This article appeared in the December 2019 issue of Resource Recycling. Subscribe today for access to all print content.

In recent years, recycling program leaders across the country have reevaluated how glass fits into the future of their materials recovery initiatives. While markets for materials like paper and plastic have been heavily influenced by import actions overseas, glass values have remained stable. However, glass can also present cost concerns on the processing and transportation front, and as programs have felt the larger economic squeeze from National Sword and other factors, some communities have elected to remove glass from the curbside mix.

With so much conversation around the material, it can be helpful to look at how glass recycling strategies are being refined in one region that features a range of community types and has a history of municipal recycling progress.

The state of Minnesota has an effective glass recycling system in place, including community collection programs, materials recovery facilities (MRFs), a secondary glass processor, and numerous end market manufacturers serving the region. It is reported the glass marketed from MRFs in Minnesota is some of the cleanest in the country, with loads having relatively low non-glass residual (NGR) rates. In general, glass-recycling stakeholders in Minnesota understand the value of recycling glass to keep it out of the costly disposal stream and are pushing forward with efforts to continue to expand glass recovery.

Those realities were made clear on Nov. 14, when the Recycling Association of Minnesota (RAM) and national secondary glass processor Strategic Materials, Inc. (SMI) co-sponsored the Minnesota Glass Recycling Summit to bring stakeholders together. The event included a tour of SMI’s St. Paul plant as well as presentations from a variety of speakers who together represented the entire glass recycling value chain.

The summit also included robust conversations about the challenges and opportunities for glass recycling, and several ideas were presented about what specific market development projects could be initiated to enhance the value of glass recycling throughout Minnesota as well as in nearby states.

This article, based on the summit proceedings as well as numerous discussions with regional recycling leaders, will offer a look at the state of glass recycling in the state and will discuss steps that are helping to strengthen the sector in Minnesota today. Much of what is happening in the North Star State can be emulated in many other areas of North America.

A widely accepted commodity

State law and policies have helped keep glass recycling stable over the past two decades in Minnesota. Known as the “Opportunity to Recycle” requirement, the Minnesota Waste Management Act requires larger cities in the Twin Cities Metro Area to provide curbside collection of at least four broad types of recyclable materials and other communities to provide drop-off services for those items.

Glass has traditionally been specified as one of the four broad types and is currently included in nearly all municipal recycling programs throughout the state.

In order to be exempt from the Minnesota Solid Waste Management Tax, MRFs must meet an 85% recycling rate, with no more than 15% of incoming weight sent to disposal by a MRF. Single-stream MRFs have seen glass recovery as one of the best means to meet this threshold for two reasons. First, glass is typically 20 percent of the total incoming waste stream. Second, the higher density of glass helps with weight-based recovery rates compared with other MRF commodities.

Like all recyclable commodities, the history of glass collection has seen many changes. Today, single-stream systems collect recyclables mixed together in a curbside cart, collected in a single-compartment truck, and deliver it to a MRF in commingled form. Most often, MRFs use machinery to screen out glass at the front end of processing and then market this “color-mixed glass” (also called “MRF glass”) to secondary glass processors for further sorting and cleaning.

