U.S. recovered paper exports in 2023 reached a 19-year low, driven by major multi-year declines in shipments into key overseas markets. Recovered plastic exports dropped slightly year over year, bringing a record low for another consecutive year.

The U.S. Census Bureau, part of the U.S. Department of Commerce, recently released December 2023 export figures, allowing for a full-year analysis.

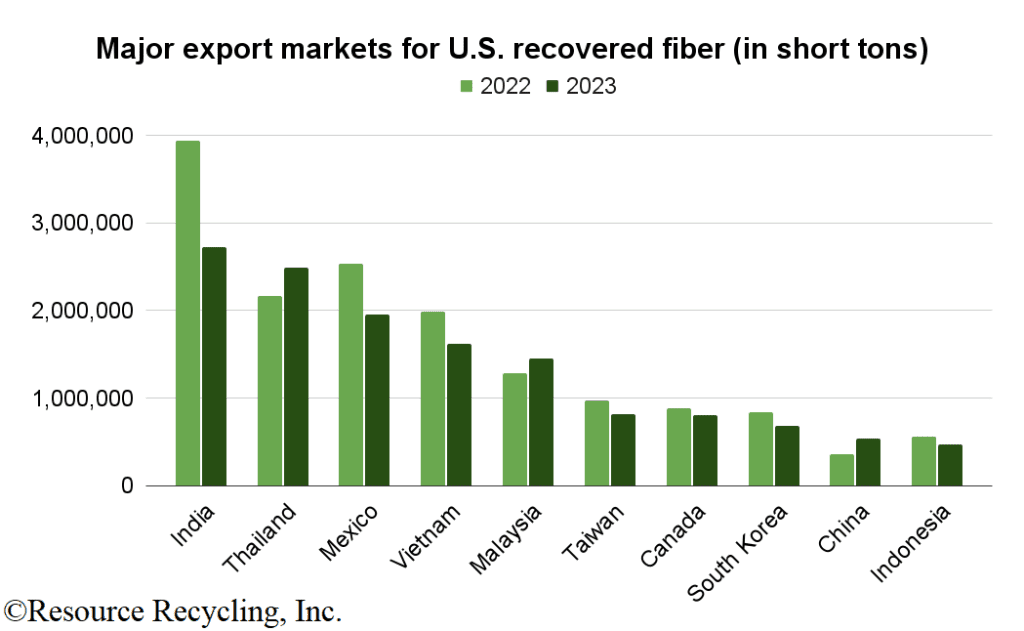

India is the largest buyer of U.S. recovered paper

The U.S. exported 14.3 million short tons of recovered fiber in 2023, down 17% from 17.1 million tons in 2022. That’s the lowest single-year amount shipped out of the country since 2004, and it’s the third consecutive year of declining export volume.

The largest export markets were India (importing 2.7 million short tons), Thailand (2.5 million), Mexico (1.9 million), Vietnam (1.6 million) and Malaysia (1.5 million).

The decrease was driven by a drop in material flowing to India. Although still the largest importer of U.S. fiber, the country brought in 31% less recovered paper in 2023 than the prior year. Other significant decreases occurred in exports to Mexico (down 23%) and Vietnam (down 19%).

The 2023 figures show China remains a low importer of U.S. material, although the country did bring in 473,000 short tons of U.S. OCC throughout the year. Exports to China, which had already decreased due to the country’s import restrictions from 2017 onward, collapsed in 2021. That year, China imported just 541,000 short tons of U.S. recovered fiber, down nearly 90% from 5 million short tons the prior year.

By grade, OCC made up the largest share of fiber exports, at 67%. Mixed paper was the next largest export grade, making up 15%. In general, OCC has increased as a percentage of fiber exports and mixed paper has decreased over the past decade. In 2013, OCC made up 47% of exports and mixed paper contributed 21%. At that time, newsprint made up a much larger portion (11%) of the export stream than it does now (3% in 2023).

