste was disposed of in sanitary landfills with an estimated 0.017 kilograms of CO2e per kilogram of plastic end-of-life emissions. Another 18% was incinerated with an estimated 3.150 kilograms of CO2e per kilogram of plastic end-of-life emissions, and 9% was mechanically recycled with an estimated 0.300 to 0.500 kilograms of CO2e per kilogram of plastic end-of-life emissions.

Increasing the amount of plastic waste recycled has been the goal of many environmental groups for years. Corporate entities have set increasingly aggressive circularity targets, ranging from 25% to 50% post-consumer recycled content in plastic packaging by 2025, despite a lag in the supply of high-quality recycled resins.

These circularity targets aim to reduce the emissions from virgin plastic resin production, but they oversimplify the nuanced differences between recycling technologies and their associated emissions impacts. Traditional or mechanical recycling technologies have the lowest associated emissions, but recycling rates continue to suffer from limited feed availability and infrastructure. In the absence of robust mechanical recycling, producers are looking elsewhere to meet their circularity targets.

Comparing technologies by emissions

Increasingly, chemical/molecular recycling methods have gained popularity as a path toward these circularity goals, but emissions data vary greatly on chemical recycling processes.

For example, data from Closed Loop Partners’ “Transitioning to a Circular System for Plastics” highlight three advanced chemical recycling processes and their associated uncertainties. Purification or solvent recycling uses solvents to remove additives such as dyes and produces a virgin-grade polymer with an estimated emissions impact of 1.6 plus or minus 0.4 kilograms of CO2e per kilogram of plastic.

Depolymerization processes use various methods (for example, heat or enzymes) to break down polymers to their monomers for repolymerization with an associated emissions impact of 2.5 plus or minus 1.4 kilograms of CO2e per kilogram of plastic. Conversion processes such as gasification or pyrolysis use temperature and pressure to convert polymers to a wide range of hydrocarbon molecules for reprocessing. These have an associated emissions impact of 2.8 plus or minus 1.6 kilograms of CO2e per kilogram of plastic.

The uncertainties displayed here demonstrate the variability in chemical recycling technologies’ associated emissions. This variability can come from differences in processes as these technologies evolve and from the methodology used in the emissions determination itself. Without a consistent methodology for determining recycling processes’ emissions, producers and consumers struggle to understand their true environmental impact and to compare between technologies.

Even with such a broad range of possible associated emissions, manufacturers should not ignore the magnitude of difference between emissions from chemical recycling and those from mechanical recycling. Ultimately, not all recycling methods are created equal.

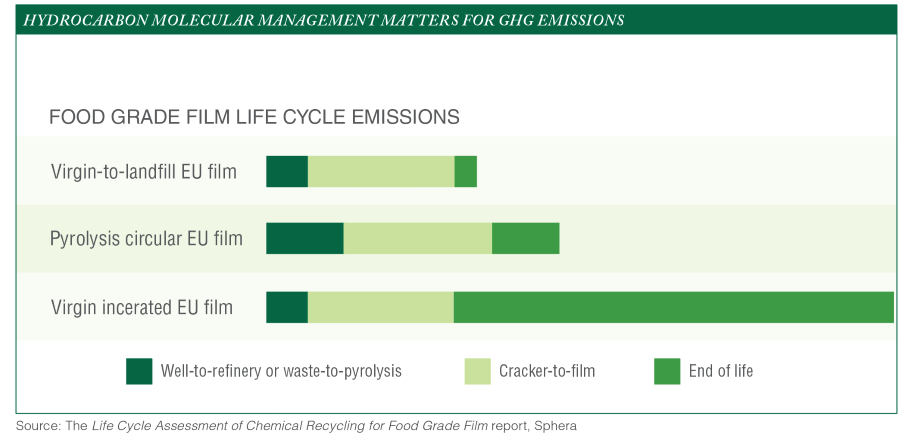

In one study of recycling of food grade film performed by Sphera, pyrolysis showed worse emissions than virgin landfilled plastic but better emissions than virgin incinerated film. Understanding these nuances is key to ensuring consumer demand market forces encourage recycling processes that result in a net emissions reduction.

Simple circularity targets present too narrow a view of the life cycle emissions embodied in plastics and a robust carbon accounting practice should consider not just the amount of recycled content but also the process by which the material was recycled. With this more nuanced methodology, a complete picture of plastic’s environmental impact becomes much clearer.

Where do we go from here?

RMI’s Horizon Zero project and Oil and Gas Solutions Initiative believe that clear guidance and focus on carbon accounting can provide a holistic view of the climate impact of different plastics production processes to drive reduced GHG emissions for a sustainable future. We will be working over the coming months to determine more effective strategies to reduce plastics’ climate risks. To that end, we will be publishing further insights and key lessons as well as plastic extrusion/fabrication-specific guidance incorporating these key principles.

Meghan Peltier is a chemical engineer and a senior associate at RMI. Contact her at [email protected] or visit rmi.org for more information.

This article appeared in the April 2023 issue of Resource Recycling. Subscribe today for access to all print content.