This article originally appeared in the Fall 2019 issue of E-Scrap News. Subscribe today for access to all print content.

When ECS Refining filed for bankruptcy in April 2018, the news came as a surprise to many.

Owned by two longtime industry leaders, the e-scrap processor had been in business for almost four decades. It boasted a nationwide footprint, an impressive customer list and advanced technologies.

So how did it all come undone?

E-Scrap News talked with a former ECS staffer and undertook an extensive review of court documents filed in California, Texas and at the federal level to better understand what led to the company’s closure.

The analysis showed that the business had long been struggling with cash flow problems and disputes with lenders.

But what finally drove ECS to bankruptcy court – and eventual closure – was a battle between ECS’ owners, who were determined to save the company they started, and a Denver-based investment fund, which was determined to collect money it was owed. The ECS owners gambled they could outmaneuver the investment fund in bankruptcy court. They lost.

The closure put hundreds of people out of work and shuttered company locations in five states, including two of the industry’s largest processing facilities. It also resulted in a significant loss of CRT processing capacity for West Coast state programs and left a number of corporate clients with one less electronics recycling vendor.

Here’s the story of the collapse that shook the industry.

Big borrowing and expansion

In many ways, 2012 was a pivotal year for ECS.

Founded in 1980 primarily to recover metals from post-industrial scrap circuit boards made in Silicon Valley, ECS had grown to be a major player in the electronics recycling industry by 2012.

Founders James and Kenneth Taggart had expanded the Santa Clara, Calif.-headquartered company into a multi-million-dollar business with a multi-state footprint. And the Taggart brothers had become well-known names in electronics recycling, helping to drive the success of the e-Stewards standard. Although it was a privately held company, documents submitted in court shed some light on ECS finances leading up to 2012. A footnote in a loan document shows ECS’ earnings before interest, taxes, depreciation and amortization totaled $18.5 million in 2011. That same year, the company landed on Inc. magazine’s list of the 5,000 fastest-growing private businesses in the U.S.

Founders James and Kenneth Taggart had expanded the Santa Clara, Calif.-headquartered company into a multi-million-dollar business with a multi-state footprint. And the Taggart brothers had become well-known names in electronics recycling, helping to drive the success of the e-Stewards standard. Although it was a privately held company, documents submitted in court shed some light on ECS finances leading up to 2012. A footnote in a loan document shows ECS’ earnings before interest, taxes, depreciation and amortization totaled $18.5 million in 2011. That same year, the company landed on Inc. magazine’s list of the 5,000 fastest-growing private businesses in the U.S.

In an interview with E-Scrap News, a former high-level ECS employee explained that it was a hot time for the e-scrap business, and ECS had several offers from several entities wanting to buy the company. The Taggarts had their sights set on further growth, but they didn’t want to give up the company in a sale, said the source, who still works in e-scrap and spoke on the condition of anonymity.

The Taggarts, who didn’t respond to requests for interviews, pursued a recapitalization deal. In February 2012, they sold a 50% stake to New York City private equity firm ZS Fund LP. A press release quoted an executive involved in the dealing as saying “ECS is poised to consolidate the industry and build out its coast-to-coast footprint.”

ZS Fund provides cash for business owners while enabling them to maintain a significant ownership stake and keep their companies independent. Indeed, the Taggarts emerged from the transaction with significant ownership stakes and leadership roles. As individuals, they retained 10% of the company, but they also held ownership positions in two other companies that, together, owned another 40%. James Taggart was CEO and Kenneth Taggart was executive vice president.

“[The transaction] didn’t change the feel of the company, really, except for the finance group got a lot bigger. There was a lot more overhead because people had to do a lot more reporting,” said the ECS source who spoke with E-Scrap News. “They were trying to bring a lot more structure to it.”

In February 2012, ECS signed loan documents that proved pivotal to the company’s future. Planning to finance the company’s growth, ECS borrowed $35 million on a term loan and secured a $15 million line of credit from Bank of America.

The former ECS employee noted a lot of people thought the financials would support the debt load, the bank among them. “Everybody was valuing companies in that industry quite highly at that point,” the source said.

Pain from metals markets

It wasn’t long before the first hints of trouble emerged.

By the end of 2012, ECS had defaulted because a metric of its financial condition fell below what the bank insisted on in the loan agreement. On April 30, 2013, ECS and Bank of America signed an agreement that amended the loan documents. The document acknowledged ECS ran at a loss during the first quarter of 2013, and it required the company to at least break even through the first quarter of 2014.

