March 7 update: Some of the new tariffs on imports from both Mexico and Canada were paused following executive orders President Donald Trump signed on March 6. The orders exempt goods that enter the U.S. under the U.S.-Mexico-Canada Agreement, which would appear to exempt recycled materials, but it’s not entirely clear. Canada’s first round of retaliatory tariffs appears to remain in effect.

The Recycled Materials Association warned of potential “severe” disruption to the materials recovery sector after tariffs targeting the U.S.’s largest trading partners took effect this week. Some tariffs on Mexican imports were paused for another month on March 6. Meanwhile, Canada’s proposed response includes tariffs on U.S. exports of recycled materials.

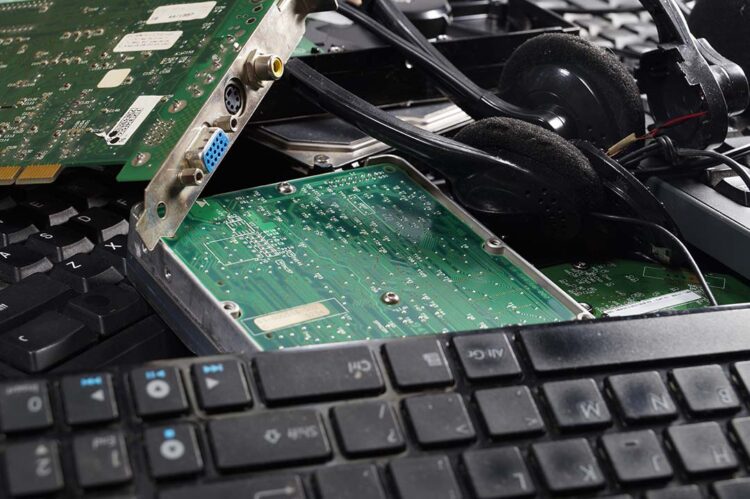

The tariffs threaten to raise costs to import end-of-life batteries, circuit boards and mixed e-scrap from Canada and Mexico. Although trade data for e-scrap is not as clear-cut as for other recycled commodities, U.S. Census Bureau figures indicate more than 14 million pounds of these materials came in from Mexico and more than 6 million pounds from Canada in 2024.

President Donald Trump first outlined the 25% tariffs in a pair of Feb. 1 executive orders, framing them as a response to drug trafficking and border security problems. They were quickly paused for one month after deals were reached with the governments of Canada and Mexico. During a press conference March 3, Trump told reporters there was “no room left” for further deals to be made with Canada and Mexico.

Still, on March 6, Trump wrote on social media that he had spoken with Canadian President Claudia Sheinbaum and decided that any imports that fall under the U.S.-Mexico-Canada Agreement will not be subject to tariffs until April 2.

After the measures took effect early Tuesday morning, Canada responded immediately with tariffs on 30 billion Canadian dollars ($21 billion) of U.S. exports to Canada beginning March 4, echoing the country’s response before the tariffs were delayed in February.

Those retaliatory tariffs are set to expand later this month, if the U.S. doesn’t remove its tariffs. The Canadian government this week published a lengthy list of commodities that would be hit with responsive tariffs. The list includes most types of scrap plastic, including the tariff code commonly used for e-plastics. It also includes the entire tariff category used for e-scrap.

Additionally, in a March 3 executive order Trump also doubled the recently enacted 10% tariff on Chinese imports to 20%. Trump has framed the tariff as a response to the flow of fentanyl and other drugs from China into the U.S., and the new executive order says the country has “not taken adequate steps to alleviate the illicit drug crisis through cooperative enforcement actions.”

The move drew immediate retaliatory tariffs from China, whose foreign ministry on March 4 issued a harsh rebuke during a press conference: “If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.”

Industry braces for ‘severe’ disruption

In a March 4 interview, Adam Shaffer, assistant vice president for international trade and global affairs at ReMA, said the industry group is concerned there could be “significant, severe disruptions” from the tariffs.

With all commodities taken into account, the U.S. remains a net exporter of recycled materials. But it imports significant quantities of some material streams, such as scrap metals. Last year, the U.S. imported 442,000 tons of scrap aluminum from Canada and 226,000 short tons of scrap aluminum from Mexico, according to the U.S. Census Bureau figures.

Trade figures show scrap electronics are a much smaller import commodity, but not an insignificant volume. Trade data has historically been hazy on the e-scrap side, with end-of-life electronics usually classified in any number of tangentially related tariff codes. But tariff code updates in 2022 offered some clarity in the process, establishing a category of “electrical and electronic waste and scrap,” including printed circuit boards, CRT glass and other components that have been shredded or otherwise destroyed and are destined for commodities recovery, not reuse.

These materials and end-of-life batteries made up the 14 million pounds from Mexico and 6 million pounds from Canada last year, and the movement, while relatively small, highlights the interconnected nature of the North American electronics recycling sector.

“It’s a very integrated market,” Shaffer said. “The business model has long been North America-based.”

