This story originally appeared in the July 2016 issue of Resource Recycling.

Subscribe today for access to all print content.

Bashing curbside single-stream recycling collection has been a popular pastime for pundits in recent months. From material interests, such as paper, plastics and metals, to CEOs disappointed in financial performance, to reporters and columnists finding a juicy story – all have commonly quipped for the last three years about the shortcomings of this municipal service. In every part of the U.S., and in almost every large municipal market, the negatives of single-stream have been laid bare: contamination, rising costs, changing waste streams, and problem or marginal materials.

It’s certainly true fresh ideas are required to fix and improve an effective, but teetering, service delivery system.

But beneath the rhetoric is the reality of a six-year drop in markets for commodities from materials recovery facility-derived materials, a value loss of over $50 per ton in the aggregate. If commodity prices were higher, the issues would seem more manageable and we’d see the robust investment the recycling industry needs. Instead, low commodity prices are causing a re-consideration of all of the aspects of recycling collection, resulting in contract disputes, the dropping of materials from collection programs, lower diversion rates and plant closures. Does this make sense for a municipal service that household consumers overwhelmingly want?

This article (the first of two parts) describes how this popular municipal service, which saw swift and unprecedented growth, is not currently supported for investment because one of its components – the MRF – is mistakenly financed via fickle commodities. Single-stream recycling’s service properties helped lead to today’s environment, where the MRF and municipal budget bear too much risk while other participants in the recycling value chain benefit from the service. Simply put, single-stream collection is a service that should be paid for by more than just revenues generated at the MRF.

The recycling expectation

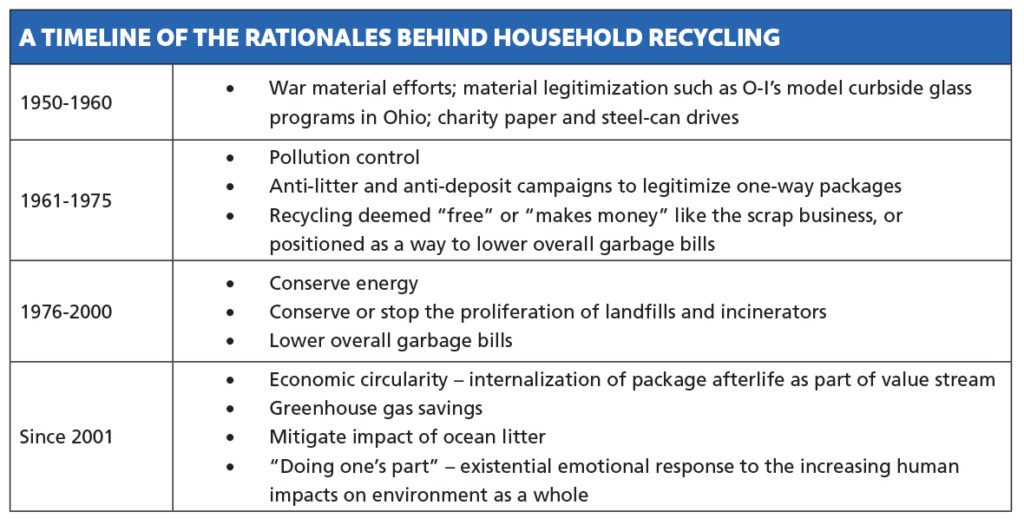

There have been many evolving and overlapping reasons for the exceptional growth of curbside recycling collection in the U.S. since the mid-1970s. The ones mentioned in the chart on page 21 were most often cited during their time and are cumulative with new ones.

Polls show that U.S. adults overwhelmingly want the benefits of recycling, in particular the benefit of reducing what is sent to landfills – over 80 percent, as cited in Glass Packaging Institute and Ipsos studies. Other benefits cited by residents include saving resources, reducing litter and conserving energy.

These trends have contributed to the demand for curbside recycling, and municipal policymakers have overwhelmingly responded by expanding the service considerably. According to numerous polls and sources, consumers increasingly want and use this service in their households – moreover, consumers expect recyclability in their products. Over time, American society has developed an expectation for convenient, accessible and permissive recycling of most materials.

Single-stream collection of recyclables has become a “preferred service,” an action or good provided that has achieved priority status in the minds of buyers and one that is worth paying for. Americans clearly prefer convenient recycling access and recyclability over things like landfill disposal and non-recyclable or non-environmentally friendly packages. But this comes at a cost and should be recognized as such.

