This article appeared in the July 2020 issue of Resource Recycling. Subscribe today for access to all print content.

Food waste reduction and diversion is crucial to creating more sustainable communities in the future.

But for many communities, it is not immediately clear how best to implement food waste collection and processing programs. Putting the pieces in place can seem like a daunting task, requiring new infrastructure as well as education to spark behavioral changes.

Fortunately, local program leaders can look to other communities to better understand key considerations and strategies to move toward better food scrap management. And in some instances, impactful action can happen by focusing on companies, schools and other non-residential generators.

In 2018 and 2019, RRS was engaged by the Natural Resources Defense Council (NRDC) to perform a commercial and institutional sector food scrap recycling landscape assessment for the cities of Denver and Baltimore. This work was part of NRDC’s Food Matters initiative that aims to partner with cities and reach a 15 percent sector-wide reduction in food waste within five years. Completed assessments, free tools, and resources for communities are available at nrdc.org.

In working through the landscape assessments, the RRS team, NRDC representatives and local city officials identified key areas of focus for developing successful food diversion programs for commercial and institutional entities. Further, RRS teamed with NRDC to outline financing and funding options for small-, medium- and large-scale organics processing operations.

The work provided information that is critical for any community looking to lay the groundwork for organics diversion.

Tailored to the community

No two communities’ goals and needs are the same, which is why it is critical to connect at the local level.

In Baltimore, the work was conducted in partnership with the Institute for Local Self-Reliance (ILSR), the Baltimore City Department of Public Works and the Baltimore Office of Sustainability. In Denver, key players included the city of Denver, the Denver Department of Transportation & Infrastructure (formerly the Denver Department of Public Works), and the Denver Department of Public Health and Environment.

Once partners are identified and engaged, the next step is learning how much food waste is generated and where it’s generated. There are two general source categories: residential and industrial/commercial/institutional (ICI). The best way to estimate generation is collecting direct data through waste sorts, looking at the amount of food in the residential and commercial/institutional streams. (Industrial food waste is unique in that it may be generated in extremely large quantities and not mixed in with any other waste; often, the best means for understanding industrial waste generation is through a survey of industrial generators.)

Many communities, however, do not have information on direct waste generation (quantity and source of material) or waste composition (type of material).

In the case of both Denver and Baltimore, direct data on commercial and institutional food waste generation was not available. Instead, generation was estimated based on available data for each sector – for example, employment, number of hospital beds, or number of students enrolled at a school.

From this work, the NRDC estimated Denver’s commercial and institutional sector generates 109,000 tons of food scraps annually and Baltimore’s number is 72,000 tons each year. Generation was then mapped by ZIP code to show food waste hotspots that could be ideal for diversion efforts.

Processing capacity

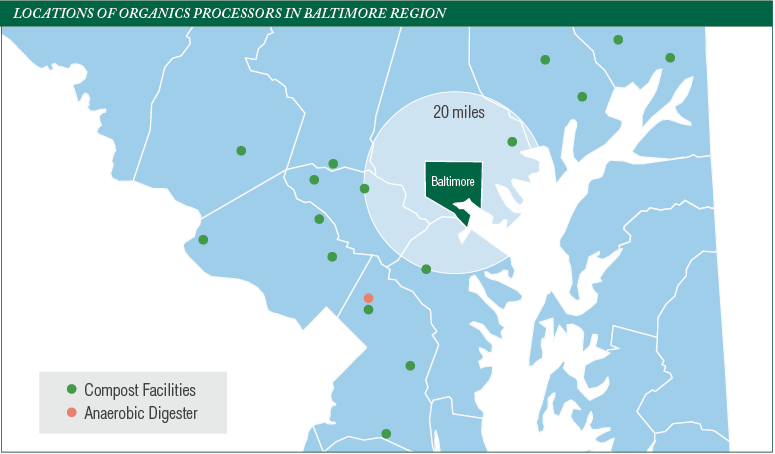

The next step is mapping the regional processing capacity for organics. There are three key pieces of information that tell the story of an area’s organic processing landscape: processing facility locations, facility capabilities, and facility capacities.

In addition, there are a number of other considerations, including facility expansion capabilities, permitting or other regulatory requirements, drive times from major generation points to processors, and whether processing facilities have neighbors that may have concern about increased truck traffic or upticks in material.