Canada’s proposed retaliation would be an even bigger blow, by commodity volume. U.S. e-scrap exports to Canada totaled 104 million pounds in 2024, according to the U.S. trade figures. All of that material is included on the retaliatory tariff list.

ReMA and other recycling trade associations, including the Bureau of International Recycling, have longstanding positions opposing trade barriers. “Generally, there is the expectation that any tariffs will reduce trade, one way or the other,” Shaffer said, adding less trade is likely to lead to less investment by recycling companies.

The Canadian Association of Recycling Industries, which represents companies across the recycling sector, said the tariffs will have “serious economic consequences as we’ve been communicating, including for our recycled materials industry, an industry which does not in any way cause a national security threat.”

“These punitive economic measures will hurt the recycled materials and manufacturing industries, as well as other key sectors, which are deeply integrated with the U.S. market, and weaken economic ties that have benefited both nations for decades,” the organization wrote in a statement.

The new trade acrimony in North America undoes some key provisions of the U.S.-Mexico-Canada Agreement, the free trade agreement negotiated during the first Trump term. The agreement, which was strongly supported by ReMA, established tariff schedules that set duties for almost all goods, including recycled commodities, at 0% for all three countries.

“Broadly speaking, these tariffs will go fully against the USMCA,” Shaffer said.

Potential positives for in-country ITAD interest

While the tariffs are likely a negative for companies buying scrap materials from across the border, some ITAD companies anticipate the tariffs could drive greater attention on asset disposition and electronics recycling within the U.S.

Companies could increasingly see these processes as ways to avoid costs associated with importing new devices.

“When tariffs are imposed on products such as smartphones, laptops, and gaming consoles, manufacturers and retailers often pass these additional costs on to consumers,” ITAD firm California Electronic Asset Recovery wrote on Feb. 24. “Even devices produced domestically often rely on components that are produced abroad. As a result, higher prices can make new electronics less accessible, potentially driving more individuals and businesses toward used, refurbished, and recycled electronics as cost-effective alternatives.”

“Companies will consider proactively adapting their supply chains to manage the impact of changes to tariffs and will look to the ITAD and recycling industry for opportunities to keep resources in-country and reintroduce equipment, components and commodity materials back into their supply chains,” ITAD firm SK Tes predicted early this year, before the tariffs took hold.

Meanwhile, precious metals refiner Glencore, which operates a Quebec smelter that consumes a significant amount of e-scrap from the U.S., recently commented on how the company approaches these types of business uncertainty.

“Nobody can predict what’s going to happen with tariffs,” Glencore CEO Gary Nagle said during the company’s recent earnings call. “Nobody knows. You wake up tomorrow morning, there is a tariff, there isn’t a tariff. Is it 10%? Is it 60%? Who knows? What we do know is uncertainty creates opportunity.”

He said the company is “naturally positioned all around the world” to be able to divert shipments in response to tariffs or other actions, even shipments that are already in transit.

“From a tariffs, geopolitical perspective? More volatility, better for our business because we are naturally positioned for that,” Nagle said.

New tariffs separate from universal metal tariffs

The 25% tariff on Canada included a carveout for energy and critical minerals, which will be subject to a lesser 10% tariff. Aluminum falls under that critical mineral designation, which follows the U.S. Geological Survey’s periodically updated list.

But despite that carveout, companies that operate throughout North America and deal in steel and aluminum are bracing for what could be a particularly pronounced effect: Those commodities are subject to separate 25% tariffs that apply to every country, the White House announced last month. Those tariffs take effect March 12. They do not apply to recycled aluminum and steel, ReMA has confirmed, but metal companies are concerned.

Aluminum giant Alcoa has operations in the U.S. and Canada, and the company does a huge amount of cross-border trade. Alcoa produces 990,000 short tons of aluminum per year in Canada, and 770,000 of those tons are sent into the U.S.

Company leaders laid out their view of the complex series of incoming tariffs in a Feb. 25 investor call.

“Our view is that currently, those two tariffs would stack for a 35% net tariff coming from Canada,” said Bill Oplinger, Alcoa’s president and CEO. “We think that’s a particularly bad outcome for a number of reasons.”

For one, he said, having an unequal tariff on metals coming from Canada compared to other countries could incentivize Canadian metal producers to send material to Europe instead, and could incentivize U.S. importers to buy from countries other than Canada.

The rise in tariffs will likely increase metal prices, Oplinger said, but the company anticipates a “net negative” in the end.

“We’re advocating with the administration to, at a minimum, get a Canadian exemption, which will allow two thirds of that metal that gets consumed in the U.S. to continue to come across the border without a tariff,” Oplinger said.

Asked whether the tariffs will lead Alcoa to restart its aluminum production capacity in the U.S., Oplinger said the company is running the numbers on start-up costs for 44,000 to 55,000 short tons of “old, very inefficient” capacity that has been idle for years. But he said it’s hard to make a decision on restarts, or new facility development, with the amount of policy uncertainty.

“We make decisions around aluminum production that are a horizon of 20 to 40 years,” he said. “We would not be making investment in the United States based on a tariff structure that could be in place for a shorter – a much shorter – period of time.”