This article appeared in the July 2021 issue of Resource Recycling. Subscribe today for access to all print content.

What will it take to push U.S. residential recycling past its decades-long pattern of stagnation? How many people still can’t recycle as easily as they can throw something away? What level of investment is needed for everyone to know how to recycle and be motivated to do so?

These were some of the questions at the heart of a recently released report from The Recycling Partnership (The Partnership), titled “Paying It Forward: How Investing in Recycling Will Pay Dividends.”

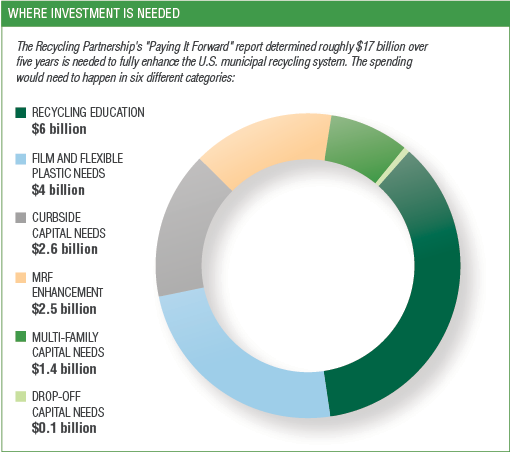

Our team found that $17 billion over five years would provide the capital necessary to transform recycling collection, processing and education in the U.S. This estimate is based on a first-of-its-kind detailed model of the recycling system – from households to the back of materials recovery facilities – and it identified gaps and their associated costs along the way.

This article provides an overview of the model’s components and how they were derived, starting with a critical area of our findings: who still lacks access to recycling in the U.S. and what is needed to reach them.

Baseline of access

The Partnership started with the Sustainable Packaging Coalition’s “2015-16 Centralized Study on Availability of Recycling” as the baseline for exploring recycling access for U.S. households. The team refreshed SPC’s numbers with newer data from the U.S. Census and added key factors to address the issue of “equitable access,” which The Partnership defines as the ability to recycle just as easily as one can throw something away.

For example, the SPC study did not differentiate between single- and multi-family circumstances, but this single factor will dramatically impact recycling access. Our research found that around 11 million multi-family households depend on off-site drop-off and lack more equitable on-property access to recycling.

In addition, applying SPC’s 2016 percentages to newer household counts found that 17 million homes do not subscribe to offered curbside services. On top of that, 4 million homes with access to drop-off recycling locations could be converted to curbside programs and 10.8 million current curb-served homes are underserved by small bin or bag-based curbside programs. Another 7 million homes have no recycling services whatsoever.

These combined shortfalls make up the access gaps the U.S. must fill for equitable recycling access to be realized.

Curbside capital needs

To determine the capital needed to fully revamp curbside recycling, our team first worked through critical assumptions.

A modernized curbside collection system should have carts for every home and automated trucks running efficiently. However, many cities do not have streets that allow for the large, lidded carts needed for automatic pickup. Also, not all cities define curbside eligibility or “single-family” homes in the same way.

So how did we account for the varying needs of the roughly 38 million single-family U.S households (out of 91.2 million total) that still need infrastructure for equitable curbside recycling access?

Based on the baseline of how many homes would be eligible for curbside service, we distinguished between homes that can effectively use carts and homes that will most likely still need to use bins (for instance, using Census housing stock data, we estimated that 6 million homes will need to use two bins because of narrow streets, row housing or other limiting factors). We then parsed out how many cartable homes are in communities without curbside programs, how many binned households need carts, and how many are in subscription areas that need to sign up for collection.

Using average factors of $50 per cart, $8 per bin, and $300,000 per truck, we estimated that just under $2.6 billion is required to provide equitable curbside recycling for the 38 million households that need better service.

Multi-family capital needs

Multi-family dwellings are an increasingly important source of future material supply. The key to successful multi-family recycling is on-property access to match how residents experience garbage service.

After examining our community recycling datasets, we assumed only 4.6 million multi-family homes currently have adequate on-property service, leaving roughly 13 million (or roughly 75% of all multi-family units) without an easy solution for recycling. This includes 11 million households currently using off-site drop-off and 2 million multi-family homes with no recycling access at all.

The details around multi-family recycling infrastructure are more nuanced than those for curbside collection due to the varying physical characteristics of properties. Each multi-family complex has unique attributes that lead to a specific type of container need (compacting roll-offs, front-end containers and carts are the typical options). The type of container in turn dictates the rolling stock needed for collection.

To build estimates, our team divided multi-family housing into categories of high-rise, mid-rise and garden style, and we applied assumptions about the collection infrastructure needed for each, using apartment data from the Federal Home Loan Mortgage Corporation (Freddie Mac) to determine the number of homes per category.

With this foundation, we estimated a need of $1 billion for collection infrastructure, $306 million for rolling stock, and an additional $120 million to provide in-home totes for 80% of the nation’s multi-family households.

Drop-off capital needs

Curbside or on-property recycling collection is not the answer for every U.S home. Equitable and informed access means that all households can recycle just as easily as they can throw something away, regardless of location. There is a significant portion of the U.S. that relies on drop-off locations for their municipal solid waste disposal, and they need parallel access to recycling.

Our model assumes some drop-off-only communities will convert to curbside, but we also assume that 10% of homes will continue to need a robust drop-off system. As we conducted analysis on these less dense areas of the country, we estimated 746 drop-offs need to be upgraded while 746 new sites need to be established, all with adequate signage. In addition, 293 trucks are required to service these locations.