In 2014, ECS defaulted a second time after the metrics worsened. A second loan amendment signed in April 2015 indicates the bank had grown wary of ECS’ condition: The bank had slashed ECS’ line of credit from $15 million to $7 million. (Thomas Sullivan, a senior vice president at Bank of America who signed the documents, didn’t respond to an E-Scrap News request for comments.)

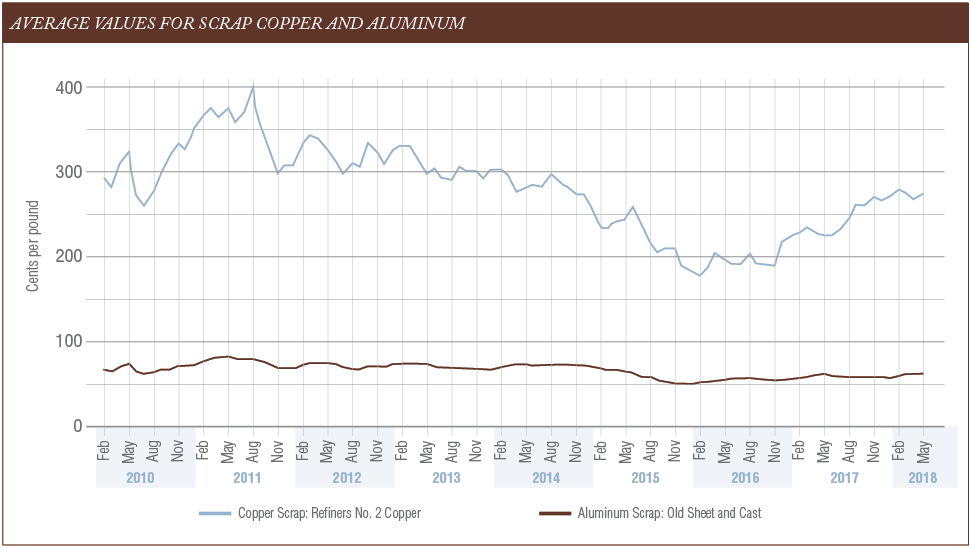

Depressed metals prices hurt ECS, although it’s unclear exactly when the markets took their toll. “The prices for recycled metals have dropped, which has directly impact the company’s revenues,” James Willis, ECS’ former chief financial officer, wrote in a June 2017 declaration in a California court. “ECS has operated at a loss in 2016 and nearly at break even for 2017. We have been working diligently since early 2016 to avoid declaring bankruptcy.”

The source who spoke with E-Scrap News said the company felt particular pain from lower steel, aluminum and copper prices, as well as the fallout of the e-plastics market (see charts below for historic scrap metals pricing).

In 2016, Bank of America completely froze ECS’ line of credit, which, by that point, the company relied on to help make payroll. In a later declaration to bankruptcy court, ECS President Jack Rockwood said the company relied on the line of credit for working capital because of inconsistent accounts receivable, a result of ECS paying customers upfront for material but then having to wait longer to be paid for commodities.

Willis, the chief financial officer, wrote that “ESC believed at the time that this was a temporary freeze, and ECS engaged in extensive negotiations with Bank of America to unfreeze that line of credit, with no success.”

Class-action lawsuit and a severe injury

Meanwhile, a number of other factors helped drain the company’s cash reserves.

In December 2015, former employee Paul Easley filed a class-action lawsuit in state court on behalf of current and former employees. Later joining him as a plaintiff was former employee Demetrio Ortiz. They alleged ECS failed to provide employees overtime pay, minimum wage, legally required meal and rest periods, accurate wage statements and reimbursements for business expenses. ECS denied the allegations.

ECS’ financial problems played into both sides’ decisions to settle, documents show. In fact, the plaintiffs’ attorneys at Glendale, Calif.-based Lawyers for Justice noted in documents that if they dragged the case out, there was a risk the company might fail in the meantime and there wouldn’t be any money left for members of the class.

The parties in 2017 finalized a settlement that required ECS to pay over $800,000. At the same time, legal costs were adding up. An internal ECS litigation spreadsheet showed the company expected to spend over $140,000 in legal expenses for the case.

Because of cash flow troubles, ECS couldn’t wire the lump-sum settlement payment when it was scheduled to, on July 3, 2017, a Monday. The Friday before, Willis submitted a declaration to the court noting “the company intends to completely fund the settlement amount, but it must take current steps to maintain the operation of the Company, including meeting its payroll obligations to its current employees.”