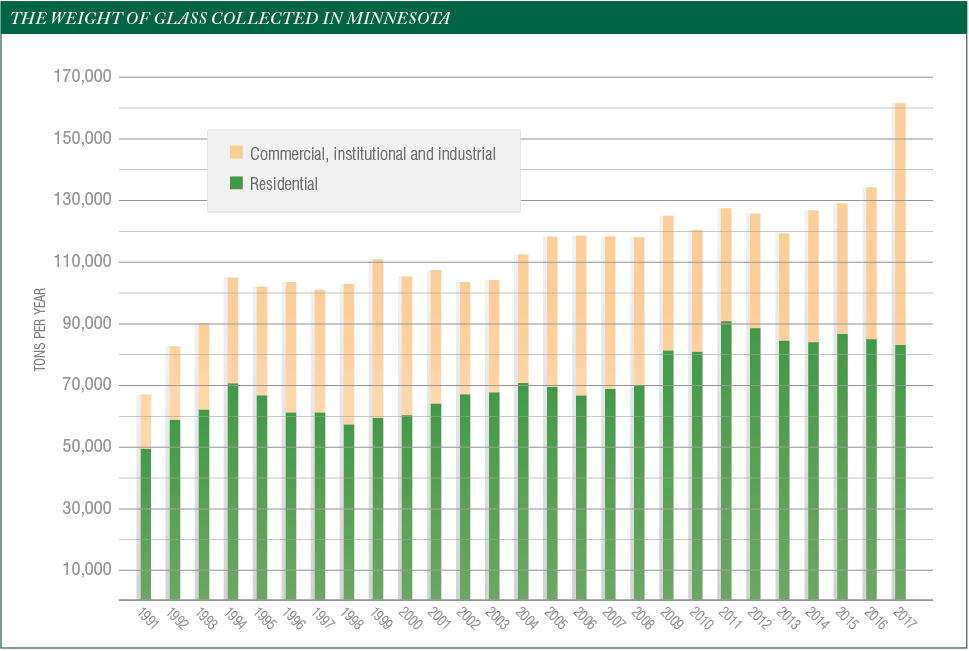

The chart below displays the historical trend of glass recycling in Minnesota in tons per year (the chart goes back to 1991, the first year the Minnesota Pollution Control Agency, or MPCA, began collecting and archiving this data). The chart is split by generator source: residential in green, and commercial, institutional and industrial (CII) in orange. The data is reported each year by Minnesota counties “as collected” and MPCA aggregates it and recently released the numbers in an online data tool.

The overall trend line in Figure 1 indicates a gradual increase in total tonnages, averaging about 4% per year and increasing to 162,000 total tons collected in 2017. From 2014 to 2017, there were significant increases in the collection of reported CII glass, which undoubtedly represents an opportunity for increased recovery rates. One important source of commercial material is bars and restaurants that may still have the potential for growth in glass recovery.

View from the processor

For haulers and MRFs, glass may have a relatively low or negative price point compared with other recyclables. This type of simple price comparison, plus the distance to markets (representing another cost), is one of the reasons some communities and recycling organizations have considered discontinuing glass collection in municipal programs. Even though glass is recycled domestically, and most often locally, there is more pressure as a result of the declining “blended” value of other recycling commodities, due in part to foreign market import restrictions by China on materials like paper and plastic.

