The Closed Loop Fund, a recycling-focused investment group founded by nine major corporations, has made its first significant funding announcement.

The group, which was started in April 2014, will loan a total of $7.8 million to fund a plastics recovery facility (PRF) in Baltimore and help two Midwest communities switch from dual- to single-stream recycling collection programs.

In addition, the fund said its financial outlay opened the door to an additional $17 million for those projects from public and private funders.

The total investment of nearly $25 million is a start toward the fund’s newly announced goal of “unlocking” $500 million in recycling investments in the next five years. The fund expects to loan $100 million of its own money as part of the $500 million goal. The rest would be supplied by public and private sources.

“A key part in the theory of change for the Closed Loop Fund is that our capital can unlock additional capital,” Rob Kaplan, the group’s managing director, told Resource Recycling today. “So it’s very clear that it’s going to take more than $100 million to resolve or improve recycling at a national scale, but if for every dollar we spend you’re able to get $5 of co-investment, then we’re really getting close to it.”

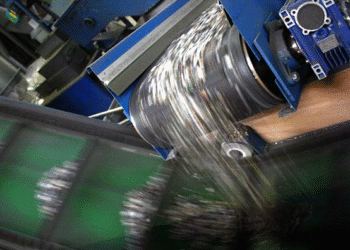

PRF in Baltimore

The fund will support a joint venture between QRS and Canusa Hershman in Baltimore, where a 128,000 square-foot PRF is beginning to ramp up operations. The facility expects to handle 55,000 tons annually of plastics Nos. 3-7.

According to Kaplan, the project, which will be loaned $2 million directly from the fund for construction and equipment costs, will have a sizable impact on domestic processing of commonly landfilled plastics.

“We believe it will help build a stronger market for hard-to-recycle plastics,” Kaplan said. “Right now across the East Coast, 3-7 mixed bales are pretty much either landfilled or exported. So the establishment of a robust market for these hard-to-recycle plastics, we think, will help incentivize municipalities and recycling programs to collect more and recycle more.”

Kaplan said the Closed Loop Fund’s low-interest loans to private enterprises are well-suited to projects like the one QRS is spearheading in Baltimore.

“Our funding is unique in that it’s below market, so it allows for riskier projects to happen,” Kaplan said. “The market for these mixed bales is definitely a risky proposition, so we can help bring the cost of capital for the overall project down to something more reasonable.”

He also said the brands that have supported the Closed Loop Fund, including Walmart, Colgate-Palmolive and Johnson & Johnson, will “absolutely” use information from QRS to improve the recyclability of packaging going forward.

Single-stream transitions in Midwest

The second part of the initial partner announcement from the Closed Loop Fund focuses on helping the transition from dual- to single-stream recycling collection in Portage County, Ohio and the Quad Cities metropolitan area on the Iowa-Illinois line.

Despite the tight commodity markets and contamination concerns, the group expects the two areas will benefit from the transition.

“We’ve not had to convince any cities about the importance of expanding recycling,” Kaplan said. “We’ve had over 60 quality proposals come in since last October requesting over $170 million.”

The fund will contribute $5.8 million between Portage County and Quad Cities in zero interest loans to pay for the changeover to carts. Outreach and education will be handled by the communities, with the likely help of outside groups and resources, Kaplan said.

The four-county Quad Cities area has a population of roughly 376,000. Portage County has a population just under 164,000.

While the intent is to ensure loans are paid back by those communities, if a recipient “is unable to make a program work, then our investment doesn’t get paid back,” Kaplan said.

“It’s why we’re taking bets on recycling,” Kaplan explained. “We believe that this type of infrastructure proves to be financially sustainable recycling intervention.”

What’s next

The Closed Loop Fund expects to move quickly on its next series of funding moves.

According to Kaplan, the next investments will likely mirror the group’s projects in Baltimore, Portage County and Quad Cities.

“We have a pretty robust pipeline of proposals and we’re expecting to announce five or so deals in the next year,” Kaplan said.