This article appeared in the August 2025 issue of Resource Recycling. Subscribe today for access to all print content.

EPR is no longer just a legislative concept—it’s becoming an operational reality that’s reshaping the materials economy.

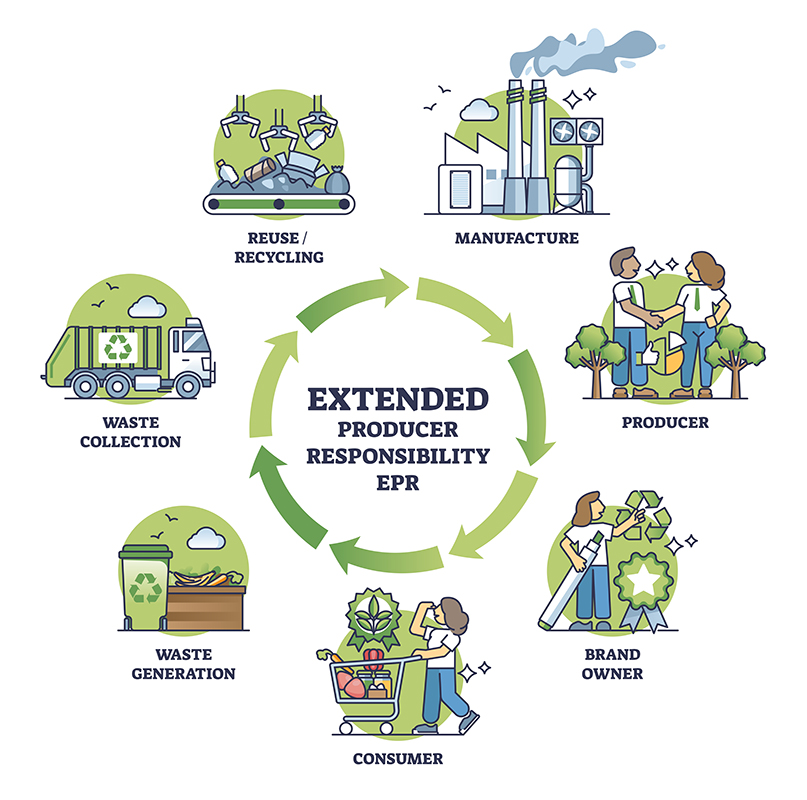

Extended Producer Responsibility (EPR) is designed to assign responsibility to producers—both operationally and financially—for the entire lifecycle of the products they put into the marketplace, especially for their end-of-life management, including collection, recycling or safe disposal.

Up until recently, EPR policy in the U.S. has been focused on batteries, paint and electronics, but now there is a concerted effort to apply EPR laws to plastic, packaging and printed paper, with new legislation seeking to modernize recycling systems and decrease waste. At the national level, coordinated efforts are underway to align definitions, streamline compliance and push for a more unified federal framework.

Earlier recycling efforts relied heavily on public education, asking consumers to recycle more and recycle better. Today’s EPR laws flip that approach by shifting responsibility upstream to producers. These policies impose measurable, enforceable obligations, including content mandates and packaging fee structures that reward recyclability and penalize waste.

“Depending on the state law, companies may face fines, higher fees, or market restrictions if they fail to comply,” said Laura Stewart, executive director of the National Association for PET Container Resources (NAPCOR). “Producer Responsibility Organizations (PROs) are tasked with auditing data, verifying claims and directing investments in recycling infrastructure.”

That shift has brought greater visibility to compliance functions and forced companies to align cross-functional teams around policy tracking, reporting and strategy. In fact, EPR is no longer just a legislative concept—it’s becoming an operational reality that’s reshaping how producers, governments and consumers interact with the materials economy.

“The biggest shift with EPR is from persuasion to accountability,” said Kelsey Herring, director of sustainability at Lancaster, Pa.-based Armstrong World Industries, which has offered a ceiling tile recycling program for more than 25 years. “In the past, EPR efforts emphasized public awareness and consumer education, but today’s policies are more formalized, with enforcement mechanisms, penalties and reporting thresholds. It’s no longer just about encouraging recycling, it’s about proving we’re doing it.”

New legislation

As of July 1, 2025, Oregon became the first state to launch a fully operational EPR program for packaging, paper products and foodservice ware—requiring producers to be financially responsible for recycling and the environmental impact of their products. Backed by approximately $200 million in funding and led by the Circular Action Alliance, the statewide program is reshaping how waste is managed, aiming to boost recycling rates, reduce contamination and ensure equitable access to recycling services across communities.