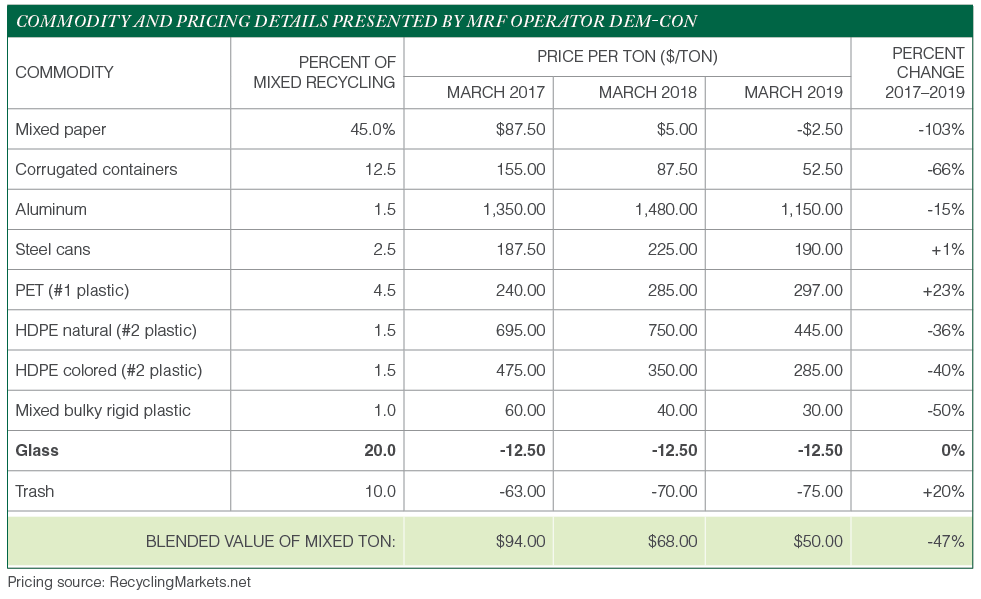

Bill Keegan, president of Shakopee, Minn.-based Dem-Con Companies, an independent recycling and waste management business in Minnesota, presented details on the economics of his operation at the 2019 Resource Recycling Conference. Keegan described the declining end market value of the “blended ton” from the total stream derived from residential programs. The table below shows the composition and relative price changes by commodity over the past three years at Dem-Con. Glass pricing has remained stable (even though this example price schedule shows glass carrying a negative price) while most of the other recyclable commodities have seen significant decreases.

Despite that pricing stability, we often see a lack of communication about the true value of glass. Some communities have quit collecting glass because of the perception, often incorrect, that there is “no market” for recyclable glass. Even if that was the case, the avoided cost of disposal alone is enough to show the value. If the material is no longer recycled, it still has to be managed and will be landfilled. The cost of disposal of glass in a landfill is about $60 to $75 per ton in the Twin Cities and at waste-to-energy facilities, it is about $80 to $90 per ton. (Waste-to-energy facilities do not want glass in their feedstock waste stream.) With these disposal costs, it is more economical to utilize recycling markets, even if moving material to recycling comes at a net loss to a program. Moreover, these avoided disposal costs do not fully reflect the other environmental benefits of glass recycling compared with landfilling the material.

Advancements at various stages of the recycling chain can also help to advance the cost-effectiveness of handling glass. Minnesota is fortunate to have a robust and diverse recycling infrastructure. There are at least 22 MRFs in the state as defined by the MPCA. Eight of these are large facilities located around the Twin Cities Metropolitan Area, and these sites all have an annual single-stream recyclables processing capacity of at least 560,000 tons.

Like many MRFs around the country, these recycling organizations have invested in new or upgraded glass cleaning/sorting equipment. Based on their unique needs and processing system designs, each of the Metro Area MRFs has selected different glass cleaning equipment manufacturers and models. Also, some MRFs try to keep their recyclable glass under cover to prevent precipitation from adding moisture that may reduce the value.

Lakeville, Minn.-based Recycle Minnesota (which also goes by Dick’s Sanitation) is currently upgrading its glass cleanup system to provide a much lower rate of contamination. The new equipment will screen and vacuum out the lighter and larger NGR contaminants. Using a silo system, the company is also improving glass load-out, storage and trucking to improve efficiency of transportation to market.

In recent years, MRFs in the Metro Area have made a combined capital investment of over $3 million for glass screens, cyclones, air knife separators and related handling equipment. The intent of these investments is to enhance the value of the glass commodity from MRFs by reducing NGR contaminants and fines. However, glass is like other commodities in the MRF. The processing equipment needs to be regularly maintained and periodically upgraded to keep up with changing technology advancements.

And where does most of this MRF glass go? SMI’s St. Paul site is the only secondary glass processor in the region. Sometimes referred to as a beneficiation plant, a secondary processor color-sorts and screens/vacuums out contaminants to produce recovered glass products that meet end-user manufacturer specifications. In St. Paul, SMI has made over $13 million in investments in its automated glass cleaning equipment.

According to MRFs who were at the Minnesota glass summit in November, one of the most valuable services provided by SMI is its ability to audit the quality of every load of recyclable glass delivered to its St. Paul plant using a specification in line with that of the Institute for Scrap Recycling Industries. This feedback can guide improvements at MRFs and lead to increased load consistency.

