This article originally appeared in the Winter 2021 issue of E-Scrap News. Subscribe today for access to all print content.

Processors were not alone in feeling supply and demand impacts from COVID-19. Their downstream partners were in a similar boat, as three smelting and refining experts recently explained.

A session at E-Scrap Virtual, the 2020 online event held in October in lieu of an in-person E-Scrap Conference and Trade Show, featured executives at large buyers of the metals recovered from scrap electronics. The discussion included George Lucas of precious metals recovery firm Gannon & Scott, Joe Bernhardt of German copper refiner Aurubis AG and Julie Daugherty of multi-materials refiner Multimetco.

They laid out some of the market factors impacting metals pricing and demand and looked forward at what to expect in 2021 and beyond. Like many sectors, the e-scrap metals market saw a significant impact from the coronavirus pandemic in 2020, which made obtaining supply a challenging task. In some cases, refiners had to shift geographically and begin looking for material on other continents.

“It was difficult to source, especially with lockdowns of a lot of countries in Europe,” Bernhardt said. “Aurubis relied very heavily on the U.S. market.”

COVID-19 hits PCB supply

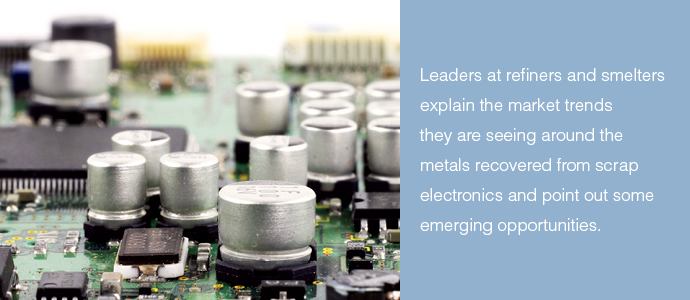

The hardest material stream for his company to source was printed circuit boards, Bernhardt said. Device dismantling operations had furloughed workers due to safety concerns, meaning far fewer devices were being processed for shipment to downstream companies like Aurubis.

“Printed circuit boards went from, in 2019 being readily available and every smelter just having their bunkers filled with material, to being very difficult to source,” Bernhardt said. Suppliers got behind on their contracts as they faced their own supply constraints: Schools and offices shuttered, putting a hitch in IT asset retirement.

Aurubis, which runs copper smelters in Germany and Bulgaria, has seen a more steady flow of PCs, laptops and other devices that are being used in home offices, Bernhardt said, but those are harder to viably ship from the U.S. to Europe for processing, so the company has relied on local European markets for that material.

Lucas of Cranston, R.I.-based Gannon & Scott said the workforce disruption was a huge hit to the flow of electronics.

“We had several customers call and say, ‘Listen, we have the material to send you but we don’t have the people to pack it out. We don’t have the drivers,’” Lucas noted. Gannon & Scott operates metals refining sites in Rhode Island and Arizona.

As employees were called back to work during reopening phases, those pressures have eased, but the weeks of business delays had a substantial impact, Lucas said.

As employees were called back to work during reopening phases, those pressures have eased, but the weeks of business delays had a substantial impact, Lucas said.

Daugherty of Anniston, Ala.-based Multimetco described a similar lull her company began to see in May. The company, which runs a platinum metals group smelter in Alabama, continued to see significant inbound supply from domestic customers in March and April. But the company has seen a recovery following that May dip.

Pricing and demand dynamics

COVID-driven company shutdowns are just one segment of a swirl of forces impacting metals markets.

The speakers noted, for instance, that investors are driving up gold prices. Electronics make up only about 10% of the end use for gold, with investment and jewelry making up the largest segments for the metal, Daugherty said.

Lucas noted that the increase in gold prices means demand for the material is higher as well. And with higher demand, recycling becomes a key supply stream for the metal, particularly if there is any disruption in traditional mining operations.

“If two mines shut down in South Africa for some reason, more companies are relying on recycling,” he said.

Recycling is growing as a supply option in other metals as well. Beyond e-scrap, Multimetco is heavily involved in refining precious metal scrap from auto catalysts. Last year was the first time that recycling of palladium in that industry surpassed mined ounces.

“It really was one of the first times that we saw that shift, where recycling was more key,” Daugherty said. Pricing pressure drove some mines to shut down operations, she explained, and recycling became “much more important” in supplying the metals. She added that the recycling space may continue to become more important because of regulations that take into account carbon footprint in sourcing materials.

