This story has been corrected.

Packaging Corporation of America will stop linking its customer agreements to third-party pricing indexes, becoming the second major packager to announce similar intentions due to frustration with the leading index.

“We were very surprised when … a couple of weeks ago, the RISI Pulp and Paper Week publication did not recognize any increase in the industry’s benchmark prices for either linerboard or medium,” said Thomas Hassfurther, executive vice president of corrugated products at PCA, during the company’s Jan. 29 earnings call.

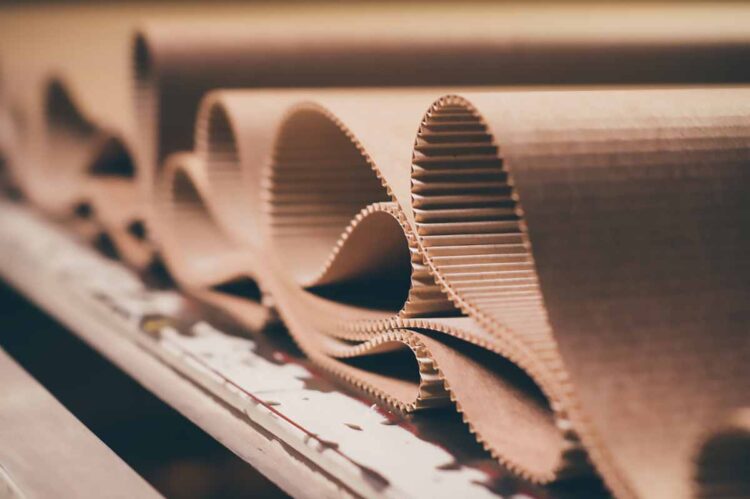

The company continues to see very strong demand and higher production costs, he said, and on Jan. 1 began implementing price increases of $70 per ton for linerboard and $90 per ton for medium – the wavy internal layer of containerboard.

“These prices have been accepted by our customers and for our market containerboard purchases, we are paying higher prices to containerboard suppliers that began invoicing us according to their recent announcement,” Hassfurther said.

Data from RecyclingMarkets.Net shows January OCC remaining steady on the month at $73 per ton. In late 2024, packaging companies announced that they would attempt to raise prices in January.

In its Jan. 29 paper packaging outlook for 2025, Fastmarkets RISI said of the producer price increases, “With overall demand still sluggish, this announcement follows the pattern of the 2024 price increases in that it is driven primarily by margins rather than demand and capacity.”

Going forward, Packaging Corporation of America does not yet have a specific replacement in mind, Hassfurther said: “We’ve not found any other indicator out there that we feel comfortable with.” In the meantime, he indicated the company will work out contract details on a customer-by-customer basis.

Hassfurther declined to say how many customer contracts had been “unwound” from referencing RISI. “I’m not going to give you percentages of how this is going to sequentially fall into place here, but it’s going to take some time, but we’re moving in that direction.”

In the meantime, Packaging Corporation of America is conducting spot business at the increased prices, while contracts tied to the index move at a different rate, Hassfurther said. “And until that index indicates the price is a liner medium going up, it won’t trigger some of those contracts.”

“Industry sources and the Pulp and Paper Week publication itself have previously reported that at least 12 or around 90% of the top containerboard producers have issued January price increase announcements,” Hassfurther said in the call. “The publication even noted that certain box makers have postponed purchases of linerboard this month to avoid the price increase.”

He went on to say RISI was gathering price information from a “very small sample of the containerboard market and using that to opine on market conditions for the entire industry,” and that “the publication often references comments regarding box prices when the relevant product is containerboard.”

Bloomberg analyst Ryan Fox noted in the call that U.S. mills are operating at about 90% of capacity and asked executives why the open market would be willing to pay more for containerboard amid “overcapacity.”

“You’ll have to ask them. I can tell you that our customers don’t see it the same way you’re calling it out,” Hassfurther said, adding that there’s a “large disconnect … to what’s really going on in the marketplace and what exists out there in terms of numbers.” He cited Packaging Corporation of America measuring volumes in millions of square feet while other measures use weight in tons, and differences between nameplate capacity and actual mill output.

Graphic Packaging

Graphic Packaging previously announced in a late October earnings call that it would decouple from third-party indexes starting in first-quarter 2025.

“What’s next for us is the development of a new index that’s actually an index that’s attached to known commodities that correlate nicely with our cost structure,” said Chief Financial Officer Stephen Scherger in the Oct. 29 call, adding that the company was in talks with “some very large global customers” for multi-year agreements.

He said the company previously had indicated it was moving all customer contracts to “more transparent and more accurate price chain mechanisms,” and that no longer tying open-market paperboard sales contracts with third-party indexes “is a small but important piece of our ongoing transition.” Those contracts comprise about 5% of Graphic Packaging business, he said.

About half of Graphic Packaging business is already linked to cost-based or annual models, Schreger said. “The current large-scale customer negotiations where we’re bringing this to life will be a nice proof point that our interest and our customers’ interest in the consistency and transparency of an alternative price change mechanism is high.”

Similar to Packaging Company of America executives, Graphic Packaging CEO Michael Doss was critical of the RISI price discovery process. “You see the third-party indexes talking more and more to brokers and getting their information from paperboard brokers. And broker strategies and their motivations could be completely different than ours for a variety of reasons.”

He added that about two years previously Graphic Packaging began re-pulping its off-grade material rather than selling it to brokers.

Editor’s note: A previous version of this article gave an incorrect name for the Packaging Corporation of America.