3rdtimeluckystudio/Shutterstock.

This article appeared in the September 2024 issue of Resource Recycling. Subscribe today for access to all print content.

Editor’s note: This is the second of a two-part series exploring the concept of circularity. Part 1 was published in the August issue.

“It’s circular. It’s like a carousel. You pay the quarter, you get on the horse, it goes up and down and around.” –Kevin Nealon as Gary Potter in “Happy Gilmore.”

In part 1 of this article, we explored the appeal of circularity and the circular economy as powerful principles of materials management, envisioning the endless cycling of package materials to reach the goal of conservation/containment of energy and material inputs — a materials management system that emulates natural stable systems, such as a mature forest, where carbon levels are balanced, and the amount of carbon naturally released in the form of gas is equal to the amount stored by the reservoir of tree and plant biomass. Everything falling to the forest floor becomes usable carbon food, which is cycled up into living trees, plants, bacteria and fungi in a closed, homeostatic system requiring the lowest productivity and inputs needed for forest resiliency and diversity.

The deep metaphorical power of circularity and the circular economy mimicking healthy natural systems led it to replace the old, more linear waste management hierarchy in the public sphere, providing a more inspiring path toward mitigating the unsustainable environmental impacts of resource consumption.

Recycling is a strategy often connected to circularity. They comparatively present an opportunity for further exploration. Recycling functions as a last resort that seems to accept the fact of mass consumption but works to mitigate it by capturing remaining value — whether monetary, energy, lower emissions or reduced carbon before disposal. Recycling and circularity can be seen as two related but separate goods, one a tactical method of salvage that aims for convenience, the other a framework for sustaining resources and lowering energy use. However, at the nexus of recycling and circularity are troubling real-world paradoxes.

However related, residential package recycling today meanders around but does not approach lofty circular tenets. Its approach to managing end-of-life materials stretches far back into human history to hunters and gatherers, when usefulness of an object diminished, lesser uses were found, or the material was consumed as fuel. In the present day, recycling of materials like paper and packaging is more of an open, linear system and business process, not a cycle of something valuable. It may be improved by using underlying principles of circularity, but circularity cannot be sustained for physical reasons through recycling — it can only get closer to that ideal. Implemented by free market actors, public programs, policymakers and other recycling supply chain players, recycling captures whatever it can for remanufacturing into beneficial products, with the uncollected or misprocessed materials being disposed of or lost.

RESIDENTIAL PACKAGE RECYCLING’S ROLE

For package recycling, the gold standard of circularity is arguably when materials are turned back into the same product. This is much less common than recognized and is found most often in materials with high captured energy and durability, like metals and paper fibers. Further, material consumption is not stopped by recycling, it is only slowed, and the residential recycling supply chain rarely closes the circle for any type of commonly recycled package. The powerful implication is that use of extracted virgin materials will continue on a massive scale for most packaging.

Yet we come not to bury recycling but to raise its absolute necessity, and with it, the need to finance and improve it for more material capture. We do, however, question the facile use of “circularity,” especially when recycling is pushed as a defining answer to a package’s circularity. Kristian Syberg, an environmental risk researcher at Roskilde University in Denmark, critiqued this tendency from across the globe, writing in Scientific American in 2023 that “attention has been primarily focused on recycling,” but the reality of recycling and the circular ideal is subject to scrutiny and misses the mark of reducing waste. This shows up graphically in some of the conditions recycling finds itself up against:

- Household recycling rates have not materially improved for over 20 years despite more investment and the popularity of residential single stream recycling. As such, the base of any new potential cycle of materials is continually diminishing, a dwindling spiral that necessitates more virgin extraction.

- Even with the high-value, energy-trapping aluminum can, 40% were still thrown away despite their value in 2020, according to The Aluminum Association, an industry group.

- Persistent gaps in access and behavior, due to a fundamentally flawed system of properly financing material collection, result in almost 4 of every 5 generated tons being lost to disposal.

- Extended producer responsibility laws are designed to address the system financing issue, but so far only five U.S. states have passed EPR for packaging.

- According to the Organisation for Economic Co-operation and Development, less than 20% of plastics enters the recycling stream and only 9% actually is recycled.