By building a map of the current processing landscape, a municipality can understand where organics processing infrastructure is strong and how it may need to expand to meet the needs of a growing food waste diversion program.

In Denver, the assessment showed that in 2019, there was capacity to process an additional 31,000 to 51,500 tons of food scraps in the region. And the potential processing capacity would grow to 465,000 to 827,000 tons if a large-scale AD facility came back on-line (the existing AD facility faced permitting technicalities and some local concerns and was forced to close in 2017, but there is optimism in the region that the facility will be able to reopen in the future). These numbers indicate that Denver could expand the diversion of food.

But while processing capacity may not be a limiting factor for Denver, NRDC and the city did identify other potential risks, including a lack of processing options. Nearly all of the regional capacity is limited to one facility. As a result, the processing system was deemed to lack resiliency because it would be severely threatened if the one facility were to shut down.

In looking to Baltimore, additional food waste processing capacity was estimated at around 29,000 tons in 2019, though 45,000 tons of capacity beyond could be available via two facilities that are newly permitted but still under construction. A big issue in Baltimore, which struggles with congestion, is that processing operations are far from the city (see map below). To ramp up food scrap diversion efforts, additional processing capacity nearer to the city is most likely needed.

In Baltimore particularly but also in Denver, the distance from collection points to processing facilities is a challenge, adding cost and time for haulers. Food waste is more expensive to transport than typical municipal solid waste or recycling because of its density and high-water content. A solution to the transportation issues faced in both cities could be more small- and medium-scale facilities located closer to generation points.

When it comes to actually developing new processing sites, the issue of funding of course becomes a major consideration. Will a new facility be publicly owned, privately owned, or organized in a public-private partnership? There are numerous examples of all these frameworks in place across the country.

Next, what capital funding sources does the community have access to? Possibilities include bonds, grants, loans, private sector capital, and enterprise funds. Finally, how will the facility operations be funded? Usually, facilities rely on a mix of tip fees, service fees, the sale of compost and incentivized waste pricing.

End markets

One of the major benefits of food diversion from landfill is the potential to create a high-value commodity from the collected scraps. When done well, adding food waste to a yard waste composting operation often improves the nutrient content of the finished product.

There are a variety of end uses for finished compost, including residential gardens, fertilizer for farming, commercial landscaping and roadside application. Before ramping up organics processing or composting operations, a community should work with local end markets to understand the quantity and type of compost (nutrient balance) in demand.

When interviewed as part of the Baltimore landscape assessment, composters in Maryland and Virginia indicated high demand for the finished compost product to the point that composters were selling out every spring. However, some stakeholders voiced concern that if composting operations across the region were to dramatically expand, the market could become flooded with finished compost.

To get ahead of this potential issue, RRS recommended a regional effort between Maryland Department of Agriculture, Maryland Department of the Environment, and Maryland Department of Transportation to bolster market demand for finished compost.

Additionally, a key point to pay attention to is state or local regulations guiding the use of compost. Some states require regular testing of finished compost for heavy metals, nitrogen and phosphorus before land application is permitted.

Getting all these details squared away points to the importance of stakeholder cooperation. This includes discussion with large-scale generators, haulers, organics processors, regulators and local leaders in sustainability and environmental justice. Conversations will help project leaders understand different perspectives, identify opportunities and foresee challenges. Ultimately, these types of discussions can help communities avoid pitfalls and foster a sense of working toward a common goal.

Stakeholder interviews in Denver shed light on the issue processors were facing with contamination in post-consumer organics. For example, while BPI-certified compostable plastics can usually break down in a commercial compost system, identifying what is and is not a certified compostable item and then removing non-compostable plastics from the stream can be challenging for processors.

Look before you leap

Food waste diversion is important, and to do it successfully at the commercial and institutional level, there is groundwork that needs to be laid before any diversion program is launched. Without that, a haphazard effort could lead to issues such as inefficient collections, higher costs, missed funding opportunities and infrastructure failures causing odor and rodent problems. Once problems develop, community trust in food waste diversion faulters, leading to costly setbacks and possible program disaster.

When food waste diversion programs are well-thought-out and implemented appropriately, however, there are huge benefits for communities. The payoff can come via saved landfill space, reduced disposal costs, reduced greenhouse gas emissions, creation of local jobs, and production of a valuable commodity that can be used locally.

Kate Maguire is a consultant at RRS and can be contacted at [email protected].