The changing waste stream and single-stream

The waste stream is changing with the demand for efficient packaging and changes in personal habits. At one time paper made up to 70 percent of the weight flowing through recycling programs, but now it accounts for less than 40 percent in many cities, especially where there is no strong daily newspaper, according to many municipal reports. And more types of complex and light materials have continued to replace some other types of packages. More permissive single-stream recycling programs have allowed some accommodation of these changing materials and new types of discards rather effectively, though it is correspondingly more expensive to do so, according to much research from industry experts. Consumers demand new packages with high performance, and after using them, they want to have those packages recycled.

In a very brief period of 20 years, industry experts report, single-stream recycling has grown to cover more than 75 percent of urban America by population, with over 2,500 municipalities using the approach. This collection method allows recycling to occur without costly over-regulation and brings convenience to households. This service has resulted in improved use of the municipal recycling infrastructure through greater recycling participation – an average of 40 percent was found in one study I participated in and which was published in Resource Recycling in 2012. At the same time, it’s opened the door to recovery of more and more types of packaging materials and paper.

In a very brief period of 20 years, industry experts report, single-stream recycling has grown to cover more than 75 percent of urban America by population, with over 2,500 municipalities using the approach. This collection method allows recycling to occur without costly over-regulation and brings convenience to households. This service has resulted in improved use of the municipal recycling infrastructure through greater recycling participation – an average of 40 percent was found in one study I participated in and which was published in Resource Recycling in 2012. At the same time, it’s opened the door to recovery of more and more types of packaging materials and paper.

Single-stream is a complete service with dependent components, however. The processing portion of the service has been channeled relatively efficiently through increasingly automated technologies. Though not every program enjoys all of these components by any means, these parts are swiftly becoming the accepted norm:

- Lightweight and high-volume walk-out recycling carts

- Automated collection of those carts

- Maximum compacting in collection trucks

- Modern high-volume bulking transfer stations

- High-speed, high-capital MRFs, which separate and clean materials, densify commodities and store yielded commodities before they are shipped to market

Also, compared with multi-stream recycling, single-stream collection’s use of automated compactor trucks with high payloads can reduce program costs of by as much as 25 percent while increasing recycling volumes by as much as 50 percent, according to several university reports. Remarkably, according to a GAA Wisconsin study, save for the worldwide economic disruption of 2008, 84 percent of the commodities collected actually are recycled, though high contamination and residue affect the ability of MRFs to sell the recyclable materials generated in the system.

Single-stream collection’s components together create one service – the components are dependent upon one another to deliver convenience. The service exists if, and only if, there is a modern materials recovery facility that cleans and finds markets for the materials collected.

Unlike collection, where capital for storage bins and trucks and pick-up services are paid for by consumer fees, the MRF is often a stand-alone component because of revenue generated by the yielded commodities. This is where the system falters when markets go down – investment stops, disputes escalate between municipalities and MRF operators, and pundits prevail regardless of what residents say they want.

Single-stream service has always cost money

One common and curious misperception about the entire single-stream service in this down market is that it is “losing money.” Though MRF accounting these days shows a loss if dependent upon the unreliable commodities market, processing is a small component of a total municipal waste service that is otherwise entirely paid for by consumer fees. The MRF provides a service.

Even though many programs throughout the country hide the expense, there has always been a net cost for any type of household recycling collection. Today, efficient municipal programs (collection and processing) cost $200 to $350 per ton. Commodity markets can offset some of that cost (commodities in June for a typical single-stream composition of inbound material had a value between $70 and $85, depending on geography). The best recycling programs can rival MSW service delivery costs, with immature or less-optimized programs costing more – some East Coast cities report costs double the range laid out at the beginning of this paragraph.

There has always been a price to consumers for single-stream recycling, when taking into account the costs for the service and with the revenues from commodity sales worked into the equation. Typical price ranges to household consumers for once-per-week single-stream collection are between $4 and $10 a month, according to an RRS Atlanta-area survey of current subscriptions and contracts as well as investigations into contracts around the country. This range takes into account present commodity offsets.

Additionally, single-stream collection makes up less than one-third of the total cost of a garbage bill, with an average of $20-$25, per household, per month, according to research in North Carolina, a recent City of Tempe, Ariz. study and a Forrester Group survey. Higher relative costs appeared on the coasts and in large cities.

