This article appeared in the February 2020 issue of Resource Recycling. Subscribe today for access to all print content.

More and more, members of the public and mainstream news reporters are making the case that there is no reason to recycle–because everything collected is supposedly being thrown out.

While it’s certainly true recycling market foundations have shifted in the wake of China’s National Sword, the fact remains that plenty of end users remain hungry for material coming out of municipal programs. And very often, these buyers are located close to where recyclables are generated.

To bring some data points to this conversation, the Northeast Recycling Council (NERC) and Northeast Waste Management Officials’ Association (NEWMOA) together recently undertook research into end-use options for recyclables in the 11 states covered by our organizations (Connecticut, Delaware, Maine, Maryland, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania, Rhode Island and Vermont).

The Regional Recycling Market Development Committee, which was formed by NERC and NEWMOA in 2018, set out to create a resource that catalogues regional end markets for materials commonly collected in curbside programs: plastic, metal and glass food and beverage containers, and paper.

Outlining these regional end markets right now is critical. As residential recycling programs encounter new economic realities, some cities are considering dropping materials from collection lists. Such action could have pronounced long-term consequences. Without a predictable source of material from residential recycling programs, processors and end users will have far less ability to expand or innovate. Therefore, the industry needs to do all it can to identify existing markets, making clear to elected officials and others that end uses continue to exist.

