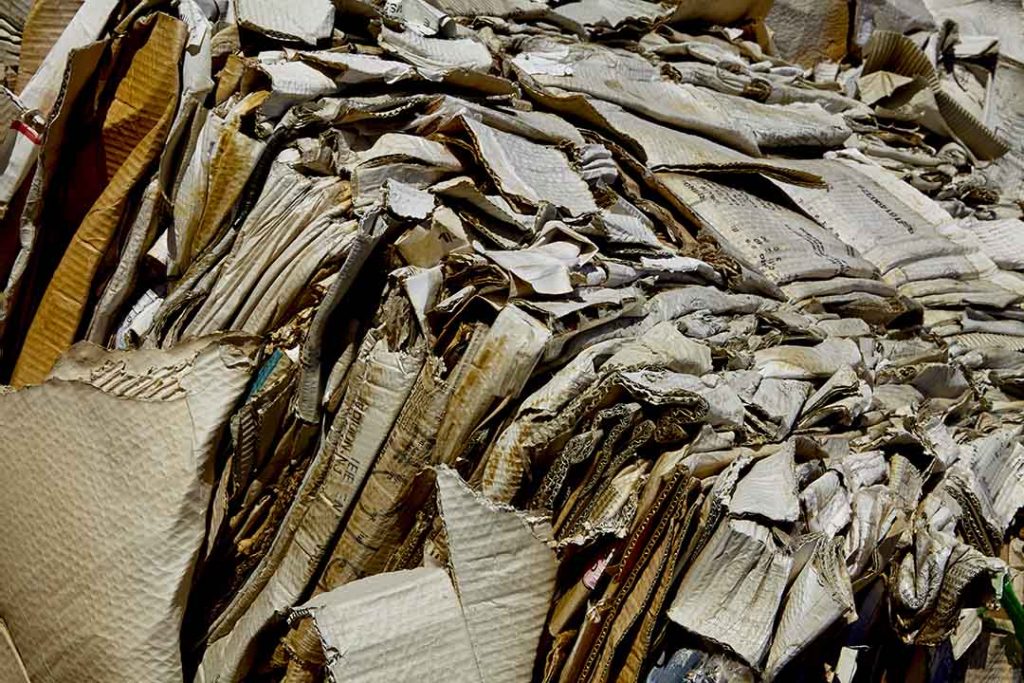

KDC and Celadon noted that in North America e-commerce trends are driving higher OCC generation in the residential recycling stream. | ja images/Shutterstock

A technology company and investment firm say they will develop two North American facilities processing more than 800,000 tons per year of mixed paper and OCC into recycled pulp and paper.

The project, led by investment firm Kamine Development Corporation Sustainable Infrastructure (KDC) in partnership with technology company Celadon, will kick off next year and will involve a total investment of $300 million.

The plan was announced Dec. 2, but the partners did not disclose where the sites would be located.

“Celadon has a unique technology capable of upcycling mixed paper and old corrugated cardboard into recycled pulp sheets and re-usable paper, creating a closed loop waste free industry,” the companies said in a release.

KDC and Celadon noted that in North America e-commerce trends are driving higher OCC generation in the residential recycling stream. Meanwhile, end markets for recovered fiber have languished due to China’s recovered fiber import restrictions.

North America is “behind in this infrastructure” due to China’s long dominance in the end market sector, the companies wrote.

“Landfilling this material is of course not the answer,” they said. “That is why Celadon and KDC have partnered together to deploy large scale recycling infrastructure across North America to create a closed loop, waste free industry and to properly manage our cardboard use.”

The project’s two facilities will be capable of processing “more than 800,000 tons of cardboard and waste paper per year,” KDC CEO Hal Kamine said in the release.

Celadon CEO Tim Zosel has previous experience building plastics recycling facilities, according to the announcement.

Bedminster, N.J.-based KDC says its “ideal investments are patented or uniquely advantaged technologies that also have a social benefit. An optimal investment for KDC is either in the angel or series A rounds, where we utilize our experience into structuring a company for success.”

One of KDC’s other investments, biodegradable straw maker Loliware, is part of the Closed Loop Partners portfolio of companies.

More stories about fiber

- Fiber end users talk price increases, demand outlook

- Pizza box demand declining, report says

- Nebraska city to accept paper cups in curbside bins