In addition to these overall system challenges, recycling circularity faces unavoidable physical limitations. Let’s examine one of the best cases of recycling circularity in the package recycling stream: aluminum cans. Other materials like glass and steel compare favorably with cans in the limited inherent loss of material in each remanufacturing cycle, but aluminum cans are much more likely to cycle back to their original form. Cardboard cycles well back to original form but material damage in each cycle limits the total cycles to around seven times, whereas can cyclability can be as high as 12-20 times.

The refining of pure aluminum requires distilling from bauxite ore, converting highly variable inputs into purified molecules of alumina, which are refined by chemical electrolysis requiring huge amounts of electricity. Newly formed pig aluminum then goes through a series of alloying and/or coatings through furnaces or chemical baths. Specific can sheet or top alloys are then painted and/or labeled to be used in the packaging process. When captured for recycling, the high energy concentration in the original product production is saved. However, if can material recyclability is limited to 20 times at best; by the end of the 20th cycle, the input of high energy concentrated virgin materials will have reached 100%. Thus, even in this best case, continued virgin material extraction is an unavoidable outcome.

The force that prevents true circularity is the same one that works against all structured systems in nature: entropy. The groundwork of entropic effects on circularity is laid even before collection in the design of packaging. From that point forward, through the entire recycling supply chain, including collection, processing and remanufacturing, entropy weighs heavily on package recyclability and its circularity. Let’s unpackage that further.

Today’s newer packaging formats have a complexity that inherently makes them less recyclable, while design trends seem to be working against recovery through recycling:

Downgauging. This umbrella concept encompasses using thinner gauge materials but also adjusting package size while maintaining functionality and quality until discard. Both trends have affected highly recyclable packaging. Steel cans and PET bottles have become at least 30% lighter, thinner or smaller over the last 20 years, and aluminum cans in the last 50 years have become lighter by half.

Downgauging is a very circular-economy practice, reducing material consumption and increasing efficiency through net savings on materials and energy. But it makes the return of materials to use harder and more expensive. Like reduce and reuse, recycling benefits from higher durability, which runs counter to common upstream sustainability and efficiency efforts. As McKinsey & Company wrote in 2020, brands and packagers “will have to face complicated trade-offs such as recyclability versus carbon footprint.” Some brands with lofty circularity goals seem to understand the dilemma and are now publicly announcing alternative carbon metrics over recyclability.

Multi-material packaging. Package system choices trend toward customization to increase benefits such as barrier and taste protection, structural efficiency and shopping aisle appeal. It is not surprising that for the most malleable material, up to 20% of plastic packaging is multi-material or multi-layered. The benefits of custom packaging are real and include safety, food preservation and longer shelf life — all these connecting to circular principles around efficient use of resources. However, multiple layers complicate recycling by adding variables to the primary targeted material to be captured through cross-contamination.

Packages utilizing materials with new chemistries and formats. Many new packages may be worth recycling (i.e., carbon capture or energy saving positive), but each new input into mixed recyclables for processing is marginal, and can result in increased contamination cost, scale inefficiency, and lack of local markets. Examples include complex forms of flexible packaging, the ever-changing cosmetic and home health package segment, ultra-convenient one-step delivery systems, and an array of food service packaging items, some having very good recycling characteristics, some of which do not.

The upshot is that conscious brand packaging design choices add entropy to the package recycling system. Although cardinal materials for packaging may still predominate in today’s packaging systems, the trends outlined above multiply against each other with deleterious effect. A key corollary of these trends is that the pace of packaging innovation has constantly outpaced the ability of residential recycling’s business and technological model to keep up. This may be the reason growing numbers of brands are now actively postponing or adjusting their recyclability and content goals downward.

AN IMPERFECT RECYCLING PROCESS

A natural part of the package recycling process from collection to remanufacturing is loss in material yield and purity from the inevitable entropy from each refinement process to reach the same package function. This system of collection and processing, through the complexity and impacts of sortation and separation to pure commodities, can be illustrated through some of the following examples:

- After packaging serves its useful function, some of it is placed in ultra-convenient household recycling carts. But data indicates that homeowners don’t always recycle all their recyclables, perhaps in part due to the challenge of making them clean and dry.

- Misleading labels and recycling messages cause “wish-cycling” of non-recyclable items. These contaminating materials erode the system’s ability to move material-sorted recyclables to remanufacturing due to chemistry, complexity or lack the scale for removal in the system.

- Recycling collection’s efficiencies optimize material deliveries at low cost but also add entropy by mixing and densification. Compaction of materials en route flattens, crushes, deforms and pushes disparate materials into each other, degrading, decaying and cross-contaminating target materials.

