Aurubis, the Germany-based nonferrous metals giant, is deepening its push into recycling and copper production with a series of major moves on both sides of the Atlantic. The company’s growth strategy illustrates a broader trend of stakeholders locking in access to recycled feedstock, as regulatory and customer requirements intensify.

The company laid out its revised strategy Oct. 8, 2025, saying, “After a phase of strong investment-driven growth, Aurubis is shifting its focus to delivering impact from its investments and smart, targeted growth that creates value and aligns with its core strengths.”

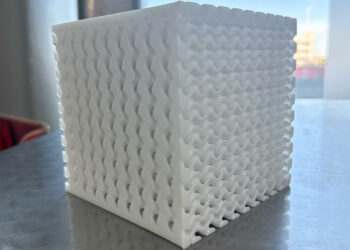

Efforts toward this include expanding commercial reach and service level to access new material streams and strengthen existing ones. One example is the company’s new multimetal recycling plant in Richmond, Georgia, its first in the US.

Aurubis CEO Toralf Haag said, “The commissioning of our facility in Richmond marks a milestone in Aurubis’ growth journey. We are first movers and have built the first greenfield smelter in the US in over a century. Our timely entry into the US market and our unique set of capabilities coupled with a supportive funding environment are a strong foundation for further growth in one of the most attractive metal markets in the world.”

In addition to the new plant, Aurubis secured millions in financing from the European Investment Bank (EIB) to expand recycling and copper production in Europe.

At the same time, other cable manufacturers, including longstanding Aurubis customers such as Nexans, are also ramping up investments in European copper recycling capacity. These moves confirm that demand for copper and critical secondary materials is rising fast and smelters are repositioning themselves to capture value from the growing tide of electronic waste.

First US foothold

In late September, Aurubis reached a commissioning milestone at its new US facility. The $740 million plant is designed to process up to 90,000 tons/year of multimetal scrap in its initial phase, recovering copper, nickel, tin, precious metals and other high-demand inputs.

“We will continue expanding our wide expertise in producing key strategic raw materials here,” Haag said at the plant’s ribbon-cutting. “With the high availability of recycling material and good local conditions, the American market offers Aurubis appealing prospects that we will continue to consider closely in the future as well.”

The plant also reflects US government efforts to strengthen domestic capacity for critical materials. While copper is not yet formally listed, it is recommended for inclusion on a draft list of critical minerals from the US Department of the Interior and its final approval is pending. Policymakers are increasingly viewing copper as strategic for electrification and by entering the market now, Aurubis is positioning itself as a key player in the US push to recover metals from urban mining and e-waste.

Fuel for growth

At the same time, Aurubis signed a five-year, €200 million ($232 million) loan from the EIB to expand recycling and copper production capacity in Europe. The EIB labeled the project an important contribution to Europe’s circular economy ambitions and energy transition goals, noting copper’s central role in electrification and renewable power grids.

“With the EIB, we’re gaining a strong European partner to support our strategic investments in a sustainable future,” said Steffen Hoffmann, CFO at Aurubis. “This financing commitment acknowledges the social relevance and outstanding quality of our investment projects. The loan’s attractive terms compared to market conditions enable us to further diversify our financing base.”

EIB Vice President Nicola Beer added, “Securing critical raw materials like copper and expanding recycling activities in Europe are essential to Europe’s resilience, sustainable development and industrial competitiveness. Copper is the hidden backbone of our modern lives; it keeps the lights on in our homes and powers the smartphone in our pockets, while also driving innovation in electric cars and renewable energy.”

Aurubis strategy offers growth, as well as risks

These recent announcements indicate a clear growth path for Aurubis. The US plant provides geographic diversification and a hedge against Europe-only exposure. The EIB loan lowers capital costs for modernization and helps align the firm with EU climate and circularity policies. And the Nexans partnership opens up stable demand channels at a time when copper prices remain volatile.

Yet the strategy comes with risks. Building and operating smelters is capital-intensive and returns depend heavily on both global copper markets and the reliability of feedstock streams. The Georgia facility, while strategically located, will have to compete with established US recyclers and navigate complex permitting and environmental oversight. In Europe, rising energy costs could erode margins, while political pressure to accelerate decarbonization may push Aurubis into further costly upgrades.

Still, there are plenty of tailwinds for Aurubis to put all these resources into its business, including the fact that low-carbon transition and the digital economy both hinge on metals like copper, nickel and tin. Governments are encouraging domestic processing, investors are financing it and downstream manufacturers are demanding recycled content. Aurubis’ latest moves illustrate this shift, showing how the world’s biggest smelters are looking more closely than ever at e-scrap as a critical feedstock.