During a recent Financial Times webinar, experts from industry and government agreed that the future holds ample potential for investment in recycling.

In the past, according to those experts, such investments have been hard to come by, mostly due to a lack of transparency and worthy opportunities. But, they argued, that’s starting to change.

The webinar, “Strategies Towards Reaching Zero Plastic Pollution,” was hosted by the Financial Times in partnership with Global Partners for Plastics Circularity on May 11.

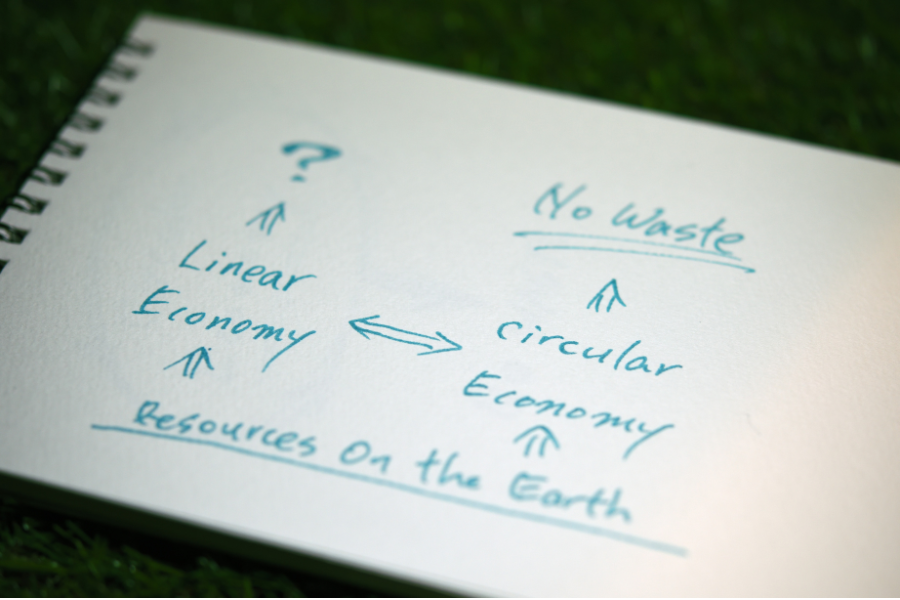

Discussions centered on how private investment can help build a circular plastics economy and how to attract investors in nations with developing and less mature recycling systems, including the U.S.

Where to start

When talking about creating global circular economies, Jihane Bal, lead sustainability director at Dow, said it’s vital to recognize that countries have different starting places, not just with infrastructure but waste management policies.

“The starting journey might be different, but we need to help them build up their system with the policies … so harmonization still works,” she said.

Eddy Mazuaansyah, deputy undersecretary at the Malaysian Environmental Management Division at the Ministry of Natural Resources added that harmonization has to happen in a local context.

“We undeniably recognize that a circular economy requires actions from everyone, not only the government but by actors across sectors,” he said, noting that the “regulatory framework cannot leave anyone behind.”

That was echoed by Bruno Carrasco, director general of sustainable development and climate change at the Asian Development Bank, who said policy frameworks need “to cover the entire value chain. You’re only as good as your weakest link.”

The three key elements to building a circular system are policies, technologies and capital, according to Carrasco.

Clear and internationally recognized standards for accountability and responsibility are part of solid policy, he said, as is removing inconsistencies between current policies that create loopholes.

Investments needed

The panelists all noted that some level of private investment is needed to close recycling gaps and build up the required infrastructure.

Circulate Capital’s managing director of Asia, Regula Schegg, said that 80% of the current plastics leaking into the environment can be stopped with existing technology and management processes but, due to a lack of capital, that’s not happening.

Investments need to be balanced up and downstream, to support the entire recycling supply chain, Mazuaansyah noted.

Bal said before there can be a significant level of investment, especially for chemical recycling, there needs to be regulatory certainty that chemical recycling “is a responsible recycling technology.”

Collecting and sorting is where the investment needs to be, Schegg said, because 60% of what is globally collected is collected by the informal sector.

“We need to showcase that this is an investable space and build an upstream approach,” Schegg said, adding that “each market is different so you need to find a strategy that works best.”

While a lack of transparency, a lack of a track record and a lack of investable opportunities have all been barriers in the past, Schegg noted that “more and more capital is coming into the market now,” and she thinks extended producer responsibility will help attract even more.

“I’m actually very optimistic that that initial gap we assessed” can be closed, Schegg said.