Officials broke ground on the second Blue Polymers recycling facility, in Buckeye, Arizona, on Sept. 25.

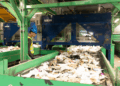

The 162,000-square-foot facility is expected to open in the second half of 2025 and will specialize in recycled PE and PP, according to a press release.

Phoenix-based hauler Republic Services, a joint venture partner in Blue Polymers with distributor Ravago, is developing a network of four regional plastics recycling facilities called Polymer Centers. The company has not yet disclosed locations for its final two plants, but announcements may be imminent, said Tim Oudman, senior vice president of sustainability innovation at Republic Services, in an interview with Plastics Recycling Update.

“We’re getting close on addresses for all of those,” he said. “So stay tuned.”

Each Polymer Center will be co-located with a Blue Polymers site, and the Buckeye facility will process materials from Republic’s Las Vegas Polymer Center, which opened in December and is about 300 miles from Buckeye. Blue Polymers’ first facility, in Indianapolis, alongside a second Republic Services Polymer Center, is still on track to open before the end of the year, Oudman said.

The Polymer Centers will serve as a secondary sorting facility for PET, HDPE and PP, and will produce a hot-wash PET flake, Oudman said. The centers will then send color-sorted polyolefins bales – post-consumer HDPE and PP containers – to Blue Polymers to process into resin pellets for both FDA-approved and non-food packaging applications. Oudman did not disclose whether the plant has any offtake agreements, but said resin sales will likely happen on both spot and contract bases.

“We’ll accommodate those customer needs, but either way, we still expect real strong customer interest,” he said.

Republic previously announced a PET flake offtake agreement with end-user Circularix for food-grade packaging applications.

“When you couple Republic’s collection operations with our recycling centers and then Blue Polymers, you can trace those plastics from the curb all the way back to the shelf, and in some cases in as little as 120 days,” Oudman said. “We’ve had more and more interest from customers, wanting to be able to trace their materials through the system. So we expect some AI solutions here that will be installed to enable us to offer that.”

Blue Polymers intends its four plants to have a combined production capacity of more than 300 million pounds of recycled resin per year.

Although Republic plans to feed the centers with post-consumer plastics from its nationwide curbside collection operations, some market participants have expressed concern about increased competition for post-consumer HDPE – and a run-up in prices – as the Polymer Centers’ feedstock requirements grow.

This is especially a concern in the Midwest, which is much closer to the concentration of HDPE and PET bale buyers in the southeastern U.S. than Las Vegas. Midwest and East Coast recycled polymer markets tend to be isolated from the West Coast due to the significant increase in transportation costs.