This story originally appeared in the August 2016 issue of Resource Recycling.

Subscribe today for access to all print content.

Often defined as “special waste,” tires have always had a unique niche within the broader recycling industry. Tires make up less than 2 percent of the municipal solid waste stream, yet tire management is tightly regulated by most states, and tire recyclers are encountering a variety of local, regional and global market development opportunities and challenges.

Tires offer a window on innovative market development strategies and the nascent shift to sustainability-focused policies. This is especially true in California, where the Department of Resources Recycling and Recovery (CalRecycle) has implemented an expansive, evolving tire recycling market development strategy for over two decades. This article offers a California tire recycling snapshot, providing a high-level status report on the sector and the issues shaping its future.

Diversion versus recycling versus sustainability

CalRecycle’s Five Year Tire Plan has long included a 90 percent landfill diversion goal for tires, though it is not legislated. But since 2011 – when legislators set a statewide goal of recycling or composting 75 percent of all materials by 2020 – CalRecycle has focused on increasing recycling activity. For measurement purposes, tire recycling includes reuse as well as use of recovered material for production of new tire-derived products from crumb rubber and use of tire-derived aggregate in civil engineering applications. Recycling excludes combustion and beneficial uses like landfill alternative daily cover (ADC) that otherwise “count” toward diversion goals.

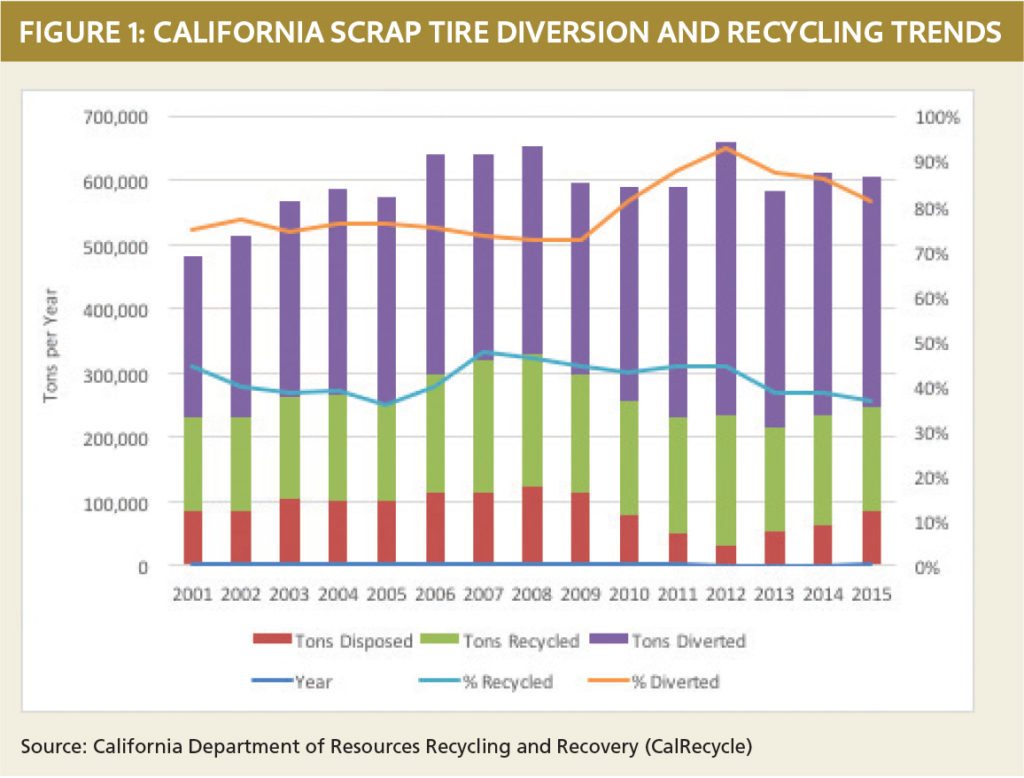

As shown in Figure 1, the volume and percentage of tires recycled has been relatively flat for several years, fluctuating between fairly tight boundaries, with a 2015 rate of 36 percent. Total diversion, on the other hand, has fluctuated more widely and increased to an all-time high of 93 percent in 2012 as tire-derived fuel exports peaked. The diversion percentage then dropped off to 81 percent in 2015.

