Prices for key e-scrap metals have experienced a wild ride this year, and the shifts in value have piled onto global trade regulations and ongoing dematerialization to create a challenging economic picture for the industry.

Prices for copper futures on the COMEX index climbed from about $3.90 per pound at the beginning of the year to a peak of over $5 per pound in May. Then they began a downslide that bottomed out back around $3.90 in early August. Prices fluctuated throughout the month and are currently sitting at about $4.10 per pound.

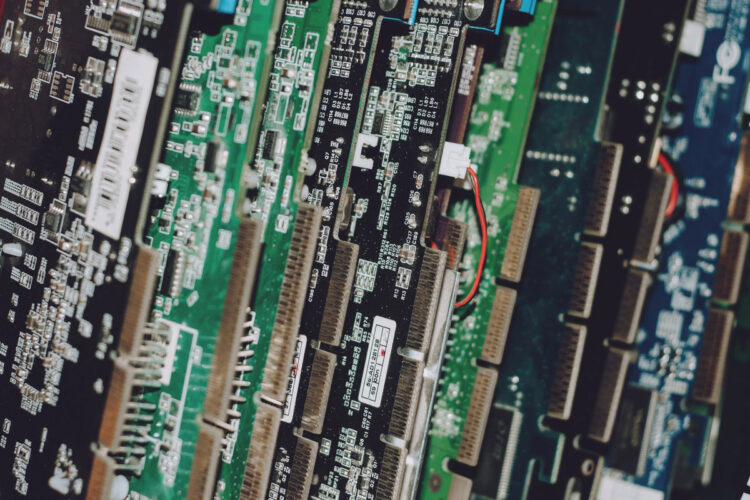

Copper varies in terms of its content within circuit boards but can average about 10%-20% of a low-grade board, so a $1 per pound change in prices can have a big impact. And the market fluctuations aren’t confined to copper: Aluminum futures prices on the London Metal Exchange climbed from about $1.06 per pound at the beginning of the year up to about $1.25 per pound in May, and are currently back down to about $1.08 per pound, down about 14% from the peak.

But moving away from base metals, it’s a different story: Gold continues to push up to record high prices, currently hovering close to $2,550 per troy ounce on the COMEX exchange. That’s up about 23% from the beginning of the year.

“There are a lot of events that are pushing markets simultaneously up and simultaneously down,” said Jeff Steinfeld, director of sales at Portland, Oregon-based Far West Metals. “It’s a very interesting time.”

Reuters reported the copper price downslide since May was tied to weak manufacturing activity and U.S. recession fears. The gold market, meanwhile, is being bolstered by investors anticipating a September rate cut by the Federal Reserve. Reuters noted that precious metals-bearing bullion “is considered a hedge against geopolitical and economic uncertainties and tends to thrive in a low-interest-rate environment.”

While copper has impacts across the e-scrap material stream, gold is a larger factor in the higher-end portions of the stream, Steinfeld noted, like servers and CPU motherboards. But even so, he hasn’t seen the higher gold price translate into significantly higher prices for those components, partially because of the drop in ferrous metal prices. For those components, the trends may be balancing each other out resulting in little shift in component price.

Indeed, despite fluctuations throughout August, price sheets shared with E-Scrap News from one East Coast U.S. material buyer for August and September show no change in offered prices for any grade of circuit board month over month.

Longtime e-scrap experts say the best bet for traders is to buy to the market – that is, try to anticipate future market trends and buy with those forces in mind. Otherwise, they may overpay with the idea they’ll make up the difference on the sell side, and that leaves too much uncertainty.

“If they’re trying to make money selling circuit boards, they’re in trouble,” said Joe Clayton, an industry veteran and business development executive at Arcoa. “They need to make money buying circuit boards.”

Pricing is just one factor affecting e-scrap processor returns. A looming change to international regulations covering e-scrap exports adds another layer of uncertainty. That is already playing out for traders exporting metals to Malaysia, which remains a major market for insulated copper wire. There, enforcement authorities are scrutinizing more containers due to recent high-profile export cases, and with the Basel Convention amendment covering e-scrap coming online in January, industry stakeholders anticipate those shipping slowdowns will continue.

Processors report a separate trend of lower amounts of metals per component, driving lower returns per unit. For instance, Steinfeld of Far West noted the amount of copper in computer cable has dropped 4 percentage points over the past five years, lowering from about 35% to about 31% by volume.

Those content shifts can happen when industry technology changes: VGA cords and HDMI cords have different levels of copper, for instance, and different generations of USB cords do as well. Steinfeld said those changes have to be taken into account when marketing e-scrap.

“In a metals market, a computer wire is a percentage of copper and a percentage of plastic, and that is it,” he said.

Those material changes are also visible on the design side. For example, in its recent annual sustainability report, OEM Logitech reported metal parts made up 5% of its overall product weight, down from 13% a year earlier. Meanwhile, plastic parts made up 39%, up from 36% a year earlier.