This article appeared in the May 2021 issue of Resource Recycling. Subscribe today for access to all print content.

As companies and governments set goals to increase recycling and the use of recycled content, does the industry know enough about the supply and demand curves of domestic recyclables to ensure our system is primed for success?

To answer that question and help inform policy and design approaches, AMERIPEN commissioned a recently published study: “U.S. Company Recycled Plastic Content Goals Analysis – Supply & Demand.”

Prepared by the Circular Matters consultancy and focused on plastic packaging goals, the research shows that the United States currently lacks the available supply and, in some cases, domestic reclamation capacity to meet corporate plastic recycled content commitments. Without additional interventions, the majority of companies are likely to fail to meet their commitments by 2025.

The analysis also provides insights into design and recycling access challenges that require additional consideration as we seek to increase levels of post-consumer recycled (PCR) content in packaging formats.

Demand ramps up

Many large companies that offer consumer packaged goods (CPGs) have announced voluntary recycling commitments over the last several years.

The AMERIPEN study examined the corporate commitments of 35 CPG companies, including many well-known brands. While the initiative started with an assumption that recycled-content goals would apply to all materials, the analysis shows that companies predominantly have robust PCR goals only for plastic packaging, including PET, high-density polyethylene (HDPE), low-density polyethylene (LDPE), polypropylene (PP), polystyrene (PS), and “other.”

The companies were intentionally flexible in articulating their goals: Most companies strategically framed their goals to grant them the ability to apply recycled content across their plastic portfolio in response to available supply. Some goals also included both recycled and/or renewable content as attributes of sustainability, complicating the quantification process.

For example, the study notes a company that offers a wide array of plastic packaging could meet a goal of using “15% recycled or renewable content across all plastic packaging” by using 30% PET post-consumer resin in half its packaging and 0% in the other half. Similarly, that company could use 15% PET post-consumer resin in one quarter of its packaging and 15% biobased material in another quarter. As a result of this complexity, the study analysts took a conservative approach to estimating demand and believe their findings also should be considered “under-reported.”

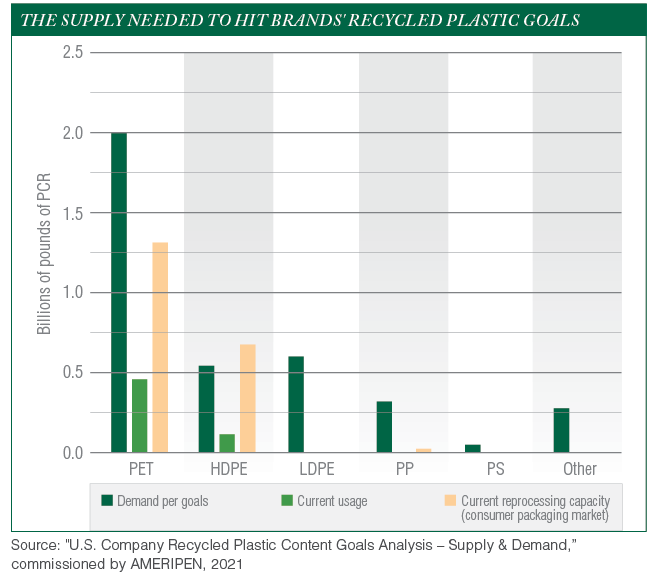

After examining the data for the companies included in the study and quantifying the demand to meet corporate commitments, the research team found that, across all plastic resin types except HDPE, demand in the United States exceeds the domestic supply and capacity (see chart below). The findings around PET clearly demonstrate the supply shortfalls: Of more than 6.3 billion pounds of PET bottles sold in the United States in 2018, only 1.8 billion pounds of PET bottles and 0.1 billion pounds of thermoforms were collected for recycling. According to the study, “If the total domestic PET reclamation capacity were to be increased to 3.8 billion pounds of capacity, and that capacity were to be utilized, collection would need to increase to nearly double current levels.”

And because recycled content used in PET bottles and thermoforms requires specific quality requirements above and beyond that of other end markets (such as carpeting), “PET reclamation capacity in the U.S. would, at a minimum, need to increase by 50% from current reprocessing capacity to meet CPG company brand commitments for their PET packaging,” according to the analysis.

