Projecting an average OCC price of $48 per ton for this fiscal year, industrial packaging producer Greif Inc. continues to enjoy lower recycled fiber costs even as it experiences lower demand for many of its products.

The Delaware, Ohio-based manufacturer of paper, plastic and metal industrial packaging products recently reported its financial results for the third quarter of its 2023 fiscal year, or the May-July 2023 period.

As was the case with other major paper product producers, the company enjoyed lower recovered fiber feedstock costs year over year, but those OCC prices are rising steadily as the year progresses. Meanwhile, demand for finished products has been down due to consumers adjusting their spending habits.

“The continued low volume environment, combined with rising OCC costs during the quarter, led to both EBITDA dollars and EBITDA margin compression compared to prior year,” Greif CEO Ole Rosgaard said during an Aug. 31 call with investors.

Meanwhile, Greif purchased a majority interest in a company that converts containerboard and uncoated recycled board into partitions. The move brings in house another end market for Greif’s recycled-content products.

Slowly rising OCC prices, but no sign of ‘inflection point’

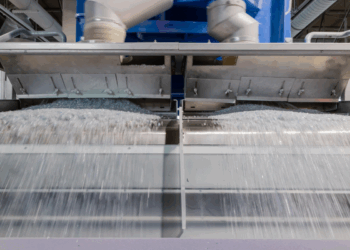

Greif’s Paper Packaging & Services business segment makes a number of corrugated fiber products for North American customers: containerboard, corrugated sheets, corrugated containers and other corrugated products. The company also manufactures coated and uncoated recycled paperboard, some of which it converts into tubes, cores, construction products and protective packaging.

The main feedstock for Greif’s products is OCC, which is why the company reports its expectations for its pricing.

According to a third-quarter financial presentation, Greif maintained its forecast that OCC prices between November 2022 and October 2023 will average $48 per ton.

During the investors call, Rosgaard said the opening of new recycled fiber mills has “created a little bit of demand on the waste companies” for OCC. Outside of that, however, Greif isn’t “hearing anything from our customers in the paper business that gives them any real solid indications of an inflection point,” he said.

Meanwhile, sales and profits in the Paper Packaging and Services (PPS) segment fell during the third quarter of fiscal year 2023. Net sales were $564 million, down 21% year over year. Greif’s adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) were $98 million, down 26%. The adjusted EBITDA margin was 17.4%, down from 18.6% during the prior-year period.

The presentation noted that lower year-over-year OCC prices were one factor helping to prop up profit margins during the quarter, along with improved labor utilization and cost cutting in the business segment.

Purchase of recycled-fiber partition manufacturer

On Aug. 23, Greif paid $75 million to buy a 51% ownership interest in ColePak, LLC, which makes bulk and specialty partitions out of containerboard and uncoated recycled board, according to a quarterly report. ColePak consumes about 25,000 tons of containerboard and uncoated recycled board per year, the quarterly financial presentation notes.

The second-largest supplier of paper partitions in North America, ColePak’s products are sold into the food, beverage and other markets, according to a press release. The paper dividers are commonly used in corrugated boxes to separate fragile contents, such as glass bottles.

ColePak has two facilities in Avon, Ohio and a plant in Fairfield, Calif., which serves the wine business. Greif has been a supplier to ColePak for over 35 years.

“As partners, ColePak adds a completely new product offering to the Greif paper converting portfolio, which provides integration to the Greif mill system in both containerboard and URB grades,” the release notes.

Greif will report ColePak’s financial results in the Paper Packaging & Services segment, starting with the results for the fourth quarter of the 2023 fiscal year (August-October 2023).

The purchase follows Greif’s acquisition of two other companies – Lee Container and Centurion Container – earlier in this fiscal year.