Exports of U.S. recovered paper dwindled to their lowest first-quarter volume since 2002, driven by substantial declines to major buyers in Thailand and India. Plastic shipments remained steady year over year.

The U.S. Census Bureau, part of the U.S. Department of Commerce, published March export data on May 2, allowing for a first-quarter export analysis.

Paper exports reach 22-year first-quarter low

U.S. companies exported 3.28 million short tons of recovered fiber during the first quarter of 2024, down 17% from 3.95 million short tons during the same period a year earlier.

That’s the lowest volume of recovered fiber exported during the first quarter since 2002, and it’s down from the 2012 first-quarter high of 5.80 million short tons exported.

Thailand is the largest importer of U.S. recovered fiber so far this year, bringing in 603,000 short tons during the quarter, down 27% year over year. Thailand became a major destination in 2023, when exports to the country spiked a dramatic 120%.

Other major destinations also saw significant drops: India imported 567,000 short tons during the first quarter this year, down 25% year over year, and exports to Mexico were down 14%.

In a converse trend, fiber exports to Malaysia jumped up by 181,000 short tons, or 62%, but it wasn’t enough to offset the substantial drop in shipments to other countries.

Of the first-quarter exports, OCC made up 68%, mixed paper contributed 15%, high-grade deinking paper – such as sorted office paper – made up 12%, and newsprint was just 2%.

Scrap plastic exports flat year over year

Scrap plastic exports flat year over year

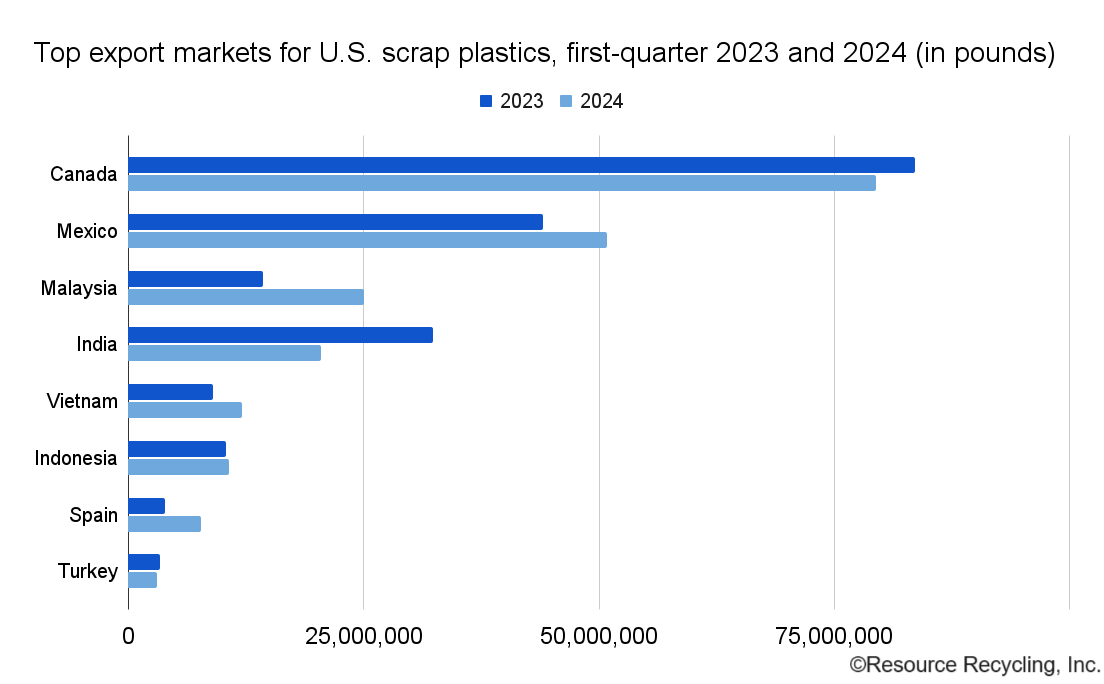

U.S. exporters shipped 234.6 million pounds of scrap plastic to other countries during the first three months of the year, almost the exact same amount that was exported during the same period in 2023.

More than half that material stayed in North America, with 79.4 million pounds, or 34%, going to Canada, and 50.9 million pounds, or 22%, going to Mexico.

The next largest portion of material went to southeast Asia and India. Malaysia imported 25.0 million pounds of scrap plastic, India received 20.5 million pounds, Vietnam brought in 12.1 million pounds and Indonesia imported 10.7 million pounds.

Some of the exports to Southeast Asia could violate the Basel Convention, which in 2021 began regulating the shipment of mixed plastics into Basel-party countries. The U.S. is not a party to the convention, which means 191 party countries – the vast majority of nations – are prohibited from receiving regulated material, such as mixed plastic, from the U.S. There are a couple exceptions in the form of bilateral agreements between the U.S. and Canada and the U.S. and Mexico, allowing for mixed plastic trade between those countries. Those arrangements suggest why Canada and Mexico are by far the largest trading partners for scrap plastic these days.

Some of the exports to Southeast Asia could violate the Basel Convention, which in 2021 began regulating the shipment of mixed plastics into Basel-party countries. The U.S. is not a party to the convention, which means 191 party countries – the vast majority of nations – are prohibited from receiving regulated material, such as mixed plastic, from the U.S. There are a couple exceptions in the form of bilateral agreements between the U.S. and Canada and the U.S. and Mexico, allowing for mixed plastic trade between those countries. Those arrangements suggest why Canada and Mexico are by far the largest trading partners for scrap plastic these days.

But the exports to Malaysia, for example, raise questions.

The U.S. and Malaysia do not have a bilateral agreement that allows for U.S. exports of Basel-covered material into Malaysia. So, under Basel language, the only U.S.-to-Malaysia scrap plastic shipments that would be allowed are loads consisting of “almost exclusively” one polymer, meaning sorted loads with virtually no contamination.

Of the 25.0 million pounds of scrap plastic the U.S. shipped to Malaysia in the first quarter of 2024, 49% was classified as polyethylene, 28% was classified as PET, and 2% was classified as PVC.

The remaining 21% were classified as “other” plastics, a catch-all category that is typically how mixed plastics are classified. But it also could theoretically include clean loads of polypropylene or ABS, which would be allowed under Basel, so it’s unclear how much of that 21% is in compliance with or in violation of Basel rules.

The U.S. EPA has a detailed breakdown of how the Basel rules for scrap plastic apply to U.S. exporters, and the U.S. Department of State maintains a list of the U.S. bilateral agreements that supersede Basel.