- Mixed-material recycling processes introduce more entropy as unloading and sortation misdirect or similarly degrade some materials.

- Reclamation and manufacturing steps for reusing the material contribute further to the loss in packaging yield per cycle, i.e., everything from re-sorting to furnace losses, fines loss and the need to improve chemical properties through dilution and so on.

The final non-circular reality is that too many materials do not ever return to the same product due to things like costs, material color, chemical composition, contamination, lost durability or specialization. Most of what we consider to be recycling is actually downcycling. The reason that packages tend to downcycle is materials used lose their purity or other characteristics in each run through the cycle, and repairing to their original condition can be prohibitive. Examples abound, such as post-consumer food-contact PET made into carpet fiber; glass recycled into fiberglass or used as alternative landfill cover (especially where there is no glass bottle manufacturing), colored HDPE containers made into piping, and mixed aluminum container bales going into lower-quality ingots.

It’s not that downcycling is a bad thing — it still reduces virgin materials, saves energy, lowers emissions and captures carbon, but it begs questions around circularity, especially when the downcycled products are not typically recycled at scale. Carpet and textile recycling happen at a small scale nationally, and few programs exist to recycle fiberglass insulation or drainage pipe.

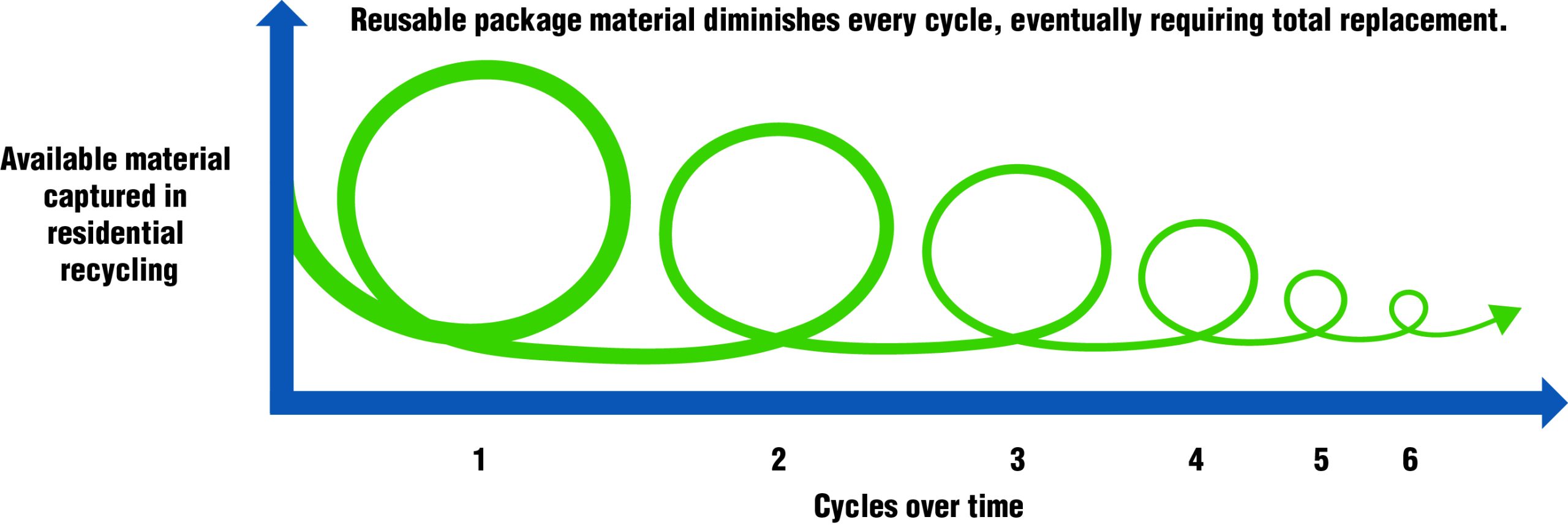

So recycling is not a closed loop, and the benefits of recycling material are not endless but only finite inputs that diminish with each cycle through the system so that total loss is achieved in a determinate number of cycles. Though the battle for better yield from the residential package recycling process is continually waged throughout the recycling supply chain, there is simply not yet enough energy or financial capability in the system to close the losses. Ironically, as capture and recycling of material increases, getting to a pure cycling of materials with little to no loss may have infinite costs and not be desirable due to the effort required.