As we move downstream from the secondary processor, we come to Anchor Glass, located in Shakopee, Minn. It is the sole glass container manufacturer in the state and has been a significant part of the legacy of glass recycling in the region.

Anchor Glass recycles glass when sorted by color to make new glass bottles and food containers. Anchor Glass also purchases “furnace-ready” flint cullet (flint is clear glass) from SMI and a limited amount of color-sorted glass directly from smaller municipal recycling programs where glass is kept separate from other recyclables. The furnace-ready cullet must meet strict quality specifications. Anchor Glass stated at the November summit they would like to increase the recycled content in their glass container products.

Recommendations to strengthen system further

Discussions with stakeholders elicited a number of steps that can help lift Minnesota glass recycling in the years ahead. Most of the recommendations will have relevance in other states as well.

First is a stronger focus on public education. The stable and sustainable nature of glass recycling should be part of continued public outreach campaigns, and efforts can include calls for more recycled glass content in the containers we purchase as consumers.

Reducing lithium-ion batteries in the stream is another straightforward way to boost glass recovery. Those items can cause fires and other problems for processors, and SMI has in fact recently instituted a company-wide battery surcharge based in part on the number of batteries found in any load of MRF glass. Some MRFs have reported the additional cost of equipment and operating improvements needed to remove batteries is relatively modest. One such improvement is to install magnets on the MRF glass output line.

Improvements in MRF glass transportation and logistics may be one of the easiest and immediate enhancements to implement. Some MRFs are installing silos to improve storage and load-out efficiencies, avoiding the costs of bunkers and front-end loader operations. Smaller municipal MRFs, meanwhile, are using roll-off trailers to double their haul capacity instead of a single roll-off box per truck.

Continued upgrades to MRF glass cleaning systems will be needed in the future. While a great deal of investment has already been made, state-of-the-art cleaning systems continue to improve. For example, density separation equipment may help further remove NGR from MRF glass before it is marketed to secondary processors. In the end, each MRF will decide if such investments are feasible based on their own cost-benefit analyses.

To that end, SMI is offering MRFs technical, engineering, and, in some cases, capital financial assistance. Enhanced communication with companies like SMI and industry trade organizations (for example, the Glass Recycling Coalition) at an early stage in planning may prove beneficial to all.

A final important step for system improvement will be identifying more end market opportunities. Several promising new end markets were discussed at the Minnesota summit, including foamed glass aggregate as an alternative to other lightweight aggregates used in highway construction. Expanded use of recycled glass as sandblast media was also discussed. Another potential minor outlet could be the expanded use of recycled glass in tile products.

New thinking in ongoing discussion

There is a need to reframe the economic discussions about recycling in general, but such dialogue shifts are especially important to glass. We need to help the public understand recycling should be viewed similar to other utilities and services. Recycling is a service that is here to stay, but it has associated costs to maintain and enhance recovery rates. The costs are partially offset by revenues from material sale and avoided disposal costs. Well-planned and designed investments in enhanced recycling systems also carry environmental benefits that cannot always be internalized by industry stakeholders.

The Minnesota summit was just the beginning of what could be a larger, continued dialogue about how to sustain and grow glass recycling in the Midwest. As part of a larger statewide, recycling market development initiative, there is a Glass Market Development Sub-Group that has been meeting over the past few months to learn about problems and opportunities of glass recycling in Minnesota.

That group will be making recommendations for specific glass market development initiatives in the near future. All stakeholders from municipalities, state governments, MRFs, secondary processors, end users and industry trade organizations will need to continue to work together to help find the best, long-term solutions.

Dan Krivit and Lea Hensel work with Foth Infrastructure & Environment’s public solid waste clients – landfills, solid waste agencies, municipalities, and counties – on solid waste and recycling operations. Krivit is a long-standing member of the Recycling Association of Minnesota and can be contacted at [email protected]. Hensel is a member of the Iowa Recycling Association and can be contacted at [email protected].