Some surprising takeaways

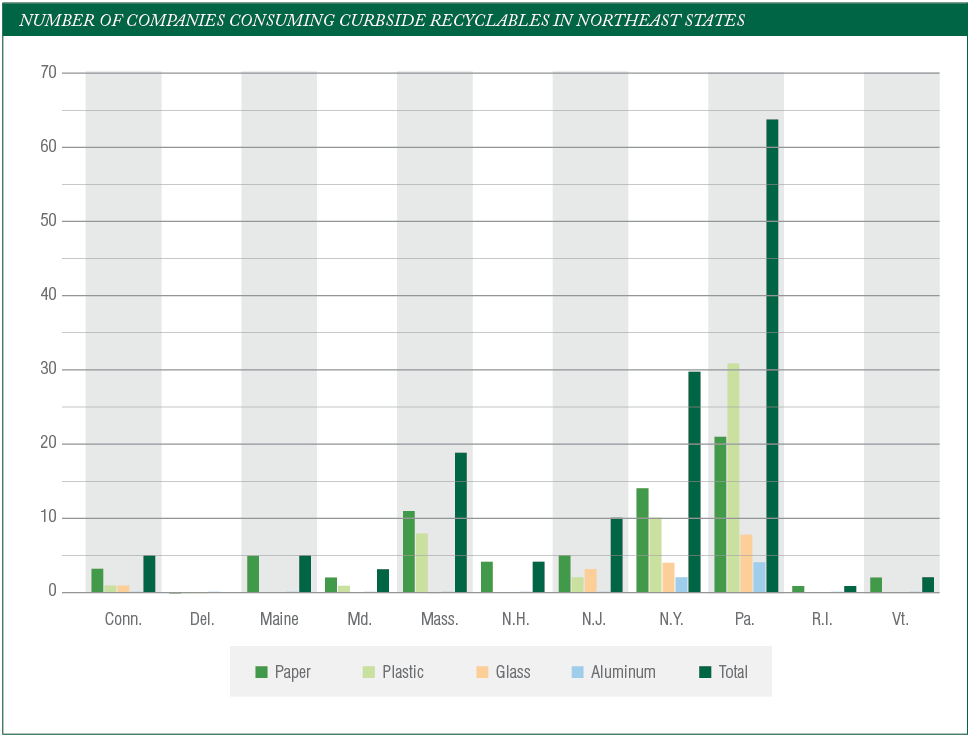

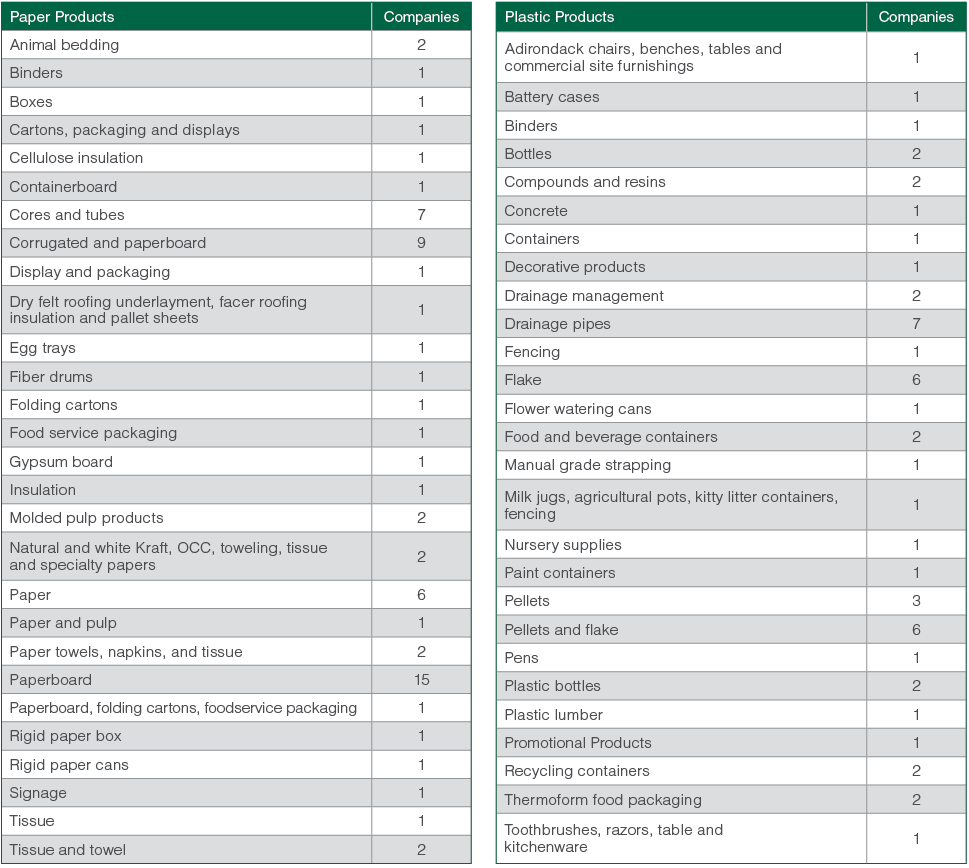

Drawing on a number of resources (including Google), the NERC and NEWMOA market comittee compiled a list of companies that either process materials coming out of a MRF or use processed materials as a feedstock. Listings were verified through conversations with the individual facilities and companies. The findings are laid out on the chart and table below.

We made several interesting discoveries along the way.

We made several interesting discoveries along the way.

For one, there is often resistance among material consumers to publicly acknowledge using recycled feedstock. Our research found many more companies are processing and using post-consumer recycled materials than is obvious from a look at their websites. In fact, some companies did not want to be included on our list, even though they are eligible. It’s clear that for some manufacturers and end users, use of recycled content makes sense from an efficiency or cost standpoint, but it’s not something they want to promote.

Additionally, we found a wider range of product categories are integrating recycled content than one might think. The end users in the Northeast go well beyond producers of plastic packaging, recycled-content paper and plastic decking.

Take, for instance, Applegate Insulation. This Michigan-based home insulation provider also has a presence in Pennsylvania. While insulation is a well-known downstream market for recovered glass, Applegate also uses lower value fiber material, buying direct from MRFs.

Another example is HydroBlox, which buys bales of plastics Nos. 3-7 to manufacture systems to manage water drainage at both homes and commercial properties. Representatives of the company, which manufactures near Pittsburgh, told us they actually struggle to find enough recycled supply to fill their demand.

Highlighting such products can help engage the public, showing that collected material really is going to a positive place.

Another important takeaway is that despite our research, important gaps remain when it comes to identifying end markets, especially for steel. We were unable to get anyone in that sector to speak to us. One company specifically said it did not want to be included; others did not return multiple phone and email inquiries. There is a similar lack of information about aluminum recycling. Aluminum companies in the Northeast using recycled content were identified in online research, but we could not verify the information.

Finally, there are more companies processing and using plastic film than we realized, but we did not include them on the list because this material is outside the scope of the project – in the Northeast, residential recycling programs rarely collect plastic film.

Note: The tables show the number of companies in Northeast states making products from recycled materials.

Next steps forward

We continue to seek companies to add to the list, and we’ve been encouraged by the industry’s reaction since we initially posted our findings in October 2019. NERC has received word that some companies on the list immediately saw an increase in business inquiries. Others are letting us know that they are developing facilities in our region and look forward to being included in the coming years.

In conjunction with the research, NERC recently adopted its first post-consumer recycled content policy. The policy notes that NERC believes that beyond voluntary initiatives, mandatory actions based on science and economics are needed to drive an increased use of post-consumer recycled material.

In support of its mission to minimize waste, conserve natural resources and advance a sustainable economy, NERC has adopted this policy to encourage legislative and procurement requirements for minimum post-consumer content. NERC believes these requirements generally should apply to all consumer goods produced from materials including, but not limited, to: aluminum, steel, glass, paper and plastics. There may be circumstances in which this is not the preferred approach, but this would be a circumstance specific to a particular commodity and product.

While the new recycled content policy is a small step, it highlights NERC’s awareness of the need to grow attention about the use of secondary feedstock while working to support both the quality and quantity of what is recycled.

Finally, it’s important also to note that NERC has been actively involved in initiatives to increase the use of secondary feedstock throughout our 33-year history. These efforts have included:

- The Newspaper Publishers Agreement – a groundbreaking negotiation that brought the Northeast newspaper industry together to commit to using a set minimum amount of post-consumer recycled content.

- The Yellow Page Publishers Association’s commitment to report on the status of recycled content purchasing efforts, design for recyclability, source reduction and other related environmental issues.

- The Direct Marketing Association commitment to reduce waste associated with direct mail by increasing the use of recycled materials, as well as source reduction and design for recyclability.

- Working with hotels in New England and businesses in Vermont to increase the use of products with recycled content.

- Creation of a recycling market database in New York state.

- The State Electronics Challenge, which works with government entities, schools, colleges and universities and nonprofits around the U.S. to purchase electronic products with recycled content.

- Developing model procurement specifications for paper, toner cartridges and office supplies.

- EPPnet, a unique national listserv for conversation about environmentally preferable purchasing.

- A glass recycling committee to help expand end markets for glass in the region.

- Government Demand Champions, a pilot funded by the Association of Plastic Recyclers to increase the use of plastic drainage pipes with post-consumer recycled content.

NERC continues to examine ways to identify and publicize markets for recyclables. Let us know of any we may have missed.

Lynn Rubinstein is the executive director of the Northeast Recycling Council (NERC). She can be contacted at [email protected].