As described elsewhere in this issue of Resource Recycling, recycling stakeholders are increasingly embracing new policy goals such as establishing a circular economy, and they are shifting from waste management to sustainable materials management as a means of achieving those goals. CalRecycle is integrating such concepts into its policies and programs, including focusing on a refined definition of tire recycling, promoting feedstock conversion (for example, replacing virgin rubber or other raw materials with crumb rubber in established products), and researching the recyclability of tire-derived products. But as with other recyclables, transforming the tire material life cycle is a difficult, long-term effort.

Initiatives under way to boost recycling

A number of efforts and societal factors are having an impact on tire sustainability trends.

First, tires are being designed for increasingly long lives, and CalRecycle has sponsored targeted education campaigns promoting the consumer maintenance needed to achieve this result. Some new tires are designed to use less material, and tire manufacturers are experimenting with plant-based rubber polymers that could replace a portion of the oil-based synthetic rubber used to make tires (in addition to natural rubber from trees, which is already part of the feedstock mix). Reduced driving patterns and the rise of “sharing economy” services like Uber may also reduce scrap tire generation. However, statistics on waste reduction, resource conservation and tire life-cycle impacts generally are not readily available.

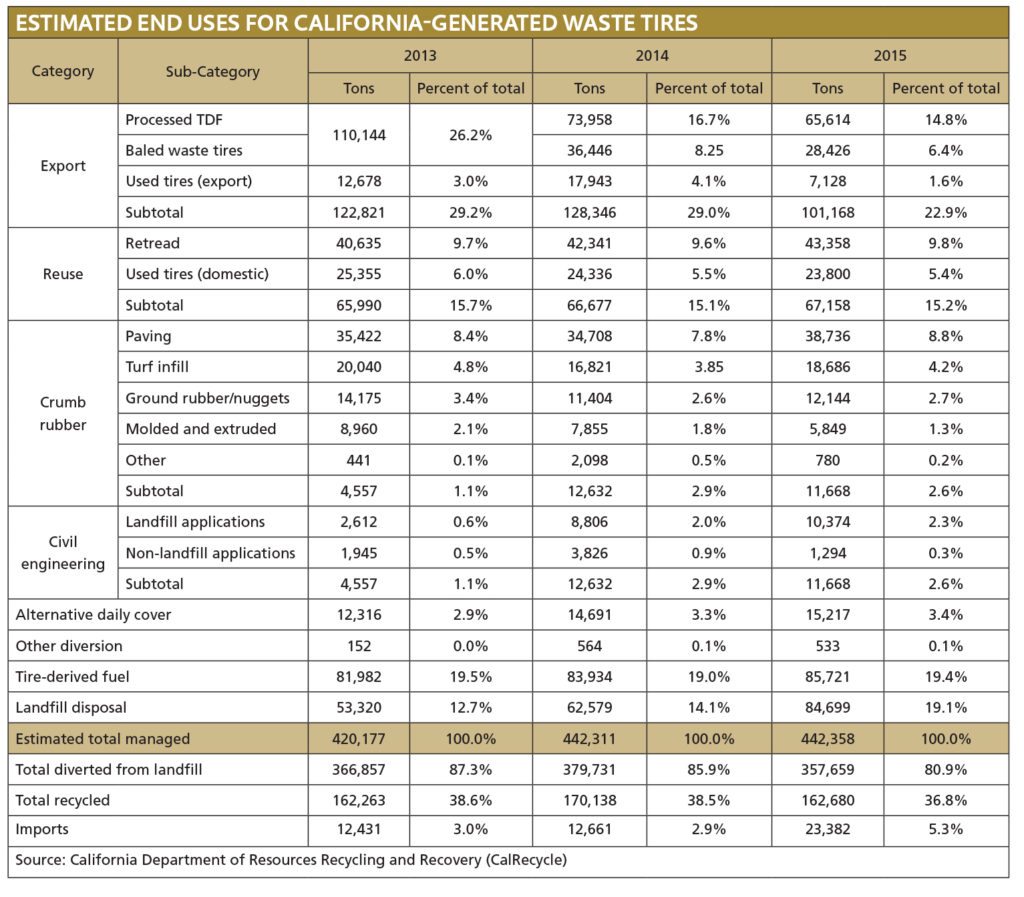

Reuse, including commercial truck tire retreading and resale of partially worn used tires, is strong and profitable, but also mature with little growth potential. Overall in California, 74,286 tons of tires were reused in 2015, with 43,358 tons retreaded and 30,928 tons sold for direct reuse. In addition, companies involved in tire reuse say the increasing quantity of lower-tier, low-cost tires from China is damaging their bottom lines. The low prices of these products undercut tire reuse sales, and due to their smaller tread size they have very limited, if any, reuse potential. In response to a formal U.S. tire manufacturer complaint, the U.S. International Trade Agency recently determined certain tire imports are unfairly priced and harm the U.S. market, and the agency developed a system of punitive tariffs, though they have not yet been imposed.

Meanwhile, CalRecycle programs have helped develop a robust crumb rubber infrastructure and markets. In 2015, 76,195 tons of California tires were used to produce crumb rubber, 17 percent of all California tires. Over 17 million pounds of buffings from retreaders were also used, but tracked separately from crumb rubber. These buffings were used primarily in pour-in-place playground surfacing and landscape mulch products.

Meanwhile, CalRecycle programs have helped develop a robust crumb rubber infrastructure and markets. In 2015, 76,195 tons of California tires were used to produce crumb rubber, 17 percent of all California tires. Over 17 million pounds of buffings from retreaders were also used, but tracked separately from crumb rubber. These buffings were used primarily in pour-in-place playground surfacing and landscape mulch products.

