This article appeared in the October 2020 issue of Resource Recycling. Subscribe today for access to all print content.

The coronavirus pandemic threw an unexpected wrench in the market for old corrugated containers (OCC) during the first half of the year. Beyond the initial supply and demand disruption, the corrugated production industry anticipates impacts that will likely be present for some time.

COVID-19 has shifted how consumers buy products, and as such, it has impacted packaging choices. For the corrugated box industry, which is a key consumer of OCC, that means changing demand for their products. But it also means a changing landscape of how end users source their raw OCC feedstock.

Resource Recycling recently connected with Rachel Kenyon, vice president of the Fibre Box Association (FBA), a trade group that represents box manufacturers. She shared details from that end market sector and explained how fiber producers are gearing up to place greater emphasis on the residential recycling sector.

The following transcript has been edited slightly for clarity and length.

Resource Recycling: What’s your take in a broad sense on what has happened with OCC as the pandemic has progressed this year?

Rachel Kenyon: I think it’s important to start with the fact that traditionally, the best partners that the corrugated industry has had in the recovery of OCC has been grocery retailers. But then also, those other commercial outlets, so places where there is a baler in the back of the room, and they’re able to collect the corrugated, bale it and get it back to us. That has been where about 85% of the feedstock has come from – those commercial resources.

When COVID happened, many factories, production facilities and manufacturing operations got shut down, in addition to a lot of retail. What we quickly saw was that while we were deemed an essential business, that feedstock was not necessarily always as readily available. We also noticed there was an acceleration in online shopping. People who hadn’t been online shopping in the past started to take that first step into online shopping, and people who had been online shopping in the past felt even more comfortable and continued to get more and more sent to their homes.

Is that material on the residential side being recovered sufficiently?

I’m sure there’s a lot more on people’s mind than worrying about whether they’re going to recycle something. But when that package comes to an individual’s home, it no longer is a business policy; it’s an individual choice. A grocery retailer, if you work there or you work in some other commercial operation, there is a policy: We put our corrugated in a baler, it gets recycled, that fiber gets recovered. But when it goes to an individual’s home, they have to make an individual choice. Do I recycle that package, do I simply throw it away, or do I use it because I have some things to box up?

So you see a change in the OCC being available, because maybe people aren’t making that choice. Or, there are communities because of COVID that have stopped their recycling programs, so they didn’t have an option to recycle that maybe they had in the past.

There are quality differences between commercial and residential OCC. What does this shift from commercial to residential generation mean for fiber end users who are consuming this recycled material as feedstock?

Contamination I think is a concern across all recycling, but certainly in corrugated. When we have single-stream recycling, those corrugated boxes get mixed with a lot of other things and people put things in the bin that maybe they shouldn’t. So not only do we want to see them bring the fiber back, but we want to see people recycle right and make sure that corrugated stays dry.

There is a real value to it not only to us but to others in terms of keeping that material dry. It makes it easier for the MRF to separate that material out, they get a better price for it, and we get a cleaner product. It’s better for the supply chain all around.

That’s the struggle too. The 85% traditionally coming from commercial resources – that for the most part is clean, dry material. It’s only corrugated that’s going into those balers; it’s not mixed with glass, plastic or other materials that maybe shouldn’t be recycled at all. When we’re only getting 15% from the residential stream, we need that 15% to be clean and dry.

With the decline in OCC coming out of the commercial stream, are you seeing enough of an increase in the residential stream to make up for the lack of volume in the commercial stream?

We don’t yet know, it’s too early to tell. We won’t know what this sort of blip in time has done until about spring of next year, but we can sense there is a shift happening. And as more and more people shift to home shopping, we want to make sure consumers are well-educated about what can and can’t be recycled, and how to recycle that material.

We know that in the future, it’s not going to be an 85-15 [commercial to residential breakdown]. It’s going to be somewhere closer to 75-25 or even greater than that. We know we’re going to have to rely more heavily on the residential recycling stream. And we need to get ahead of that and be able to help where we can share the messages about how to recycle corrugated and to let people know that corrugated is one of those truly circular materials. We are using that feedstock. We need that feedstock.

There is a lot of focus today on plastics, and the concern that plastics don’t get recycled or if they do, they don’t get recycled into the same product again. If you put a corrugated box in your bin, it will come back as another corrugated box, exactly the same product. And 50% of that will be recycled content – that’s what the average is across the industry. When you have that much of it being recycled content, we need consumers to be actively engaged in recycling.

So the ratio change goes beyond the immediate pandemic impact. It’s something you’re preparing for in the long term as well?

Yeah, and I really think the pandemic has sort of accelerated that process. They talk about e-commerce growing at 15% a year. People will ask if I can show where that same spike occurred in corrugated shipments. And I can’t do that, because it’s not purely additive to the market. It is a substitution. If things are being shipped in e-commerce that means they’re not going to a store. They’re not going to those traditional supply chains.

What is your take on the factors influencing OCC demand this year, and where is demand headed in the future?

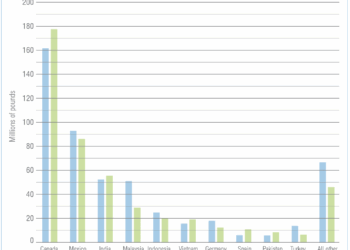

It’s important to remember that OCC is a global commodity. For instance, because of China’s National Sword, at the end of 2017 we saw a drop in the recovery rate. We’ve been hovering around 90% since about 2011 or so.

In 2017, our recovery numbers dropped to 88.8%. … What happened was toward the end of 2017, maybe people stockpiled, then they found other markets for it. They shifted around. It wasn’t necessarily all China; it went to other places in Asia. It is a global commodity.

In 2018, there was this 30% growth in net exports. Our recovery number was 96.2%. So you saw it drop off a little, and then come back because all of a sudden we found some other markets for it. So it will depend not only on what is happening here in North America, but what’s happening globally to see what happens with OCC.

What are those recovery numbers measuring?

It’s everything that’s being produced here in the U.S. There’s no way to track the OCC that comes in with the product – we don’t track the box, we track the product that comes in.

There are some products coming here that are already packaged. That fiber does factor in for our recovery rate. But the recovery rate, we’re not doing it any differently than anyone else around the world. Everyone calculates their recovery rate the same way. That’s why you see places like Japan and Australia sometimes have recovery rates over 100%. They’re islands, so they’re getting a lot of stuff shipped in. The stuff is counted, the box isn’t.

We’ve seen a number of recent mill conversions to use recycled feedstock, building up the domestic recovered fiber market. Has the pandemic disrupted or put a pause on this recent mill-conversion activity?

I think it’s definitely slowed things down a bit, and I think that’s true across a lot of different industries, not just ours. There were two or three mills that were scheduled to start up in the spring this year. One of them did, and a couple others are delayed a bit. But I think those delays are things that are happening across a lot of different industries for a lot of different reasons. Maybe construction crews aren’t working, for example. I think just the general economy has slowed some of the projects down. But I think you’re going to see those projects continue. It might just take a little bit longer because of the COVID pandemic.

Colin Staub is the senior reporter at Resource Recycling and can be contacted at [email protected].