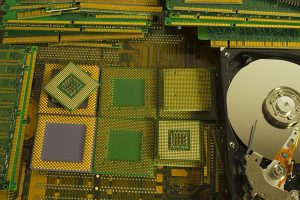

The major reason for processor smiles is the strong and ongoing surge in the value of palladium. The price paid for the white metal has risen 50 percent since last summer, topping off at about $1,400 per ounce, which exceeds the current value for gold. The key cause of the price rise is growing demand by auto producers, especially in China (80 percent of palladium use is for catalytic converters used in new cars). In addition to rising demand, palladium supply concerns have risen in key mining regions, including those in Russia and South Africa.

Also helping push up the value of metal-containing electronic scrap, especially recovered printed circuit boards, is the rising value of gold. Prices have moved higher since last November due to investors moving into the gold market and away from corporate stocks, reflecting investor concerns over ongoing international trade wars and other types of economic turmoil.

Copper has also seen prices rise recently, although not dramatically. A slight rise in demand from industrial countries has moved copper’s value up 9 percent this year.

Steady demand from photovoltaic product makers has brought stability to the silver market. The silver industry’s international trade association predicts the value of silver will increase by 7 percent this year.

Photo credit: Unigraphoto/Shutterstock

More stories about markets

- Earnings results point to active IT hardware lifecycles

- Metallium looks to long-term contract with Glencore

- ABTC expansion drives triple-digit revenue gains