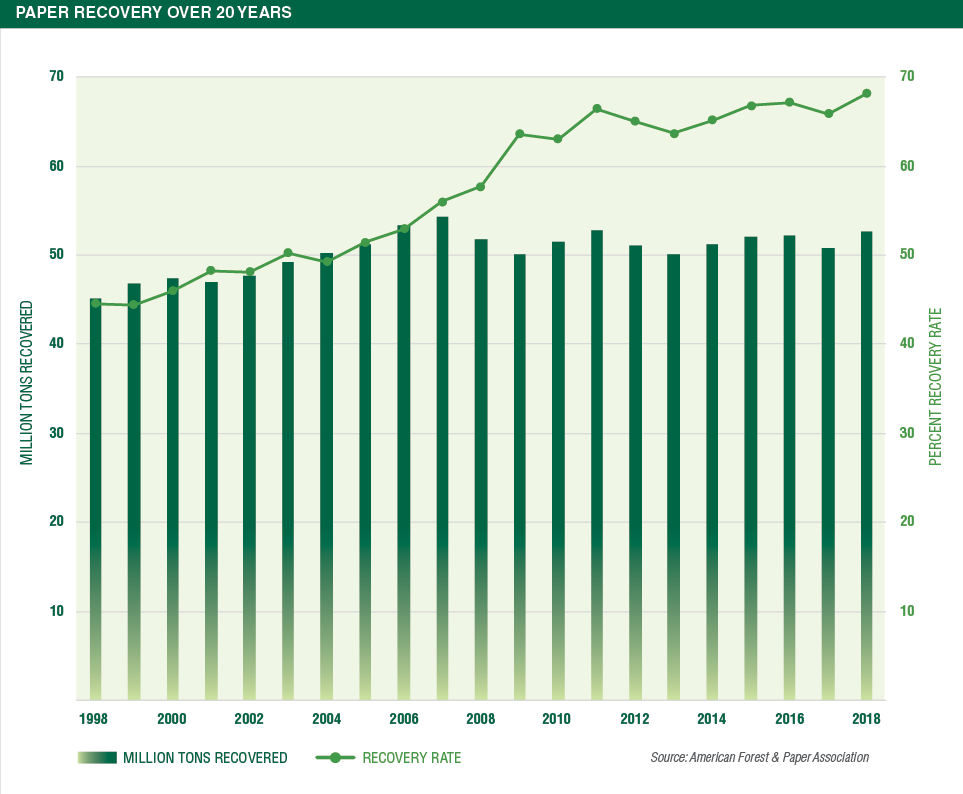

The U.S. paper recovery rate has been at or above 63% each year for the past decade.

Every year, the American Forest & Paper Association (AF&PA) releases the U.S. paper recovery for recycling rate. The annual figure informs us how much recovered paper is being used to create new products in a given year and is also an important indicator of how much paper and paper-based packaging is kept out of landfills after use.

In 2018, the U.S. paper recovery for recycling rate increased to 68.1%, more than double what the rate was in 1990 and the highest U.S. paper recovery rate ever recorded. In addition, the rate has been at or above 63% each year for the past decade.

Our industry has a goal to exceed 70% paper recovery for recycling by 2020, and we are constantly doing our part to improve the quantity and quality of paper recovered for recycling.

The China challenge

In July 2017, China announced that it would halt the import of many recovered materials, including “scrap and unsorted waste paper” (defined as “mixed paper” by China) by the end of the year. It also implemented very strict quality standards on other grades of imported recovered paper.

Being the largest export market for U.S. recovered paper, the impact of China’s import restrictions on the U.S. recovered paper market came soon after: The U.S. paper recovery rate fell from its previous record of 67.2% in 2016 to 65.9% in 2017. Many doom and gloom news stories about the future of recycling followed.

However, markets for recovered paper are very resilient. Since 2016, the U.S. paper industry has increased its use of recovered paper to make new products by 3.8% and announced manufacturing capacity expansions that will use additional recovered paper. Interestingly, U.S. exports to China of new paper products increased since 2016, indicating that China’s demand for paper products remains high.

Meanwhile, recovered paper export markets have fully recovered from China’s abrupt import restrictions. In 2018, there was an overall 4.2% increase in U.S. recovered paper exports compared with 2017. While exports to China were off 30.5% in 2018, that decline was more than offset by exports to other trading partners – other Asian countries in particular. And despite its import restrictions, China remains the single largest export market for U.S. recovered paper.

This all shows that U.S. paper recovery for recycling is successful because it is market driven.

Supply, demand and global economics all play a role in how much paper is ultimately recovered for recycling, because recovered paper markets are driven by the same dynamics that characterize the broader economy.

The use of recovered paper to manufacture new products is something that takes place around the world and the market determines whether recovered paper will be used by U.S. mills or exported and used in other countries.

Strengthening paper recycling

Strengthening paper recycling

AF&PA is in favor of letting the market decide outcomes, including the area around paper recovery for recycling. The voluntary recycling system in the U.S. has proven to be capable of achieving and maintaining very high rates, even with natural ebbs and flows in the market.

AF&PA, our members and our partners do work to ensure these high paper recovery for recycling rates are maintained through efforts to increase the quantity and quality of paper recovered for recycling.

Our work with The Recycling Partnership creates public-private partnerships that bring sound recycling infrastructure to communities where it does not yet exist and invests in improvements to the recycling system in communities where it is established. Since its founding in 2014, The Recycling Partnership has worked in more than 1,000 communities across the nation.

States, communities and the industry all play roles in making residential recycling successful. Communities can improve the performance of residential recycling systems by adapting effective practices. Research conducted for AF&PA in 2015 by Skumatz Economic Research Associates identified key drivers underlying strong-performing community recycling programs:

- Accepting 12 or more kinds of paper and paper-based packaging in residential collection.

- Implementing weekly recycling collection.

- Investing $1 to $2 per household in consumer education.

- Including recycling education in schools’ K-12 curriculum.

In addition, states can create a fair policy environment and provide support to communities to help improve residential recycling. AF&PA’s Building Effective Recycling Programs guide helps states assess progress toward recycling-friendly policies, including:

- Setting voluntary recycling goals.

- Avoiding restrictive regulations on managing recyclable materials.

- Promoting universal access to curbside and/or drop-off residential recycling collection.

- Providing technical assistance with the right tools and resources to municipalities.

AF&PA also develops educational materials to inform audiences about best recycling practices. This includes identifying what is recyclable; informing consumers why they should make the effort to recycle; reminding them to make sure items are clean and dry before they are put in the recycling bin to minimize contamination; and helping residents refrain from “wish-cycling.”

An ongoing effort

Paper recovery for recycling is an integral part of the paper industry’s legacy of sustainability. AF&PA and our members are proud of achieving a record 68.1% paper recovery for recycling rate in 2018. And we are working toward achieving our goal to exceed 70% recovery by 2020.

We know achieving that rate will require the same team effort – working with states, communities and Americans who recycle paper at work, home and school – that has enabled the industry to maintain a recovery rate at or above 63% for each of the last 10 years.

Brian Hawkinson is executive director of recovered fiber at the American Forest & Paper Association. He can be contacted at

[email protected].

This article originally appeared in the June 2019 issue of Resource Recycling. Subscribe today for access to all print content.

Strengthening paper recycling

Strengthening paper recycling