New legislation will soon roll out in six other states—California, Colorado, Maryland, Maine, Minnesota and Washington—and more is expected in the years ahead.

Anthony Tusino, director of government and public policy for The Recycling Partnership in Silver Spring, Md., is focused on the advocacy side of EPR, among his responsibilities. He believes companies are starting to understand the obligations of EPR at the state level and see the need for a national level of consistency.

“EPR is a cost-sharing program at its heart for corporate partners to step up and take responsibility for the recycling system, and as we see each of these seven states come along this journey, we see an increased need for consistency for definitions and terminology, but also in objectives and scope of program plans,” Tusino said.

Kate Bailey, chief policy officer of the Association of Plastic Recyclers (APR), offers kudos to companies who are doing a tremendous amount of work right now to comply with the new and upcoming EPR policies.

“This is moving very quickly across many states and there are a lot of complications, as it’s always hard doing something for the first time,” she noted. “There is a tremendous amount of work happening and overall, a great response to these regulations is being put in place.”

Still, there are bumps in the road and the focus for many companies now is on the data side of things and understanding what packaging they are putting on the market in different states and what their fees are going to be.

“I am seeing companies that are prepared and those that are scrambling,” Bailey said. “We are getting more requests for information and there is some confusion on regulations, and that’s trickling down to the other supply chain partners.”

To help clarify things, CAA is doing extensive work in outreach and consumer engagement and state agencies are working to be transparent about what needs to be done.

“There are a lot of nuances, particularly in plastic packaging, and no one is trying to be difficult,” Bailey adds. “It’s just that there are a lot of parts and pieces we need to work through and consider the different scenarios. A lot of learning is going on right now.”

Navigating the Patchwork

Gaspard Duthilleul, COO of Greyparrot, an AI waste analytics company, noted EPR is moving in the right direction in the U.S., but the patchwork of state-level policies makes it anything but simple for brands to navigate.

“One packaging design might tick all the boxes in Colorado but fall short in Oregon simply because the covered materials or deposit systems differ,” he said. “For any producer or brand operating across state lines, especially global brands, this means that design decisions must be made with a more worldwide perspective. You can’t afford to optimize for just one market when the regulatory landscape keeps shifting beneath your feet.”

State EPR regulations, Duthilleul added, are also shaking up both regional and global relationships between brands, packaging producers, waste operators, and local governments in ways not seen before.

“For some operators, it presents an opportunity to innovate and increase transparency within the system,” he said. “For others, it’s still an uncomfortable disruption. Overall, however, it’s forcing everyone to sit at the same table, which is long overdue.”

NAPCOR’s Stewart feels what separates great EPR legislation from less productive legislation are programs that tie incentives directly to environmental outcomes. “Oregon’s approach, for example, lowers fees for producers who design packaging that’s easier to recycle and less wasteful,” she said. “That structure gives companies a reason to lean into materials like PET, which support performance, circularity and cost-efficiency.”

Producer responsibilities

As these EPR bills take shape, more suppliers will need to adapt their products and services to meet this nationwide regulatory change, presenting opportunities for companies and businesses built with circularity in their business models to capitalize on these opportunities. The challenge is, changing a single element of packaging isn’t trivial, as it can mean producers retooling entire assembly lines, retesting shelf life or securing new certifications.

“These choices aren’t cheap or quick, yet they’re critical if we want EPR fees to genuinely drive better outcomes,” Duthilleul said. “There’s a risk that poorly aligned state incentives could prompt brands to pursue cost savings in ways that don’t actually yield the greatest sustainability gains nationally or globally. Getting it right demands clarity, consistency and robust data.”

Kevin Kelly, CEO of Emerald Packaging, a leading produce plastic packaging company based in Union City, California, noted companies are spending tons more time figuring out what needs to be done for compliance with various state programs that education is barely getting attention.

“For a company our size, which lacks internal resources, we need to hire consultants and do a major analysis just to figure out if or how we are a producer under various state programs,” he said. “Then we have to find a software program to help us track what’s required by each state. In some cases, it’s too early and too confusing to do anything but argue.”

The proposed SB54 plastics packaging regulations in California, for instance, use the words “manufacturer” and “producer” interchangeably, but then say the “producer” is the brand owner, essentially. But “manufacturer” makes it sound like the packaging company bears the responsibility.