Improving collection and reprocessing capacity to meet demand will require stakeholder interventions, the analysts conclude.

The end market equation

The end market equation

In evaluating existing end markets for recovered plastic resins, the study found packaging makes up less than 50% of total PCR sales, suggesting that any increase in demand from the packaging market would be met with significant competition from other end uses.

This is important not only because it implies restrictions on the capacity of some reprocessors that are developing materials specific for other end uses, but also because significant disruption on these patterns will have unintended consequences across numerous industries.

In assessing demand for packaging, the analysts also note that packaging has explicit regulatory and technical design specifications that may further hinder use. Viscosity, color and scent characteristics can prove a challenge for packaging applications, where image, touch and smell are often key selling points.

Additionally, the analysts note a current lack of available reprocessors that can manufacture recycled resins to meet Food and Drug Administration regulations for food contact packaging. Even if we were to increase collection and reprocessing capacity, we may need additional investments to ensure regulatory and design requirements, according to the data.

Four areas of focus

Recycling collection and reclamation quantities for all resins must increase from current levels if corporate commitments are to be met. To develop effective policy and programs that address this shortfall, stakeholders should consider exploring four key issues.

First is collection. For most resins, we need to increase the amount of recyclables coming into the system. This may mean increasing investment in educational campaigns to help boost consumer participation in recycling. More specifically, there may be value in educating consumers on both the need to reduce contamination at the bin and the economic and employment value of recycling as a strategy to increase participation.

In addition, some policies, such as bottle deposit legislation, may help drive increased collection for certain resins.

The next issue to address is capacity. Although brand goals are designed to be flexible, limited access to robust recycled material for most materials necessitates investments in technologies to expand reprocessing for resins and expand the quality of recycled resin output. The analysts highlight that increasing the number of plastic reprocessors that are capable of producing food-contact-approved resins would require minimal change.

Boosting the U.S. supply of recycled plastic also will require advances in chemical recycling technologies, a wide spectrum of processes that includes pyrolysis, gasification, depolymerization and more. Chemical recycling shows promise in producing PCR resins that are virgin-equivalent. Chemical recycling of PET specifically would expand recycling beyond bottles to include PET textiles such as carpet. While this technology is promising, chemical recycling options are in their infancy and may not be economically viable for five years or more, analysts caution.

The third consideration to drive progress is material quality. While education at the bin and streamlined packaging design could help improve the quality of materials collected, additional strategies for sortation and reprocessing will require significant investment – and industry funding to help focus on quality may be beneficial. AMERIPEN’s proposals for packaging-industry financing to support recycling have a strong focus on quality and end-market demand.

Related to quality is the notion of “highest and best use.” The study notes that some materials have demonstrated a hierarchy for recycled content, pointing out that products with lower quality needs often realize greater environmental benefit from recycling than those with more refined needs, which demand more processing to meet specifications. Stakeholders should consider targeting where recycled content creates the greatest environmental value, rather than employing design strategies for reuse across all products.

Finally, there is the policy element of the conversation. Policy affects all areas of recycling, as we’ve seen with the suggestion of bottle bill legislation to support collection or financing to improve capacity and increase reprocessing. But perhaps the most relevant and most frequently discussed policy for recycled content is the increasing push for recycled content mandates. While mandates can help markets and stimulate demand, meeting their stipulated goals should be done with significant caution, according to the study analysts.

The industry currently lacks available supply to meet even voluntary goals. More mandates and greater expectation for recycled content will magnify that instability across the recycling system. The study notes that mandates should be undertaken with consideration for the entire recycling system – collection, capacity and quality – to ensure the industry can match mandate-driven demand with available supply.

Success depends on collaboration

The above ideas for interventions all hold promise but require further dialog. To ensure the necessary supply of PCR and the domestic capacity to meet CPG companies’ current voluntary commitments and any future mandates, we need collaboration. AMERIPEN will continue to work closely with stakeholders throughout the packaging infrastructure to help align packaging providers with recycling market development agencies to support collaborations toward increased investment, policy support and public education.

Dan Felton is executive director of AMERIPEN – the American Institute for Packaging and the Environment – a policy-based trade association for the U.S. packaging industry. He can be contacted at [email protected].

The end market equation

The end market equation