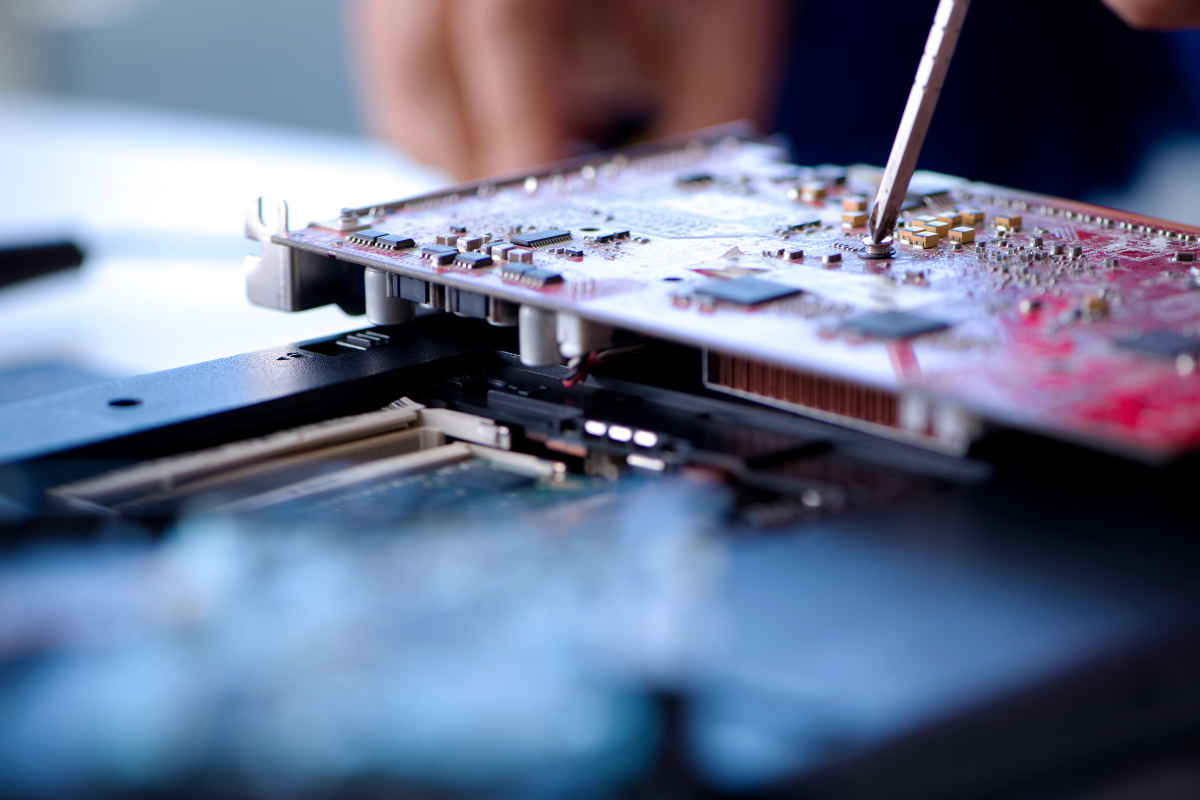

Sage Sustainable Electronics acquired Pennsylvania-based Relectro, a national provider of electronics repair, refurbishment and logistics services that services more than 25,000 assets per year. | Elnur/Shutterstock

Sage Sustainable Electronics, financed by Closed Loop Partners, has acquired an electronics repair and refurbishment company, aiming to gain a stronger foothold in the reuse world.

The company, Pennsylvania-based Relectro, is a national provider of electronics repair, refurbishment and logistics services. Founded in 2011, it repairs more than 25,000 assets each year for warranty repair firms, insurance firms and mobile device providers, among others. It also has a 40,000-square-foot facility located less than 10 miles from where Sage plans to build a fourth national repurposing center.

Brian Itterly, Relectro founder and CEO, said in a press release that he looks forward to the next phase of growth and that “our repair and refurbishment services complement and build on Sage’s reuse and recovery services, offering a wider range of solutions for businesses across the country.”

Sage acquired Relectro through a follow-on investment from Closed Loop Partners’ buyout private equity group, according to a press release. Closed Loop Partners became a majority shareholder of Sage in 2023.

“Today, Sage faces an evolving IT industry,” the release stated. “Devices are being replaced much more often, with an average refresh cycle by IT departments of two years for smartphones, four years for laptops and five years for printers.”

That increasing demand for repair services drove Sage to acquire Relectro “to provide a comprehensive suite of solutions that can keep more devices in circulation,” according to the release.

Bob Houghton, Sage CEO, added in the press release that acquiring Relectro enables Sage to expand its depot repair services for enterprise clients.

This acquisition marks the seventh investment from Closed Loop Partners’ buyout private equity group, which is employing a buy-and-build strategy to “scale platforms and enabling technologies across plastics and packaging, organics, circular technology and textiles to develop, accelerate and modernize circular supply chains and recycling and reuse infrastructure,” according to the release.