This article has been corrected.

Over the past three years, fewer of California’s CRTs are going directly to hazardous waste landfills and more are flowing through intermediate glass processors, state data shows. But that may not mean more glass is ultimately being recycled.

One of the state’s largest e-scrap processors, ERI, suspects intermediate processors may be separating leaded from unleaded glass and then landfilling material.

“Just because they’re intermediate doesn’t mean it’s not going to a landfill,” said Aaron Blum, ERI’s co-founder, chief operating officer and chief compliance officer.

In 2015, California’s electronics recycling program first enacted regulations allowing e-scrap companies to landfill CRT glass and still receive a processing payment from the state. Before that, the only way they could get paid the per-pound processing fee from state government was to send glass to an established final recycling outlet – lead smelters or CRT manufacturers – or to an intermediate glass processor. The new rules came as the world’s last major CRT manufacturer, Videocon, began reducing or eliminating the CRT glass it accepted at its Indian manufacturing site.

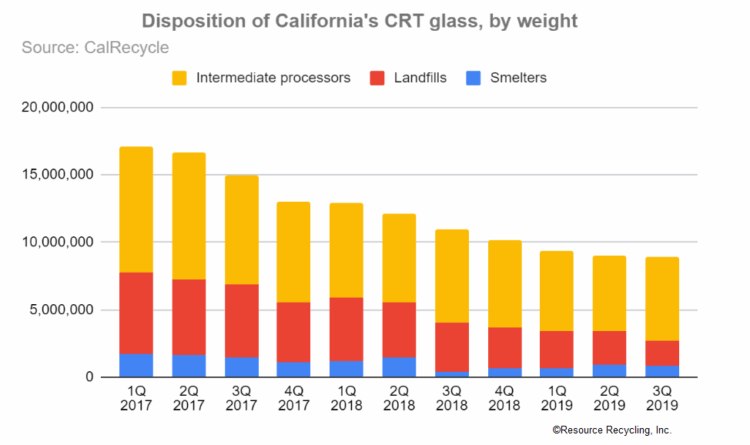

By the following year, landfilling had become a popular downstream option. E-Scrap News reported 45% of CRT glass handled by program participants in 2016 went directly to disposal sites. As of last year, that number had dropped to about 27%.

California’s 17-year-old Covered Electronic Waste (CEW) Recycling Program, the country’s oldest, is funded by fees consumers pay at point-of-sale. The state collects the money and provides payments to e-scrap companies collecting and processing covered electronic devices, which include CRT displays, LCD displays, laptops with LCD screens (including most tablets), plasma TVs and portable DVD players with LCD screens. The combined collection and processing payments are currently 49 cents a pound for CRTs and 60 cents a pound for non-CRT devices.

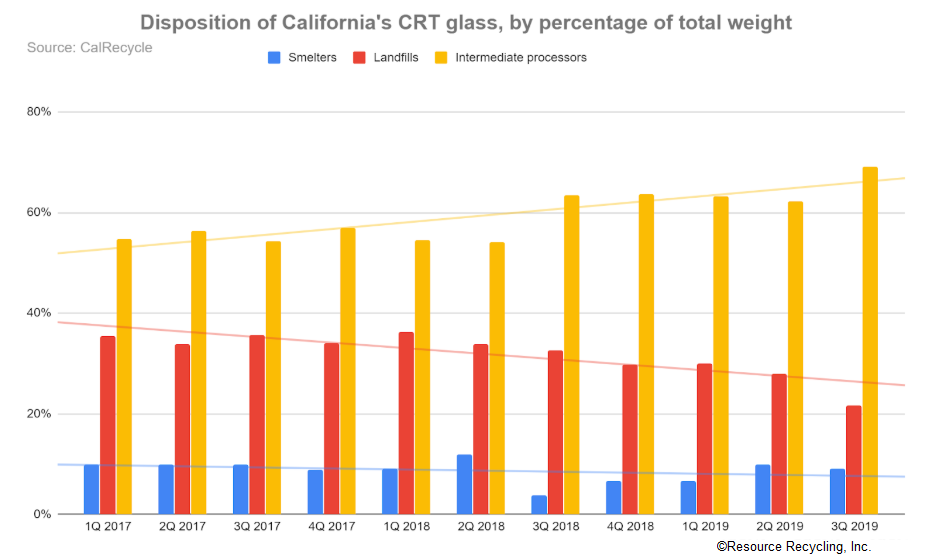

Total pounds processed through the program have been falling since 2012, when companies processed 212 million pounds. Last year, the number was just over 90 million pounds. CRTs are making up a smaller and smaller percentage, as well. In 2012, CRTs accounted for 98% of program weight; last year, CRTs were 69%.