“So, a lot of time is going into understanding those proposed regulations, and offering comments to clarify issues,” Kelly said.

NAPCOR represents members with operations in most of the states that have passed EPR legislation and Stewart has seen a clear trend in the growing investment in post-consumer recycled (PCR) content, driven by EPR policies and brands’ sustainability targets.

“States like California are setting the floor through legislation; their minimum content law requires most beverage containers to include 50% PCR by 2030, while its EPR program uses eco-modulated fees to reward recyclable, low-impact packaging,” she said. “Since it’s difficult to segment products by state, companies are incorporating more recycled content into their products at a national level to ensure they adhere to state standards.”

With so much changing legislatively, Herring at Armstrong World Industries noted the responsibilities for companies have definitely moved upstream.

“Where sustainability teams once focused on building consumer-facing narratives, now our procurement, quality and product teams are being pulled into conversations about end-of-life, take-back logistics and reporting obligations,” she said. “These regulations require an enterprise-level response, not just communications. At Armstrong, we’re working across business units to embed circularity and compliance into every stage of our product lifecycle.”

The challenge for companies therefore is balancing the need for regulatory compliance with the desire to maintain sustainability and brand reputation. “We’re trying to juggle both,” Emerald Packaging’s Kelly said. “For instance, we educate customers about their responsibilities under the new laws. But that’s education on compliance, not sustainable packaging.”

Tusino noted companies are eager to get their materials back, though as the programs are implemented, there’s a gap between when the program plan comes into alignment and when the materials return in the supply chain. “There’s anticipation for that gap to close,” he said. “Producers know it’s going to take a lot of work to get from the letters on the page of the statute to the returns we are expecting in the recycling system.”

Other hurdles are complexity and misalignment. Every state is different, which makes it hard to standardize processes. And many new regulations are rolling out faster than companies can adapt their budgets and systems, leading to unexpected funding requirements and straining cross-functional teams.

Future of education

Awareness both at the company and consumer levels are important components of EPR strategies being successful. Thankfully, education hasn’t gone away, Herring explained, it’s just shifted focus.

“We’re doing more to educate internal teams, installers and contractors about how take-back programs work and what can and can’t be recycled,” she said. “It’s also about setting realistic expectations with customers. For example, our mineral fiber ceiling tile recycling program is successful, but it does face limitations due to contamination and collection capacity. Clear, honest communication is essential. EPR isn’t a one-size-fits-all solution.”

Enforcement will remain a cornerstone of what gives EPR programs teeth, but over time, education will be critical for scale and effectiveness.

“The more stakeholders understand how and why these systems work, the more impact we’ll see,” Herring adds. “We’re already investing in education, not just for customers, but for internal teams, architects and partners. Long-term success will come from marrying strong policy frameworks with widespread awareness and collaboration.”

Stewart noted circularity depends on collection, and collection starts with people.

“The truth is, the best-designed package won’t be recycled if it ends up in the garbage bin,” she said. “That’s why education must stay central to EPR. Policy can drive investment into the recycling system, but public participation is what makes it work. We’re seeing progress on this front. In 2023, the U.S. PET bottle recycling rate hit a 30-year high, with more recycled content going back into bottles than ever before. That’s a signal that voluntary brand commitments, legislation including recent mandatory recycled content laws and educational efforts are having an impact.”

Looking ahead

As EPR evolves, industry insiders believe enforcement will dominate strategy going forward. Companies will therefore have to make sure they understand the current regulations, the additions as they evolve, and the yet unborn new laws as states jump on the EPR bandwagon.

“Worry won’t just be possible fines from a state, but lawsuits by activist lawyers alleging companies aren’t complying,” Kelly said. “Undoubtedly these regulations will become much more complex over time, and more difficult to completely comply with, just like the wage and hour law in California, which runs over 700 pages. Brevity and clarity rarely prevail as regulations of this sort get revised and added to over time.”

The future of EPR isn’t about choosing between education and enforcement—it’s about getting both right. “Smart companies see this,” Stewart said. “They know enforcement sets the floor, but education raises the ceiling.”

Keith Loria is a D.C.-based award-winning journalist who has been writing for major publications for close to 20 years on topics as diverse as healthcare, travel and sustainability. He started his career with the Associated Press and has held high editorial positions at publications aimed at entertainment, sports and healthcare.