She said palladium and rhodium prices have been high and continue to trend upward, and she forecast that could continue, particularly as auto production has ramped up again.

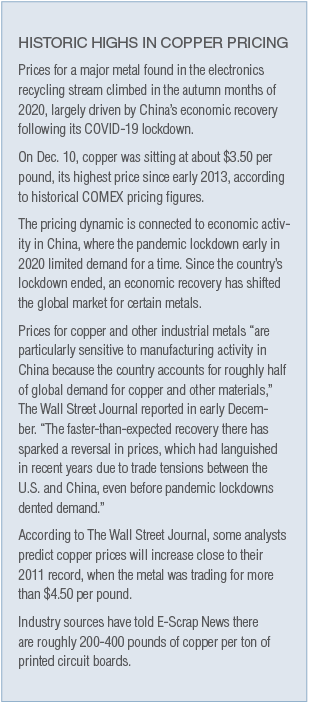

Copper took a significant hit when the automotive industry shut down for a few months, Bernhardt said. But he sees signs for strong demand and pricing for copper, specifically when looking at the growth of infrastructure projects in Asia and elsewhere, projects that require electric distribution. In fact, in early December 2020, global copper prices hit an eight-year high (see sidebar).

Investing to clean up commodities

Lucas said demand in the e-scrap metals market would benefit from guarantees that there are buyers for certain metals. He gave Tesla as an example, noting that the company is looking for nickel, lithium and other components that go into its electric vehicle batteries.

“They’re saying, ‘We don’t have enough supply because we don’t have the raw materials to make it happen,’” Lucas said. “Once you have some end users like that you can identify, it lets a company like ours go out and say we’re going to look at this new material stream, we’re going to start processing this. Right now we can’t do that.”

Additionally, the speakers highlighted improving processing quality as a significant development within the e-scrap space. Facilities are investing in infrastructure to create a cleaner commodity.

“Sorting, getting your material in the right classifications, is really key for your downstream vendor,” Daugherty said.

Bernhardt added that the higher metals pricing supports the continuance of that trend, because it makes it more feasible for companies to add sorting capabilities, including employees to hand separate materials.

That follows a familiar trend of metals markets driving upstream processing practices, he noted. At one time, when cell phones contained even more gold than they do now, it was still common for the devices to be thrown out rather than dismantled for their components, due to metals pricing, Bernhardt said.

“Now there’s enough value in the metals there that they can be hand manipulated, and items removed and re-enter the recycling stream, which is great to see,” Bernhardt said.

That highlights the importance of following metals markets, Lucas explained. It all goes back to gathering and analyzing data and making decisions based on the figures.

“You have to have the information and data to know that when a price changes up or down, it’s going to set the way you run production and what you’re going to sort and not sort, how you’re going to apply the labor,” he said.

Focus on metal sourcing

Meanwhile, wider sustainability trends are also expected to have an effect on demand for recycling as a whole.

The call for a “circular economy” has grown in the electronics industry, as in other consumer goods sectors.

More and more larger OEMs are starting to think of moving to some type of a closed loop system, Lucas noted, where they are working directly with recycling firms to bring materials from their own products back into their manufacturing process.

Lucas explained how this system benefits the manufacturer operationally and economically.

“If you think of it from their part, as the precious metals prices continue to go up, you could help a lot of the manufacturers eliminate market risk [of] having to go out and purchase that precious metal for production,” he said. “They’re generating it themselves, so if they recycle that and it comes back into their system, that’s less market risk and less precious metals they have to buy in the open market.”

Daugherty said a separate but similar trend can be seen in manufacturer efforts to increase their focus on responsible sourcing of metals. Recycling offers a lower carbon footprint and can offer safer procurement of metals for manufacturing, compared with virgin metal mining.

“That’s a trend as well as a regulation,” she said, predicting that more and more manufacturers will have to start funding recycling of their products.

Lucas pointed out other factors leading companies to value recycling over mining for material sourcing – namely, cost and material availability.

Mining operations saw a big drop in production this year, he noted, which created more demand than supply for some metals. When that sector starts to stall or not fulfill demand, more end users are going to start looking to recycling to fill their needs, Lucas said.

“Anything that can be mined, for the most part, can also be recycled,” Lucas noted.

Colin Staub is the senior reporter for E-Scrap News and can be contacted at [email protected].