The MRF portion of the $4 to $10 recycling bill ranges from 25 to 50 percent of the total and less than 12 to 20 percent of all MSW waste delivery components – somewhere between 15 and 40 cents per person per week, not counting the commodity offset.

The point is single-stream collection, in addition to being popular, is a very cheap service, one of the smallest in-person delivery costs for a homeowner. Someone comes to your home, picks up all your potentially recyclable discards, sorts them out for you and finds uses above traditional disposal.

Confusion about the role of the MRF

Reliance on poor-paying commodities have skewed the role of the MRF in the single-stream service. Here’s why:

- MRFs clean a mixed stream and create material that reaches at least the minimum level of quality needed for recycling.

- According to the International Monetary Fund and other sources, real commodity prices, adjusted for inflation, have fallen since the Civil War an average over 1 percent per year, so MRFs can generally expect over time that commodity values will be less available and unreliable to pay for their service.

- While the homeowner enjoys the preferred convenience service and the collector and municipality enjoy the savings from the efficient collection, the MRF finds itself in the no-win position of high risk and rising unrecoverable costs.

- MRFs have been viewed outside the total service package, are confused with the more traditional scrap business model, and took on unreasonable risk.

- Municipalities, whose contracts bet on commodities paying for the cleaning services of the MRFs, as well as ancillary management and education programs, have experienced budget shortfalls and contract disputes, requiring politically unfavorable rises in rates and taxes. But these hikes have been necessary to sustain the service.

- Commodity prices do not go up when more materials are recycled in this stream, but costs do – and the new marginal material makes the average value of all commodities go down until there is enough of the new material to spur investment.

- Given consumer demand expectations, more marginal materials will be eventually added and recycled in the future.

Single-stream service is not the scrap business

One of the most confusing issues about single-stream MRFs is the false assertion that they are similar to the scrap business model and should be held to a comparable profit accountability.

The models are, in fact, very different.

As described previously, MRFs clean mixed materials continuously to minimum quality standards, save for a few outstanding outliers, as their main activity. This cleaning allows for households to mix materials. MRFs then arrange markets for the material.

MRF model characteristics include:

- Receive and process all materials contracted to them, regardless of commodity market trends.

- Sort to a minimum standard in order to market materials without exorbitant costs.

- Each additional material recovered increases the cost of cleaning.

- Each marginal material added lowers overall commodity values.

- The supply of material to be cleaned for recycling has near-perfect inelasticity. Economists use “inelasticity” to explain continuous supply being delivered to buyers regardless of price.

- Buyers of commodities from MRFs have the powerful advantages of knowing supply inelasticity exists and MRFs producing minimally acceptable material, eroding any MRF-commodity pricing power.

Scrap facilities, on the other hand, use material price management as their model – purchasing materials they then densify into truckload-quantity packages profitably. They control the supply of materials through greater (but still limited) storage abilities and the function of price. In a simple example, if markets for a given scrap category fall, buyers lower their price with the market price, pushing sellers to wait to sell until the market

goes back up. This gives well-managed scrap businesses needed elasticity of supply to keep market prices for their material in equilibrium.

In addition, traditional scrap businesses buy source-separated materials, and can limit and focus on the materials they wish to manage. Scrappers only sort for price advantage, and they usually are able to meet higher quality standards than MRFs. By these mechanisms, a positive margin, even based on existing commodity values, may be maintained most of the time through pricing power.

Holistic thinking

Without the ability to clean mixed commodities at a materials recovery facility, the already-embedded savings in collection and the convenience to the homeowner would disappear. After all, only after single-stream-collected commodities are sufficiently sorted and cleaned do they contain scrap value.

The preferred service of single-stream is burdened by commodity risk at the MRF and has led to misconceptions of the MRF’s utility and its function. It should be seen as a complete service to be paid for, with some other treatment for the commodity offset. Failure to recognize the MRF’s necessary and cardinal cleaning function in the service model and confusing it with the scrap model has led to intolerable losses at these facilities, a black eye for a popular service, and a poor investment environment.

The only answer is to take a different approach and to treat MRFs as part of the holistic service. Part two of this article will take up some of those options and offer ideas to bring investment into a stressed system, especially at the MRF level.

Michael Timpane is affiliate vice president for Resource Recycling Systems (RRS). He can be reached at [email protected].