EverMetal Holdings has entered the US recycling market with the acquisition of CAI Custom Alloys, marking the debut of a private equity-backed platform focused on critical metals used in aerospace, defense, power generation and technology.

The deal was announced Wednesday and positions EverMetal among the first companies consolidating the fragmented superalloy recycling sector, according to a press release.

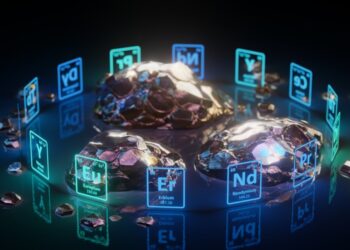

Backed by GEF Capital Partners, EverMetal says it will build an integrated supply chain for strategic metals including nickel, cobalt, tungsten, tantalum, rhenium, hafnium, titanium and niobium. GEF, a Washington, DC-based climate solutions firm, closed its US Climate Solutions Fund II at $325 million in April 2024.

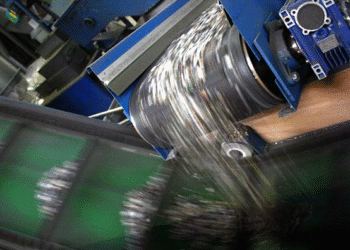

CAI, founded in 2009 and headquartered in Belvidere, Illinois, processes high-performance superalloys and supplies prepared materials for vacuum and air melt applications across aerospace, medical, defense and energy markets. The company moved into its current facility in 2013 and handles a broad slate of alloy families and pure metals.

Company statements and third-party reporting note that CAI is among a small group of domestic processors holding vacuum-melt certifications from major aerospace customers. This designation is often required for inclusion in jet engines, turbine blades and other high-specification components.

In an interview with E-Scrap News, EverMetal CEO Hugo Schumann described a shift from a mining career to recycling and explained the rationale for the new platform. “I spent 20 years in the mining industry, and in the last five years started getting more interested in technology, recycling, critical metals generally, and came up with an idea of building an investment platform dedicated to critical metals recycling.”

Schumann said EverMetal plans three to five additional acquisitions over the next three years, beginning with US collection and preprocessing operations and later expanding into the United Kingdom, particularly Sheffield. He said the focus will remain on nickel and cobalt superalloys, while also adding exposure to others. “We are going to build a really attractive portfolio,” he said.

Plans for CAI include adding a second shift and expanding sorting capacity, along with investment in new scanning technologies such as advanced XRF tools capable of measuring carbon and key elements in complex scrap. Schumann said most laboratory work is currently outsourced but could be brought in house. He added that EverMetal will rely on CAI leadership, including President Jeff Rubino and Vice President C.T. Hardison, to maintain trusted relationships with aerospace customers.

Although EverMetal has not yet engaged directly with the Department of Defense, Schumann said outreach is planned. He also said the company intends to publish its first sustainability reports this year, including life-cycle assessments and greenhouse gas tracking, under GEF’s influence.

Expansion beyond Belvidere is likely to include Huntsville, Alabama, and Wichita, Kansas, both home to major aerospace industries. Schumann said EverMetal intends to add jobs at CAI but did not specify figures.

He added that the superalloy recycling market remains fragmented, with many small or family-owned businesses nearing retirement. “We want to build a US champion,” Schumann said.