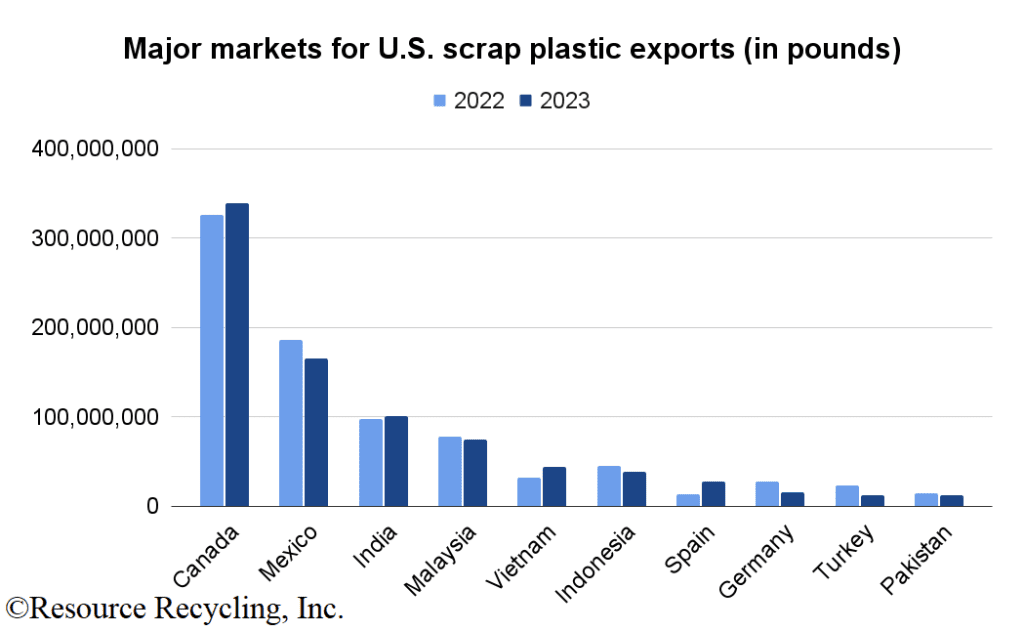

Plastic exports concentrated in Canada

The U.S. exported 918 million pounds of scrap plastic in 2023, down from 962 million pounds the prior year.

2023 marks the fourth consecutive year of the lowest plastic export volume on record since the U.S. Census Bureau began keeping records in 2002. And it’s a dramatic drop from where exports were at a decade ago: In 2014, U.S. scrap plastic exports hit a record high of 4.8 billion pounds, and the 2023 volume represents an 81% drop.

Much of the decrease was driven by China’s retreat from the global scrap plastic trade beginning in 2018. In 2017, for instance, China imported 1.2 billion pounds of U.S. recovered plastic – more than the entire amount exported from the U.S. in 2023. China slashed scrap plastic imports in 2018, and today the amount of recovered plastic flowing from the U.S. to China is negligible.

Unlike in the fiber market shakeup following China’s retreat from that sector, other countries have not increased imports enough to offset the loss of the Chinese market for U.S. scrap plastic.

Beyond the Chinese market exit, increasing global regulations on the scrap plastic trade have impacted export volumes. Amendments to the Basel Convention have limited the markets available to U.S. exporters, leaving Canada as by far the largest importer of U.S. material.

In 2023, the largest export markets for U.S. scrap plastic were Canada (339 million pounds), Mexico (165 million pounds), India (101 million pounds), Malaysia (75 million pounds) and Vietnam (44 million pounds).

By grade, mixed (classified in trade data as “other”) plastics made up the largest portion in 2023 at 37%. Polyethylene made up another 37%, with polystyrene, PVC and PET making up the remainder.

Despite the substantial decrease in volume in recent years, U.S. scrap plastic exports continue to receive heightened scrutiny. Just this week, the Basel Action Network (BAN) and the Last Beach Cleanup – two organizations that monitor plastic exports – issued a report highlighting shipments coming out of California. The groups noted a 2021 law approved by California lawmakers requires that exports out of the state meet Basel Convention criteria, and the groups presented evidence indicating California’s exports are consistently exceeding acceptable contamination levels.