This is clearly a pessimistic characterization, but every step in the recycling process — reaching all the way back to design — is improvable, and clear steps can be taken that will lead us closer to the circular chimera. Many of the tactics for circular strengthening are well-known but we still need new, broader and more robust approaches. Remembering that the battle against entropy in material circularity is a product of conscious business and political decision-making choices, to provide the proper motivation and sense of urgency, we remind readers that if we keep consuming increasingly complex materials at the same rate, the powerful forces of entropy will guarantee ongoing high-impact, high-energy of virgin material extraction and use, all of which will make it extremely difficult to sustain nature or help cool the planet.

There are some essential steps forward we can take.

There are some essential steps forward we can take.

First, bring back “reduce and reuse.” As observed by the World Economic Forum, “in a properly built circular economy, one should rather focus on avoiding the recycling stage at all costs. It may sound straightforward, but preventing waste from being created in the first place is the only realistic strategy.” Here we come full circle back to the old waste management hierarchy that prioritized reduce, reuse and recycle, with the first two being the only true circular methods for reducing waste that bring the highest benefits to the environment. It is high time to push these strategies to funded policy and into brand business models. The recent move to EPR is beginning to create a long-needed bridge to do just that. Along with deposit recycling systems, enforcement components and supply chains to reduce and reuse are taking hold, a highly welcome development. Finally, brands still have, and are constantly working on, the many opportunities to pursue waste reduction upstream by addressing the size of formats for product delivery and product/package ratios. Efforts downstream to make reusable or more durable package formats and minimization of materials that simply become waste traveling through the recycling process need similar attention.

Second, accountable circularity metrics throughout the package supply chain could help even the playing field where circularity features are more highly favored:

- Create enforceable design metrics that measure and reward brands for packaging reductions, reuse potential and recyclability in a cumulative, hierarchical scoring format. This would drive them to do things like maximize material strength and durability for reuse and recycling while consistently moving toward less material complexity and more material uniformity.

- Insist upon accountable recycled content metrics and clear labeling to both enhance market pull for clean recyclable materials and ensure cleanliness through consumer understanding.

- Provide easy-to-understand, full greenhouse gas accounting and public incentives as requirements for residential, EPR and deposit recycling programs.

Third, properly finance recycling collection through a combination of EPR, DRS and mandatory recycling ordinances, providing the resourcing and legal motivations needed for universal recycling access and for the educational efforts required to expand clean recycled material stream yields. Meanwhile, properly cost disposal options for all of the externalities in their disposal fees, i.e., long-term emissions and impacts on downstream life systems, so that clear choices can be made.

Lastly, while eco-modulating packaging for recycling-oriented attributes is a tenet in EPR, virgin material eco-modulation could also be used to internalize upstream externalities, minimize material loss and mitigate the impacts of virgin material use. For instance, packaging fees and incentives could help identify and monetize the necessary capital to drive up regenerative conservation, use renewable energy in virgin material production and better control pollutants such as methane from oil and natural gas production.

This two-part article has sought to explicitly recognize the limitations of recycling to meet full circularity, and to challenge recycling professionals to think about the strategies that improve the ability of recycling to contribute to circularity as the final resort before household packaging is disposed of. Our hope is that it also helps build discretion in the current uses of the word circularity to make it become less superficial, i.e., tossing around the goal line of circularity through the method of recycling, which can only partially get us there.

In addition, package recycling supply chain stakeholders must consider making more fervent strides towards reduction in overall waste potential and more complete cycling of materials. They must bring forward real solutions to address the impacts of single-use packaging waste as soon as practicably possible, including mitigating the impacts of continued virgin material use. This will take the resources and further regulatory underpinnings that a circular economy will be based upon. It won’t happen by itself. We need to pay our quarter now for the speed of results to be meaningful.

Michael Timpane has been a partner and vice president with RRS since 2015 and specializes in the recycling supply chain. He has worked for each of the largest post-consumer recycling companies in their time – Reynolds Aluminum, BFI, and WM – for over a decade each in his half-century career.

Scott Mouw is senior advisor for strategy and research with The Recycling Partnership. He comes from a background of public recycling, including directing the state of North Carolina’s recycling program.

There are some essential steps forward we can take.

There are some essential steps forward we can take.