What the latest numbers show

E-Scrap News recently requested CRT disposition data from the California Department of Resources Recycling and Recovery (CalRecycle), which administers the electronics recycling program. The data spans 2017 through the third quarter of 2019.

The numbers show that the percentage of unprocessed glass tonnages going straight to hazardous waste disposal has trended downward (from 45% in 2016 to 27% in 2019). Meanwhile, the percentage going to intermediate processors has trended upward (from 50% in 2016 to 65% in 2019), and the percentage shipped straight to lead smelters has grown but remained relatively small (5% in 2016 to 9% in 2019).

The following graph shows initial downstream destinations for California’s CRT glass (article continues below graphic):

The following graph shows the changes in terms of actual weight (article continues below graphic):

The following graph shows the changes in terms of actual weight (article continues below graphic):

In each of the categories are specific companies jockeying for business.

When it comes to intermediate processors, in recent years four e-scrap companies have served that role, although two have dominated the weight.

The companies and weights received from 2017 through the third quarter of 2019 are the following: GLS Group, part of Cal Micro Recycling (38.3 million pounds), e-Recycling of California (35.9 million pounds), PC Recycle (4.9 million pounds) and ECS Refining (24,000 pounds). Once a major player in the state program, ECS Refining is now closed. The last time it processed glass under the state program was in January 2017.

E-Scrap News reached out to both Cal Micro and e-Recycling of California to learn more about their procedures. A Cal Micro executive declined E-Scrap News’ request for an interview. Inquiries sent to an e-Recycling of California executive were not returned.

At the same time, e-scrap companies have sent unprocessed CRT glass to three hazardous waste landfills and one solid waste landfill over the past three years. They are the following: Waste Management’s Kettleman Hills hazardous waste landfill (18.3 million pounds), US Ecology’s hazardous waste landfill in Beatty, Nev. (10.7 million pounds), Madera County’s Fairmead Solid Waste Disposal Site (10.2 million pounds) and Clean Harbors’ Buttonwillow hazardous waste landfill (5.0 million pounds).

Finally, two lead smelters have received unprocessed CRT glass from California e-scrap companies over the past three years. They are Korea Zinc’s Onsan Complex in South Korea (7.0 million pounds) and Doe Run in Boss, Mo. (5.0 million pounds). The last time Korea Zinc took in unprocessed glass from California was in July 2018, records show. Exporting CRT tubes or unprocessed CRT glass requires U.S. EPA notification and approval. According to the EPA, no company currently has approval to export to Korea Zinc.

Much may still be going to disposal

Ana-Maria Stoian-Chu, manager of CalRecycle’s Covered Electronic Waste (CEW) Recycling Program, emphasized that the department’s data only tracks a CRT’s initial downstream destination after it has been “canceled,” which means the display device has been stripped down to a bare tube and the vacuum has been relieved.

If the tubes are destined for further processing after they’ve been canceled, then CalRecycle would know which intermediate processor they were shipped to. But CalRecycle doesn’t track where intermediate processors ship their separated and processed glass.

ERI’s Blum pointed out that intermediate processors may be separating leaded from unleaded glass so they can ship unleaded panel glass to a municipal landfill, which is cheaper than a hazardous waste landfill. The leaded funnel glass could be going to a hazardous waste landfill or even smelters, he noted.

ERI is one of the largest processors of California’s CEW. In terms of CRTs, specifically, Blum said the company is handling about 500,000 pounds a month of CRTs. Currently, the company sends whole, bare tubes straight to hazardous waste landfill, he said.

With the loss of Videocon and state regulations limiting approved downstreams, options are few, he said. Smelters aren’t able to serve as solid downstream for the large quantities of CRT glass leaving ERI facilities, he said, describing smelters as “touch and go.”

Shipping glass to hazardous waste landfills is more expensive than municipal landfills, and ERI has to pay more to ship the material as “hazardous waste” than it would if it were considered “universal waste,” he noted. Also, at the end of the year, the company has to pay a hazardous waste tax to the state.

But there are also advantages: The hazardous waste landfills are dependable, they’re heavily regulated and they don’t present volume limitations, Blum said.

“There’s really no other outlets for us to utilize in the state of California,” he said.

And with drastically decreasing tons of CRTs entering the end-of-life stream in California, he doubts people will invest in new CRTs processing options.

This article has been corrected to state that the Fairmead Solid Waste Disposal Site is a solid waste landfill, not a hazardous waste landfill.