ECS ended up paying $832,000 in a series of transfers through December 2017. Nearly 700 former and current employees received checks in the mail totaling $438,000, and the rest of the money went to attorneys fees as well as a penalty payment to a California workforce development agency and settlement administrator charges.

As ECS negotiated an end to the class-action lawsuit, it also navigated the fallout from an employee injury at its Stockton, Calif. facility. The litigation spreadsheet indicates an employee lost part of his arm, resulting in a workers’ compensation claim.

The Occupational Safety and Health Administration (OSHA) opened an accident inspection in April 2016 and, in August 2016, issued penalties of $63,000. In September 2016, it lowered the fines to $31,000.

At the time ECS’ internal spreadsheet was updated, it was unknown how much ECS would have to pay in total in the aftermath of the accident, but the document roughly estimated $500,000.

In a later declaration in bankruptcy court, James Taggart acknowledged the lawsuit and employee injury made 2017 a difficult year because they resulted in unexpected cash demands on the business.

Additionally, according to the former employee who spoke with E-Scrap News, in 2015 or 2016, ECS lost a big customer that had funded recycling programs across the country. Without naming the company, the former employee said the decision was out of ECS’ control: New leadership at the customer brought a change in direction in the way they managed their recycling program.

“It definitely put another pinch on the cash flow,” the former employee said.

SummitBridge battles

In 2017, ECS was introduced to the investment fund that ultimately brought it down.

In March 2017, in what was a surprise to ECS, Bank of America sold ECS’ debt to a fund called SummitBridge National Investments V LLC. The asset manager for the company is Denver-based Summit Investment Management, which specializes in acquiring distressed debt, including sub- and non-performing loans secured by operating businesses.

SummitBridge reported ECS owed it $5.7 million on the line of credit and $19.9 million under the term loan. It said ECS defaulted at the end of 2016 when it failed to pay obligations under the credit agreement when they matured.

Mark Kilcoin, asset manager for Summit Investment Management, didn’t respond to a request from E-Scrap News for comment. A SummitBridge attorney declined to comment.

In court documents, ECS leaders portrayed SummitBridge as taking an uncompromising position. James Taggart said SummitBridge refused to restructure the loan; instead, in June 2017, SummitBridge forced ECS to sign a forbearance agreement, which gave ECS until the end of 2017 to satisfy its obligations before SummitBridge would go to court to have the company’s assets sold.

James Taggart described the agreement as SummitBridge pursuing “collection activities.”

The agreement came with a number of strings attached. ECS had to pay SummitBridge $160,000 a month through the end of 2017, turn over a trove of financial information and hand over control of ECS’ bank accounts. It also required ECS to generate quarterly earnings of at least $850,000.

While it paid SummitBridge, ECS’ strategy over that time appears to have been twofold: attempt to negotiate loan restructuring with SummitBridge and try to borrow money from Wells Fargo Bank to pay off SummitBridge. Ultimately, both efforts were fruitless.

In January 2018, ECS missed its first debt payment to SummitBridge. In March 2018, SummitBridge delivered its final offer, which “consisted basically of the turnover of ownership of the assets to SummitBridge, with other debts left unpaid,” James Taggart wrote. ECS’ owners refused the deal.

The former ECS staffer emphasized to E-Scrap News how “deeply, personally, emotionally invested in the company” the Taggarts were. And the employee noted the aggressive strategy of SummitBridge. “If they had a thing where $500 more would have kept the business going, they would have said ‘Nope, that’s our $500. Too bad,'” the source said.

In April 2018, the conflict reached a head. James Taggart wrote that on April 23, “we made an offer to buy the business for $6.0 million (cash and note), and other potential resolutions. Instead of responding to that offer or negotiating (as they said they would) SummitBridge froze the Debtor’s bank accounts.”

The following day, April 24, 2018, ECS filed for Chapter 11 in U.S. Bankruptcy Court for the Eastern District of California.

Strategy to block a takeover

The filing was a strategy to head off a takeover by SummitBridge and save the company. At the time, ECS had about 340 employees, almost all of them full time.

Company leaders were candid about their strategy in statements to the media and their suppliers.

“They wanted us to sign the company over to them – we didn’t feel that would work for us and so we were forced into a situation where the only thing we could do was file for bankruptcy,” James Taggart told E-Scrap News at the time.

ECS’ director of sales, Jon Walker, sent a notice to suppliers explaining that ECS had been working to restructure debt with its bank and investors for over two-and-a-half years.