About half of California crumb rubber flows to rubberized paving applications, supported by CalRecycle grants and technical assistance to local agencies. CalRecycle research and support paved the way for 2005 legislation requiring Caltrans (the state transportation agency) to use crumb rubber in at least 35 percent of its paving projects. Although that target has not yet been achieved, the policy has greatly boosted demand. And Caltrans is now investigating new specifications that could more than double state rubberized pavement use by 2018.

CalRecycle’s grant program for tire-derived products funds local purchases of other (non-paving) products made from crumb rubber. Along with a variety of direct monetary and technical/marketing assistance services, these programs have provided direct support to crumb rubber producers and tire-derived product manufacturers. About a quarter of California crumb rubber in 2015 was used as infill in synthetic turf athletic fields. Despite sustained media coverage of perceived environmental, health and safety concerns, this segment has sustained strong sales.

Molded and extruded products made up about 8 percent of crumb rubber sales in 2015, making it the smallest-volume segment. However, it is a diverse area. California-made products in this category include roofing, flooring, sealants, landscaping items and much more. With the potential for high-value product manufacturing, CalRecycle is providing additional support to this segment, including a pilot incentive program that offers 10 to 40 cents per pound to manufacturers as well as product testing and technical assistance.

Other markets for material

CalRecycle is focused on expanding the above recycling markets, but tires continue to move to high-volume, occasionally volatile diversion markets, and sometimes to landfills. Tire-derived aggregate (tire shreds meeting engineering specifications) is used in a variety of civil engineering applications – for example, vibration mitigation in light-rail systems and lightweight fill used in landslide repair. CalRecycle technical assistance helps develop and execute projects and is complemented by a grant program.

In 2015, 11,668 tons of California tires were used at landfill projects. In coming months, 42,000 tons are projected to be used in a single lightweight fill initiative. Barriers include educating agencies and engineers about the cost and performance benefits when compared with conventional construction materials in civil engineering applications and overcoming logistical and regulatory supply hurdles.

Tire-derived fuel is a strong and profitable market segment that thrives without state support. In 2015, four California cement kilns consumed 85,721 tons of tire-derived fuel (over 19 percent of all California tires), in addition to over 12,000 tons of tire fiber, a crumb rubber production residual. This demand level is near the upper boundary given current kiln permitting and infrastructure. CalRecycle has been legislatively prohibited from promoting tire combustion since 2003, although prior to this it did provide support for research on the technology.

