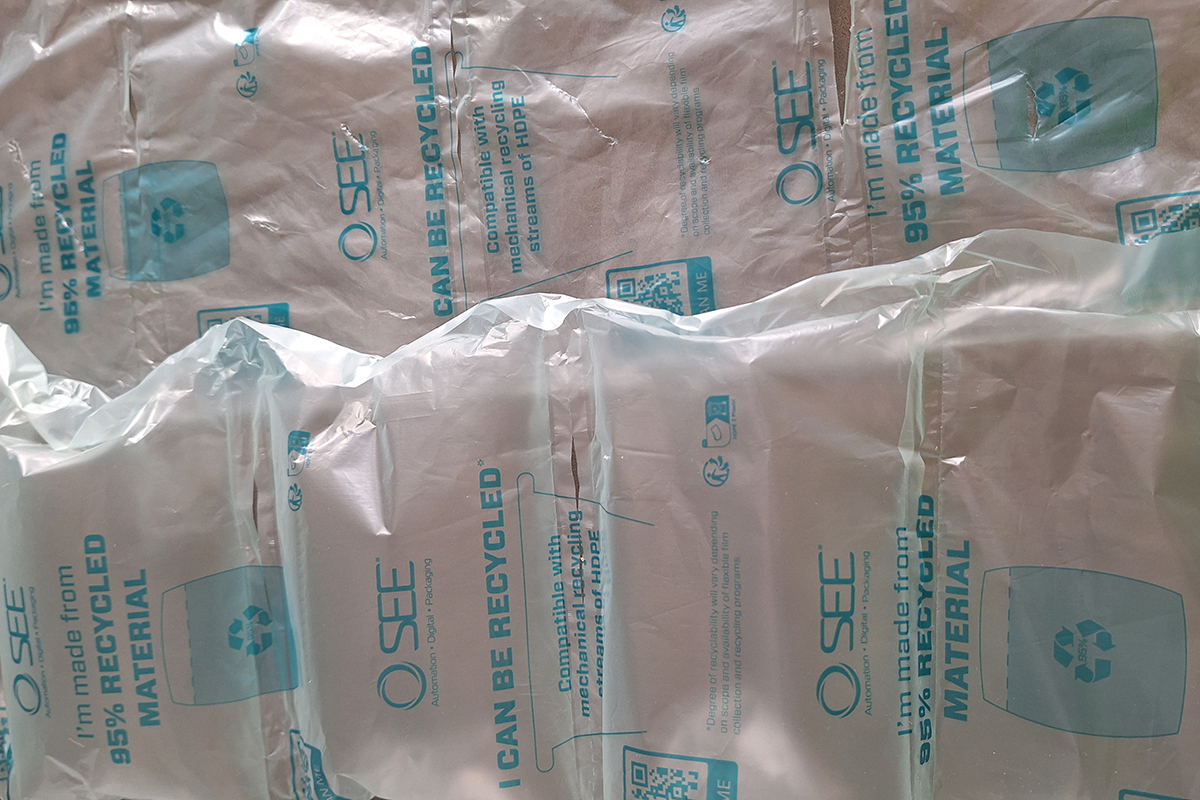

Production of film and flexible packaging is growing while recycling rates remain low. | K M Hargreaves / Shutterstock

While film and flexible packaging represent about 34% of the total US plastic packaging industry by weight, abysmal recycling rates are requiring adjustments across the entire system.

Despite 4% annual growth in FFP production, less than 1% is recycled nationwide, a gap consisting of interconnected challenges across the recycling system, said Katherine Huded, executive director of material systems at The Recycling Partnership, during a recent webinar.

The barriers include insufficient end markets, high processing costs relative to commodity prices, limited residential program acceptance, contamination concerns, diverse packaging formats and sortation challenges at MRFs.

Recycling for film and flexible packaging remains largely inaccessible for most Americans. About 2% of households in the US can actually recycle FFP in their curbside or jurisdiction programs.

In the US, primary recycling access for these items usually is by way of return to retail or drop-off programs, she said.

Extended producer responsibility (EPR) policy for packaging is “catalyzing change in the US recycling system,” with California emerging as a testing ground for other states looking to implement policy, Huded said.

One state, many lessons

All eyes are on California, the most populated state in the US and world’s fourth largest economy, as it enacts sweeping recycling reforms under SB 54.

“Ultimately, it’s requiring 25% source reduction, 100% recyclable or compostable packaging, a 65% recycling rate, and that all recyclables are headed to responsible end markets all by 2032 and that’s right around the corner,” Huded said.

The state has 13 covered material categories for film and flexibles. Now that policy is driving systemic change, what’s needed to support FFP in California and the rest of the US is on the horizon.

The objective is to build scalable pathways on existing systems, said Neil Menezes, vice president of material services at Circular Action Alliance (CAA), the producer responsibility organization (PRO) that administers California’s EPR program for packaging.

“We’re not looking to drop brand new MRFs across the US, because it’s not going to be the most effective and efficient way of our resources. We really want to get a better understanding of what’s happening today, and how do we leverage the expertise of the collective system,” he said.

In addition to California, CAA is managing EPR implementation in Colorado, Minnesota, Oregon and Maryland. Menezes said the organization is also petitioning to be PRO for both Washington and Maine, two more states working toward implementation.

“EPR is gaining momentum in the US, and it’s an important push that we need. And so, if not now, when, if not us, who? It’s go time,” said Rachel Lawrence, senior director of sustainability at PepsiCo.

Learn global, implement domestically

European and Canadian EPR systems effectively demonstrate that high FFP recycling rates are achievable, but the US needs solutions that build on existing infrastructure.

They are successfully capturing household, residential film and flexibles from mixed single streams, from bagged recyclables or through various MRF sortation methods.

“These countries are seeing higher residential participation rates and higher recycling rates, even for plastic packaging, upwards of 50% today in some places. So it is possible and we can learn from others around the world,” Huded said.

Belgium has achieved 50% recycling rates for film and flexibles while France is getting closer to a 30% recycling rate. Teo Medellin, director of corporate packaging sustainability for Procter & Gamble, said curbside collection is bringing larger volumes of FFP into circularity.

In Europe, operations are fine-tuned to grab and take away FFP to make bales and move the product.

“Now, we don’t have to reinvent the wheel. That’s very good news for everybody. It can be done,” he said. “The problem is, a business problem is, how do we move the bales?”

“If we want to get to high levels of performance, 60-65% recycling rate, we’re going to need to start thinking how we are going to recover those pellets in a way that they are going to provide future value,” Medellin said.

Economic incentives and end markets

Financial support throughout the supply chain and robust end markets are essential to make FFP recycling economically viable and scalable.

“If you can solve the demand side, I think a lot of these other issues are almost secondary,” Menezes said.

The brand-led US Flexible Film Initiative (USFFI) is focused on filling the gap for the financial support needed to catalyze FFP recycling, by providing funding to create and move bales.

“We’re entering into contracts with reclaimers and markets nationally… with payments structured on a per pound basis,” said Maite Quinn-Richards, executive director of USFFI. Quinn-Richards is also president of Resource Recycling, Inc., which publishes Plastics Recycling Update.

The approach ensures that MRFs can consistently produce film applications, and that the reclaimers have the stability to process bales.

“In our experience, there may be a small fraction of operators who can make it work without financial support, but most need that incentive to keep the system stable, scalable and sustainable, ultimately proving that flexible packaging can and should be recycled with the right incentives in place, we do have to incentivize everyone,” said Quinn-Richards.

More stories about film