“We are certain that some competitors will use scare tactics and misleading information to tarnish our reputation but as mentioned before this was a strategic move to maintain control of the company and eliminate a hostile takeover from our investment bankers so we could continue to service our customers,” the notice read.

By the time of the filing, ZS Fund was no longer an ECS owner, and the Taggarts had become the sole shareholders and board members, Rockwood, the company president, wrote in a declaration to the bankruptcy court. It’s unclear exactly when ZS Fund offloaded its stake. (The fund’s partners declined to comment for this article.)

At the time, James Taggart told E-Scrap News ECS had successfully come up with financing to continue its operations. Eight days before the bankruptcy filing, the Taggarts created a company called Butch and Sundance LLC and agreed to loan ECS $6 million after it filed for bankruptcy.

They wanted the company to use that financing to help keep the company’s doors open while they pursued “an orderly reorganization,” Rockwood wrote.

However, in the motion to approve the financing, the Taggarts’ attorney didn’t disclose to the court that the Taggarts owned Butch and Sundance.

SummitBridge pounced.

“This case is a thinly disguised scheme by insiders of the Debtor designed to freeze out the Debtor’s prepetition secured lender who is owed more than $25,000,000,” SummitBridge attorneys wrote.

SummitBridge noted that under the plan, Butch and Sundance, which was owned by the Taggarts, would loan money to ECS, which was owned by the Taggarts. ECS would then use some of the money to pay rent on the Mesquite, Texas and Stockton properties, which were owned by ECS Big Town LLC and Sinclair Partners LLC, companies also owned by the Taggarts.

James Taggart later wrote that “it was never our intent or strategy to not disclose” in the filing their relationship to the lender. As owners of the two largest ESC properties, the Taggarts had been asked to provide financing, and they agreed to, he wrote. “We believed the Debtor was worth saving,” he stated.

The lack of disclosure drew a tongue-lashing from Robert Bardwil, the bankruptcy court judge.

“I really only conclude at this point that there’s been skullduggery or incompetence, and that’s really troubling to the court,” Bardwil said during a May 1 hearing. He later approved only a $100,000 emergency loan from Butch and Sundance to ECS.

The former ECS employee suggested that the Taggarts were simply outmatched in bankruptcy court. “They had no experience in bankruptcy,” the source said. “And they were on the other side of the table [from] somebody who that’s what they do for a living.”

Last-minute purchase offers rejected

Hope of saving the company wasn’t extinguished, but time was running short.

On May 8, Bardwil appointed lawyer Donald Gieseke of Reno, Nev. to serve as trustee overseeing ECS. Gieseke made clear his goal was to find a “reasonably soft landing” in the case. He tried to sell the still-operating company.

Another nationwide e-scrap company, Regency Technologies, expressed an interest in buying ECS, although Gieseke wrote that it wasn’t a formal offer. Documents show the offer was worth at least $3.9 million and as much as $5 million.

James Taggart laid the blame for the deal not going through on SummitBridge. The fund “would not agree, apparently simply because that purchaser would have needed to rent the warehouses owned by entities in which my brother and I have a controlling interest.”

By the end of June, Gieseke received a formal offer from ECS insiders to buy the company, but it wasn’t acceptable to SummitBridge. Thomas Willoughby, Gieseke’s attorney, said during a June 29 hearing the offer was “weak” and would have involved waiving claims against ECS’ owners. It also didn’t provide upfront cash for SummitBridge, he said.

Gieseke wanted more time to try to sell the company, but ECS was running at a loss of between $300,000 and $500,000 per week, and the unpaid administrative liabilities were piling up. SummitBridge had a secured claim on ECS cash and most all of ECS’ other assets.

During the June 29 hearing, Willoughby told the judge that “at the end of the day, it’s up to the secured creditor whether they’re going to eliminate those jobs or not at this stage and hold an auction for the equipment.”

The answer from SummitBridge’s attorney Tom Mouzes was clear: “We think wind down is appropriate at this point.”

Hearing that, Judge Bardwil approved ECS’ immediate closure.

The news came as a surprise to industry players outside the company.

“I just think it’s important that we all recognize that if it could happen to ECS, it could happen to anybody,” Jonathan King of TV manufacturer TCL North America said on-stage at the 2018 E-Scrap Conference a few months after the closure. To him, the episode reinforced the need for OEMs to fully examine the financial health of companies they do business with.

“The due diligence now that you need to do to make sure that you’re dealing with a company that you really truly want to work with has just become that much more complicated in an industry that’s already, I think, pretty complicated,” King said.

Jared Paben is the associate editor of E-Scrap News and can be contacted at [email protected]