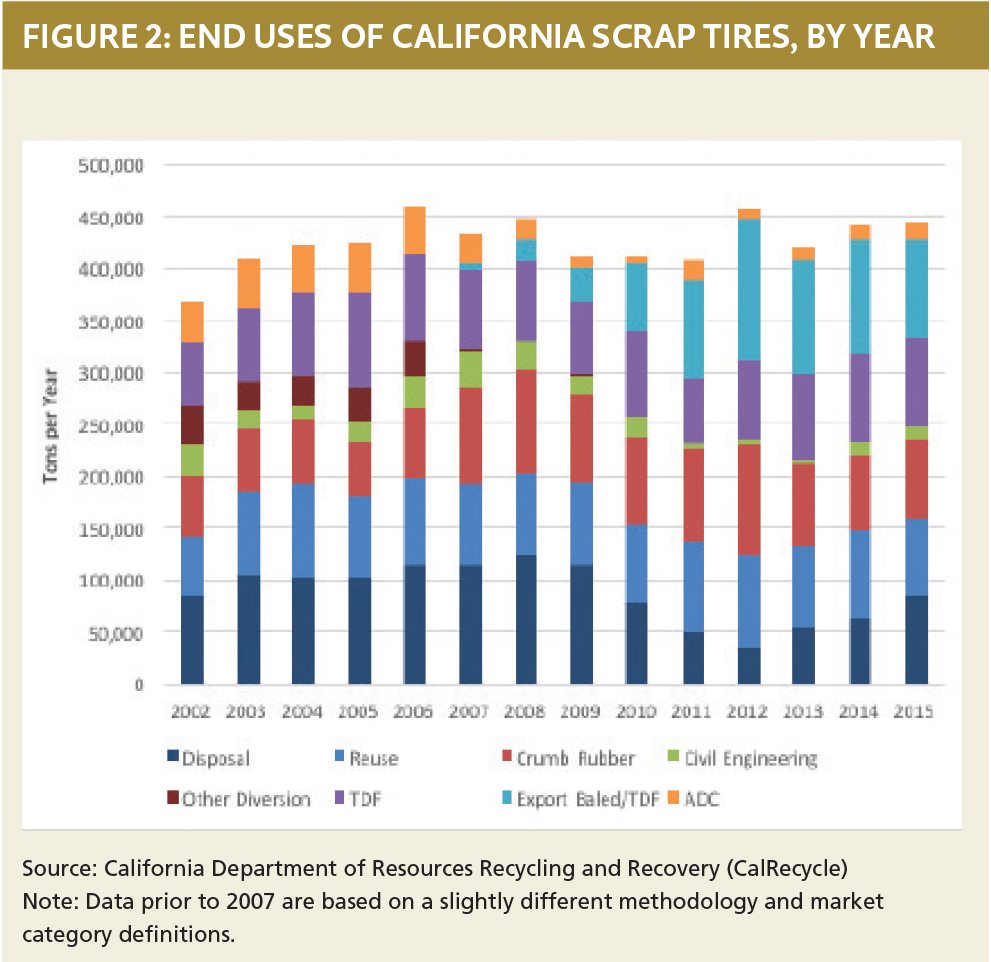

Used tires have long been exported from California, mainly to Mexico. But beginning in 2008, a surge in demand and pricing catalyzed rapid growth in tire-derived fuel exports. New baling operations (sometimes unpermitted) began competing aggressively for tire supplies with established processors, driving tip fee revenue down and triggering severe industry disruptions. This trend peaked in 2012, declining somewhat recently due to port strikes, CalRecycle enforcement and historically low prices for competing fuels like oil and coal. As is seen in markets for other recyclables, export is notoriously volatile and can shift abruptly with changes in demand, pricing, container availability and national policies.

With strong competition and limited markets, processors sometimes view landfills as a profitable alternative, based on differential tip fee revenue and avoidance of operational costs needed to prepare materials for value-added markets. In 2015, three California landfills used a total of 15,217 tons as ADC. This is similar to recent years, although a single landfill’s decision to start or stop using ADC can greatly influence total use. Also in 2015, tire disposal increased by 35 percent to 84,699 tons, the most since 2011, as export volumes declined.

What lies down the road

Predicting how tire recycling will evolve is difficult, and it’s even harder to say how sustainable materials management policies will be embraced or whether the ideals of the circular economy will be achieved. But the industry can still point to a number of key issues as important factors.

