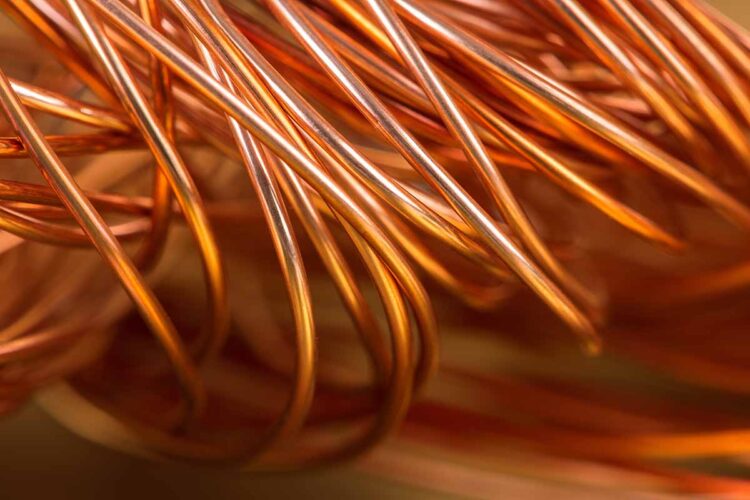

When copper was added to the US Geological Survey’s proposed list of critical minerals in August, the move signaled a strategic policy shift extending beyond mining and toward formally confirming its geopolitical significance.

The draft list closed for public comment on Sept. 25 and the Department of the Interior is reviewing feedback before finalizing the list, expected by early November. Given copper’s central role in electrification, energy infrastructure and manufacturing supply chains, experts say its inclusion is almost certain to be finalized.

For the electronics recycling sector, the designation represents an important policy change that links e‑scrap recovery more directly to national resource security, industrial resiliency and clean‑energy growth. The draft list recognizes what recyclers have long argued: that copper – embedded in nearly every circuit board, cable and motor – is a critical asset.

Copper’s inclusion follows years of lobbying by the Copper Development Association and mounting evidence that global supply cannot keep pace with demand from data centers, electrification and AI infrastructure. In a 2024 report, the association noted that S&P Global projections show the US could face import reliance exceeding 60% by 2035 unless secondary supply from scrap is significantly expanded.

A June 2025 analysis from McKinsey projects a 3.6 million metric ton global copper shortfall by 2035 and identifies e‑scrap as among the most important untapped sources of refined copper. For electronics recyclers, this means circuit boards and wiring looms are shifting from waste streams into high‑value ore bodies.

Policy tailwinds and funding access

Being on the federal critical‑minerals list is an important step that unlocks streamlined permitting, eligibility for Department of Energy R&D grants and potential preferential access to federal procurement and tax‑credit programs – paralleling incentives already applied to lithium and rare‑earth recovery. Interior Secretary Doug Burgum told Reuters in August that the list aims to reduce import dependence and catalyze domestic production through both primary and secondary sources.

That policy backing can translate into new financing opportunities for US e‑scrap operators. Federal clean‑energy programs and circular economy R&D funds are aligning with critical‑minerals objectives, placing copper squarely within high‑priority investment categories. Recyclers upgrading separation or refining technology could gain access to DOE or EPA grants tied to resource‑efficiency goals.

Strategic partnerships on the horizon

The new designation also changes how other sectors view recyclers. Manufacturers in electronics, cable and renewable‑infrastructure supply chains are expected to seek stable, domestic copper streams insulated from international volatility.

As McKinsey notes, recovery operators who move early to secure long‑term arrangements with smelters or OEMs could lock in premium contracts as copper markets tighten.

This trend is already visible abroad, with Asia and Europe fostering direct partnerships between recyclers and copper‑foil, battery and energy‑equipment manufacturers. Similar collaborations are beginning to take shape in North America as policymakers and investors align circular supply priorities with national security goals.

Pressure to modernize

But opportunity also means scrutiny. New funding and heightened visibility will push recyclers to improve copper‑yield efficiency, traceability and purity documentation. Copper’s critical‑mineral status would broaden certification and reporting requirements akin to those governing lithium and cobalt recovery.

Firms with transparent material flows, environmental accreditation and quality‑verified output will be best positioned as government and OEM procurement programs embed circular‑materials criteria. Technology leaders such as those advancing DOE‑backed sensor‑sorting and hydrometallurgical‑recovery initiatives (including Intel E‑Waste’s REACT program) could set the new benchmarks.

Market outlook

Copper’s critical‑minerals designation is expected to arrive as the commodity is testing record‑high prices. On the London Metal Exchange, copper is trading near $10,700/ton, up roughly 15% from a year ago, driven by constrained mine output and persistent electrification demand. Analysts now regard the metal as being in a structural bull market rather than a short‑term rally.

Forecasts point to further gains over the next year. Fitch BMI expects copper to average $9,650/ton in 2025, while Bank of America projects a climb above $11,000 by 2026, potentially hitting $13,500-$15,000 under tighter supply conditions . Goldman Sachs likewise sees prices stabilizing within $10,000-$11,000 through 2027, citing low inventories and slow mine development.

In the longer term, Wood Mackenzie projects global copper demand to rise 24% by 2035, reaching 42.7 million tons annually – an increase of 8.2 million tons/year. Meeting that need will require nearly 8 million tons of new mine capacity and 3.5 million tons of recycled copper, underscoring the pivotal role of electronics recycling in balancing supply chains.

For e‑scrap operators, this market context underscores a sustained, policy‑backed bull cycle rather than a passing price surge – one that redefines recycled copper as both a strategic and financial asset.