All together, we estimate a total of just under $102 million is required to fully capitalize the drop-off system in the U.S.

Education emphasis

Education emphasis

A fully capitalized collection and processing system will not realize its potential without meaningful education and engagement.

Our model evaluated the cost for robust investment in education to ensure people are knowledgeable and motivated recyclers. Investing in this level of education and engagement is anticipated to increase the national recycling rate 20 percentage points beyond the rate that would be seen from infrastructure investment alone. Based on The Partnership’s experience in communities across the U.S., we find that coupling recycling access with meaningful education not only increases and sustains high recycling rates, but it also delivers cleaner materials to MRFs and reprocessors.

The Partnership developed the cost estimate for education based on our work over the past seven years. Addressing material quality at the curb costs about $3 to $5 per household annually to substantially reduce contamination. Additionally, resident education is needed to build recycling knowledge and trust in the system, driving increased participation.

Our team went through the exercise of outlining the true education costs in various sized cities with the core principle that people need to be informed at least seven times per year to build consistently good recycling behavior. We analyzed the additional costs that are critical for growing awareness of schedules, program details and reasons to recycle.

This all led us to estimate that $10 per household per year (or $6 billion over five years) is what’s needed on the educational front to fully enhance U.S. recycling.

Ensuring MRFs are prepared

When all 120 million U.S. homes (a number that includes both single-family and multi-family) receive equitable and informed recycling access, materials recovery facilities can expect huge increases in material. Although many MRFs are making processing improvements, our report models a massive scaling of these investments across all of the roughly 375 residential facilities in the U.S.

We divided MRFs into three throughput categories – small, medium or large – and assigned a number of upgrades per category. The total investment necessary to fully modernize this critical infrastructure point came to $1.54 billion. In addition, assuming that 25% of new tonnage would require new MRF capacity, we projected the need for 57 new MRFs, at a total cost of roughly $1 billion.

These investments would build out MRF infrastructure to cleanly process vastly expanded new tonnage.

Film and flexible materials

Film and flexible (F&F) plastic items constitute the biggest category of unrecovered household packaging. If F&F package recyclability design continues to advance and if large-scale markets emerge, F&F could become widely accepted in collection programs.

To map this scenario, we divided MRFs into one category of large facilities that could process loose F&F and a second category of smaller MRFs where bagged F&F would be a better approach. Upgrade costs for the first category amount to $475 million and for the second expenses would be $240 million. Adding F&F capability to the 57 new MRFs outlined in the previous section of this story demands another $132 million.

Further, the estimated 60 million households under the bagged model would need a steady supply of bags to ensure high participation, and this would carry an annual cost of $510 million annually (or $2.5 billion over five years). Introducing F&F to existing programs would also require upfront education projected at $120 million per year ($600 million over 5 years).

The overall projected need for F&F thus adds $4 billion to the overall model costs. Again, this depends on F&F stakeholders developing specification-based markets for the material.

Other material sectors have made huge market investments over the past several decades to achieve mainstream acceptance in collection systems and MRFs; this report points to the need for the F&F sector to scale investments greatly to ensure their materials are recoverable in practice and address consumer frustration with the current recycling gap for these materials.

Other system costs

The “Paying It Forward” report also analyzes supplemental system costs that would come alongside the improvements outlined in earlier sections.

These include extra costs associated with collection operations, MRF processing and replacing equipment over time. While acknowledging the need for more analysis, we estimate collection operations cost $10 billion per year today, and we envision this rising to $13 billion with new tonnage. MRF processing costs, meanwhile, currently sit at $1.3 billion and would rise to $1.9 billion. Replacement of capital in place is estimated at a $3 billion annual cost.

We also recognize that additional investments will be needed in post-MRF processing and markets to accommodate new tonnages. Many examples of private investment are already underway and could be accelerated with the right strategies.

Commodities win

Commodities win

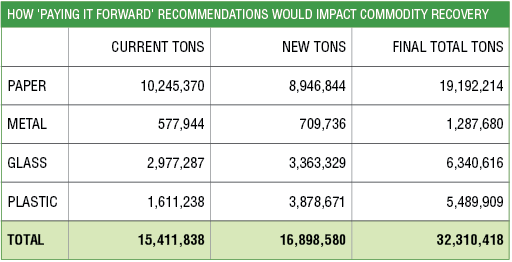

Clearly, a recycling system that returns only one third of household recyclables back to the economy (as is the case in the U.S. today) has huge room for improvement. Equitable, informed access, and efficient MRFs are the foundation of recycling’s next leap forward. With scaled capital strengthening these fundamental building blocks, tons of material will follow.

Using basic factors of household generation, program performance and education impacts, we project more than doubling residential recycling tonnage, benefitting every commodity. See the chart above for details.

Improvements are Imperative

The “Paying It Forward”report is meant to drive conversation about the scope, scale and needs in solving the issues of equitable access, persistently low recycling rates and stakeholder goals that currently do not align with the recycling scenario in the U.S.

The research is built on an analytical model that leverages our extensive knowledge of the recycling system, understanding of community programs and their performance, and direct experience with system costs and responses to interventions. We have the proven solutions to level up the U.S. recycling system, and it is imperative that we do so to meet the needs of both people and the planet.

Capital is necessary to scale and accelerate that change and deliver sustainable, low-carbon supply chains. The Partnership looks forward to collaborating with all system stakeholders to make it happen.

Scott Mouw is The Recycling Partnership’s senior director of strategy and research and can be contacted at [email protected]. Cody Marshall is the group’s chief community strategy officer and can be contacted at [email protected].