First is the question of market growth. CalRecycle has successfully developed a range of diverse scrap tire markets. But recycling markets have not grown significantly in several years. Rubberized paving applications hold great promise for increased, long-term demand. But even if doubled, paving would still use less than 20 percent of California tires. While currently stable, synthetic turf infill and nuggets do not appear poised for huge expansion. Civil engineering can use large volumes but is sporadic.

CalRecycle is increasingly promoting new tire-derived product development and feedstock conversion, and several promising companies are currently producing or developing diverse products. But to date, the volume of rubber used remains relatively low. There is certainly more potential, and an unexpected innovation could occur at any time. But difficult barriers must be overcome, including:

- The time and cost needed to reformulate existing products or develop new ones

- Tire rubber technical characteristics, which often relegate it to use as a filler in products with forgiving performance and color characteristics

- Current low prices for competing raw materials derived from oil or other primary materials

- The predominance of product specifications requiring virgin rubber use, established by thousands of original equipment manufacturers, architects and government agencies

Moreover, California has a relatively small rubber products industry when compared with the Midwest or Southeast, so fewer companies are available to consider tire-derived product development.

Critics have also pointed out that some tire recycling markets merely delay rather than replace landfill disposal, or do not make use of the inherent material properties. Products like mats, landscaping pavers, synthetic turf infill and others are not readily recyclable at the end of their useful lives. CalRecycle is beginning to research and support tire-derived product recycling, with an initial focus on synthetic turf infill as many fields approach the end of their design lives and will need to be replaced. The Synthetic Turf Council is also promoting reuse of crumb rubber turf infill.

True closed-loop recycling, of course, would mean tires are recycled into new tires. This may have the highest environmental benefit, but currently only a small amount of East Coast-produced crumb rubber is used in tire manufacture. Tire manufacturers cite concerns with rolling resistance (related to fuel efficiency) and safety that limit the potential for recycled content tires. Also, there are no tire manufacturing facilities in Western states. For these reasons, tire-to-tire closed-loop recycling may never be an option for California scrap tires.

Perhaps more than in any other recycling industry segment, entrepreneurial firms in tire recovery have sought to commercialize so-called emerging technologies for many years. Devulcanization can render tire rubber usable in a wider range of manufacturing applications. Pyrolysis and gasification are related technologies that yield fuel products along with carbon black, a material that technically has many potential markets but which has proven difficult to market when produced this way. Commercial operations using these technologies in North America are still very limited. The appropriate role of conversion technologies involving fuel production in a circular economy vision is controversial. Proponents are optimistic, but history shows the emergence of these technologies will be slow at best.

Considering all those factors, it’s hardly surprising a vigorous debate is occurring over how state policies can best advance tire recycling. Connecticut and Vermont legislators recently proposed, but didn’t adopt, tire extended producer responsibility (EPR) legislation. But in California, where EPR is embraced for a variety of hard-to-manage products, the debate is different and varied. In 2015, CalRecycle published a new vision for scrap tire management policies based on expanded per-ton incentive payments to tire-derived product manufacturers and possibly crumb rubber producers. The vision also calls for expanded procurement requirements, a phased-in landfill ban for tires and tiered tire fees to promote the sale of longer-life tires. Currently, pending legislation (AB 1239) would increase the tire fee and enact expanded per-ton incentive payments.

Information, innovation and collaboration

Information, innovation and collaboration

Ultimately, tire recycling – and advancement toward circular economy goals – may rest on three key pillars. First is the need for accurate, real-time data to help evaluate market opportunities and life-cycle sustainability measures. Second is the need for grand-scale innovation at every level, including tire design, crumb rubber production and tire-derived product manufacturing practices.

Finally, collaboration across the supply chains and across public-private organizations is crucial. For example, short of full-scale EPR, tire manufacturers could potentially play a more active role in collaboratively researching, developing and investing in new tire-derived-product technologies and ventures that embody circular economy principles.

While the pace of market development can sometimes be slow, new forms of information sharing and collaboration may be a winning combination.

Ed Boisson, principal of Boisson Consulting, specializes in recycling industry development. He was lead author of several recent CalRecycle tire market studies, in collaboration with DK Enterprises and under subcontract to Louis Berger Group. He can be contacted at [email protected].

Information, innovation and collaboration

Information, innovation and collaboration